Answered step by step

Verified Expert Solution

Question

1 Approved Answer

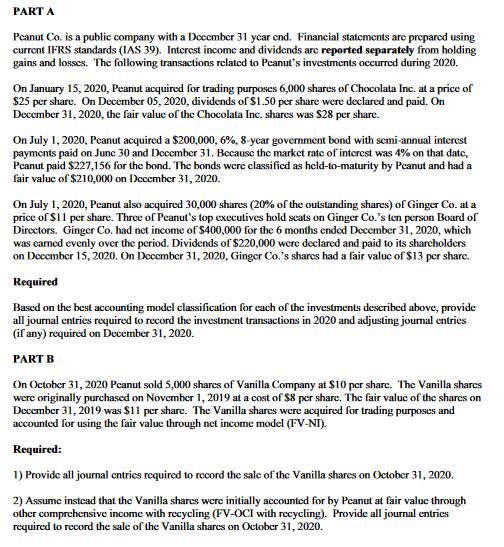

PART A Peanut Co. is a public company with a December 31 year end. Financial statements are prepared using current IFRS standards (IAS 39).

PART A Peanut Co. is a public company with a December 31 year end. Financial statements are prepared using current IFRS standards (IAS 39). Interest income and dividends are reported separately from holding gains and losses. The following transactions related to Peanut's investments occurred during 2020. On January 15, 2020, Peanut acquired for trading purposes 6,000 shares of Chocolata Inc. at a price of $25 per share. On December 05, 2020, dividends of $1.50 per share were declared and paid. On December 31, 2020, the fair value of the Chocolata Inc. shares was $28 per share. On July 1, 2020, Peanut acquired a $200,000, 6%, 8-year government bond with semi-annual interest payments paid on June 30 and December 31. Because the market rate of interest was 4% on that date, Peanut paid $227,156 for the bond. The bonds were classified as held-to-maturity by Peanut and had a fair value of $210,000 on December 31, 2020. On July 1, 2020, Peanut also acquired 30,000 shares (20% of the outstanding shares) of Ginger Co. at a price of $11 per share. Three of Peanut's top executives hold seats on Ginger Co.'s ten person Board of Directors. Ginger Co. had net income of $400,000 for the 6 months ended December 31, 2020, which was earned evenly over the period. Dividends of $220,000 were declared and paid to its shareholders on December 15, 2020. On December 31, 2020, Ginger Co.'s shares had a fair value of $13 per share. Required Based on the best accounting model classification for each of the investments described above, provide all journal entries required to record the investment transactions in 2020 and adjusting journal entries (if any) required on December 31, 2020. PART B On October 31, 2020 Peanut sold 5,000 shares of Vanilla Company at $10 per share. The Vanilla shares were originally purchased on November 1, 2019 at a cost of $8 per share. The fair value of the shares on December 31, 2019 was $11 per share. The Vanilla shares were acquired for trading purposes and accounted for using the fair value through net income model (FV-NI). Required: 1) Provide all journal entries required to record the sale of the Vanilla shares on October 31, 2020. 2) Assume instead that the Vanilla shares were initially accounted for by Peanut at fair value through other comprehensive income with recycling (FV-OCI with recycling). Provide all journal entries required to record the sale of the Vanilla shares on October 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PART A Chocolata Inc On January 15 2020 Debit Cash 6000 x 25 150000 Credit Trading Investments 150000 On December 05 2020 Debit Dividends receivable 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started