Question

Part A: On January 1, 2019, Portugal Corporation bought 100% of the stock of Sweden Corporation for $500,000 (with cash). The Balance Sheets of the

Part A:

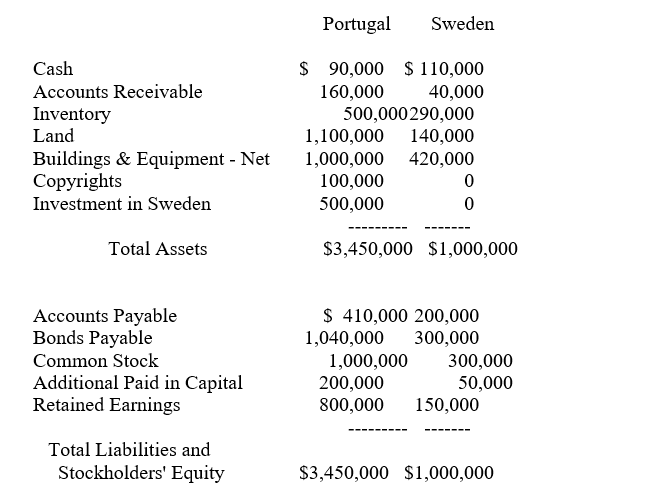

On January 1, 2019, Portugal Corporation bought 100% of the stock of Sweden Corporation for $500,000 (with cash). The Balance Sheets of the two companies immediately after Portugal acquired (January 1, 2019) Sweden Corporation showed the following amounts:

At the date of acquisition, Portugal owed Sweden $40,000. Also, on the date of acquisition the Book Value of Sweden equaled its Fair Value. At the end of the first year of combination, Portugal expects a combined tax rate of 35%. Portugal expects Sweden to have net income of $80,000 in 2019. The CEO of Sweden thinks that Portugal's CEO is an idiot. Portugal uses the equity method for its investment in Sweden.

Required:

1. List all journal entries that Portugal made to record its investment in Sweden on the date of acquisition.

2. List all Elimination Entries that would need to be made in order to prepare a workpaper for the consolidated Balance Sheet of Portugal and Sweden immediately after the combination (January 1, 2019).

3. Prepare a workpaper for the consolidated Balance Sheet of Portugal and Sweden immediately after the combination (January 1, 2019). Show all necessary elimination entries in their proper columns. Use a coding system for each elimination entry, such as A, B, C, or 1, 2, 3.

Part B:

Everything is the same as in Part A, except the following: Portugal Corporation bought 90% of the stock of Sweden Corporation for $450,000 (with cash). The Balance Sheet of Portugal immediately after it acquired Sweden Corporation had two changes from Part A, the Cash balance is $140,000 and the Investment balance is $450,000.

Required: The same as in Part A.

Portugal Sweden Cash Accounts Receivable Inventory Land Buildings & Equipment - Net Copyrights Investment in Sweden $ 90,000 $110,000 160,000 40,000 500,000290,000 1,100,000 140,000 1,000,000 420,000 100,000 0 500,000 0 Total Assets $3,450,000 $1,000,000 Accounts Payable Bonds Payable Common Stock Additional Paid in Capital Retained Earnings $ 410,000 200,000 1,040,000 300,000 1,000,000 300,000 200,000 50,000 800,000 150,000 Total Liabilities and Stockholders' Equity $3,450,000 $1,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started