Answered step by step

Verified Expert Solution

Question

1 Approved Answer

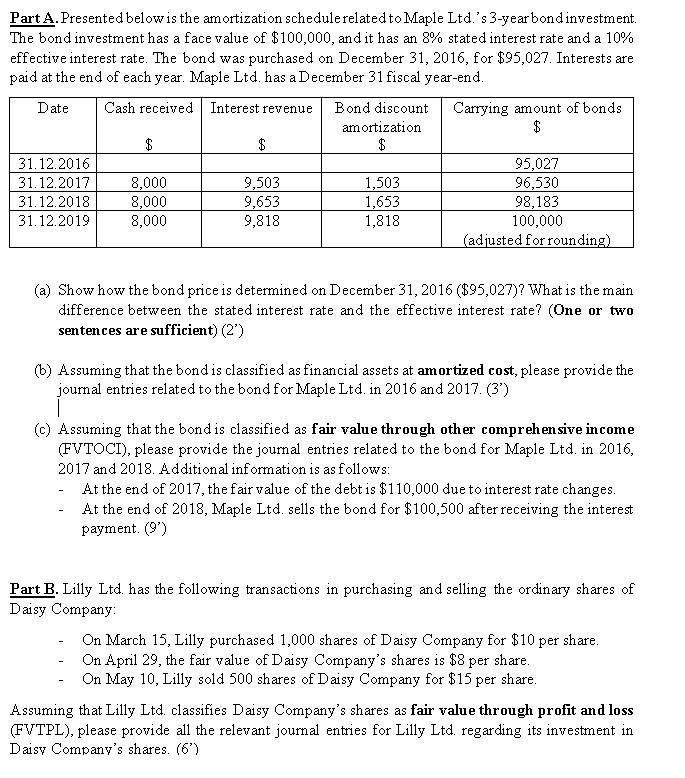

Part A. Presented below is the amortization schedule related to Maple Ltd.'s 3-year bond investment. The bond investment has a face value of $100,000,

Part A. Presented below is the amortization schedule related to Maple Ltd.'s 3-year bond investment. The bond investment has a face value of $100,000, and it has an 8% stated interest rate and a 10% effective interest rate. The bond was purchased on December 31, 2016, for $95,027. Interests are paid at the end of each year. Maple Ltd. has a December 31 fiscal year-end. Date Carrying amount of bonds Cash received Interest revenue Bond discount amortization $ $ $ $ 31.12.2016 95,027 31.12.2017 8,000 9,503 1,503 96,530 31.12.2018 31.12.2019 8,000 9,653 1,653 98,183 8,000 9,818 1,818 100,000 (adjusted for rounding) (a) Show how the bond price is determined on December 31, 2016 ($95,027)? What is the main difference between the stated interest rate and the effective interest rate? (One or two sentences are sufficient) (2') (b) Assuming that the bond is classified as financial assets at amortized cost, please provide the journal entries related to the bond for Maple Ltd. in 2016 and 2017. (3') (c) Assuming that the bond is classified as fair value through other comprehensive income (FVTOCI), please provide the journal entries related to the bond for Maple Ltd. in 2016, 2017 and 2018. Additional information is as follows: - - At the end of 2017, the fair value of the debt is $110,000 due to interest rate changes. At the end of 2018, Maple Ltd. sells the bond for $100,500 after receiving the interest payment. (9') Part B. Lilly Ltd. has the following transactions in purchasing and selling the ordinary shares of Daisy Company: - On March 15, Lilly purchased 1,000 shares of Daisy Company for $10 per share. On April 29, the fair value of Daisy Company's shares is $8 per share. On May 10, Lilly sold 500 shares of Daisy Company for $15 per share. Assuming that Lilly Ltd. classifies Daisy Company's shares as fair value through profit and loss (FVTPL), please provide all the relevant journal entries for Lilly Ltd. regarding its investment in Daisy Company's shares. (6')

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started