Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A Part B Part C Part D Please answer all parts and label your answers please. Also please make sure to be accurate and

Part A

Part B

Part C

Part D

Please answer all parts and label your answers please. Also please make sure to be accurate and bold your answers. I only get 1 attempt per question. Will make sure to rate your answers as well. Thank you so much for all your help. Really appreciate it!!!!!!!!

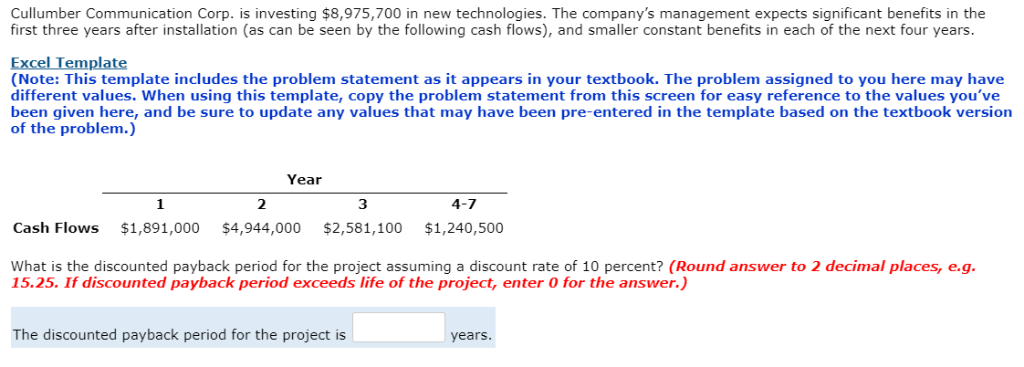

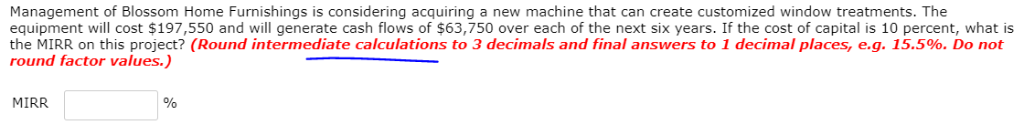

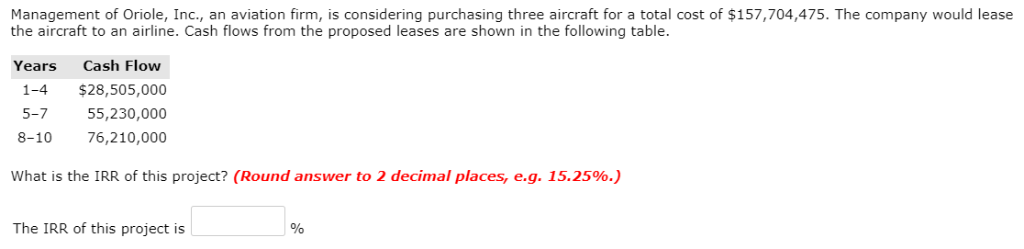

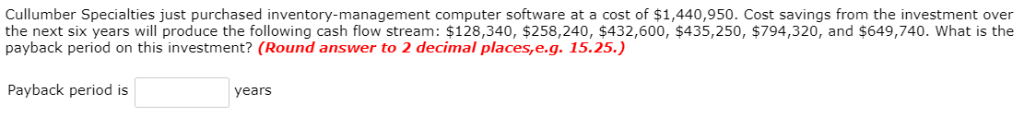

Cullumber Communication Corp. is investing $8,975,700 in new technologies. The company's management expects significant benefits in the first three years after installation (as can be seen by the following cash flows), and smaller constant benefits in each of the next four years Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Year 2 3 4-7 Cash Flows $1,891,000 $4,944,000 $2,581,100 $1,240,500 What is the discounted payback period for the project assuming a discount rate of 10 percent? (Round answer to 2 decimal places, e.g. 15.25. If discounted payback period exceeds life of the project, enter 0 for the answer.) The discounted payback period for the project is years Management of Blossom Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $197,550 and will generate cash flows of $63,750 over each of the next six years. If the cost of capital is 10 percent, what is the MIRR on this project? (Round intermediate calculations to 3 decimals and final answers to 1 decimal places, e.g. 15.5%. Do not round factor values.) MIRR Management of Oriole, Inc., an aviation firm, is considering purchasing three aircraft for a total cost of $157,704,475. The company would lease the aircraft to an airline. Cash flows from the proposed leases are shown in the following table Years Cash Flow 1-4 $28,505,000 5-7 8-10 76,210,000 55,230,000 What is the IRR of this project? (Round answer to 2 decimal places, eg. 15.25%.) The IRR of this project is Cullumber Specialties just purchased inventory-management computer software at a cost of $1,440,950. Cost savings from the investment over the next six years will produce the following cash flow stream: $128,340, $258,240, $432,600, $435,250, $794,320, and $649,740. What is the payback period on this investment? (Round answer to 2 decimal places,e.g. 15.25.) Payback period is yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started