Answered step by step

Verified Expert Solution

Question

1 Approved Answer

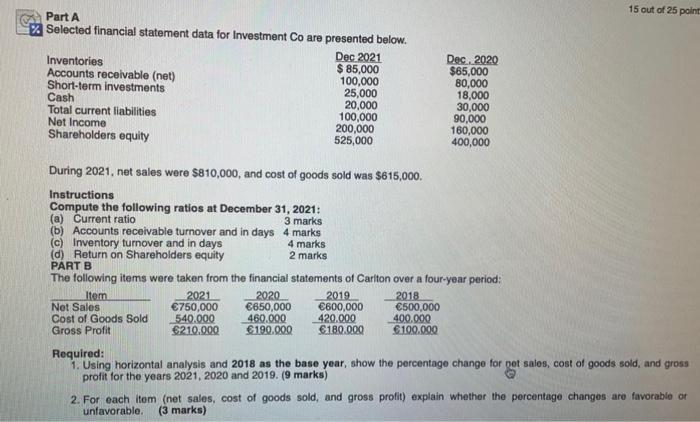

Part A Selected financial statement data for Investment Co are presented below. Inventories Accounts receivable (net) Short-term investments Cash Total current liabilities Net Income

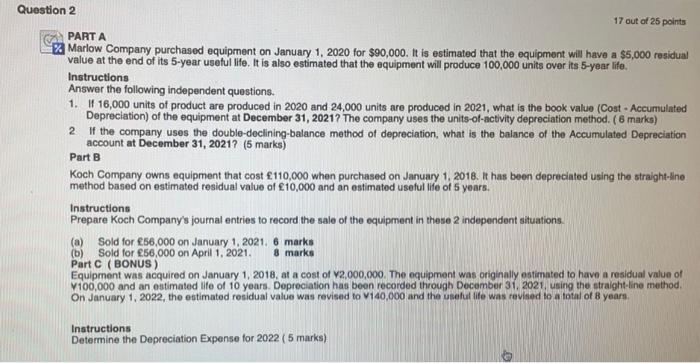

Part A Selected financial statement data for Investment Co are presented below. Inventories Accounts receivable (net) Short-term investments Cash Total current liabilities Net Income Shareholders equity During 2021, net sales were $810,000, and cost of goods sold was $615,000. Instructions Compute the following ratios at December 31, 2021: 3 marks 4 marks Item (a) Current ratio (b) Accounts receivable turnover and in days (c) Inventory turnover and in days (d) Return on Shareholders equity PART B The following items were taken from the financial statements of Carlton over a four-year period: Net Sales Cost of Goods Sold Gross Profit 2021 750,000 540.000 210.000 Dec 2021 $ 85,000 100,000 25,000 20,000 100,000 200,000 525,000 4 marks 2 marks 2020 650,000 460.000 190.000 2019 600,000 420.000 180.000 Dec. 2020 $65,000 80,000 18,000 30,000 90,000 160,000 400,000 2018 500,000 400.000 100.000 15 out of 25 point Required: 1. Using horizontal analysis and 2nd 2019. (9 mark year, show the percentage change for pot sales, cost of goods sold, and gross profit 2021, 2020 the 2. For each item (net sales, cost of goods sold, and gross profit) explain whether the percentage changes are favorable or unfavorable. (3 marks) Question 2 PART A Marlow Company purchased equipment on January 1, 2020 for $90,000. It is estimated that the equipment will have a $5,000 residual value at the end of its 5-year useful life. It is also estimated that the equipment will produce 100,000 units over its 5-year life. Instructions Answer the following independent questions. 1. If 16,000 units of product are produced in 2020 and 24,000 units are produced in 2021, what is the book value (Cost - Accumulated Depreciation) of the equipment at December 31, 2021? The company uses the units-of-activity depreciation method. (6 marks) 2 If the company uses the double-declining-balance method of depreciation, what is the balance of the Accumulated Depreciation account at December 31, 2021? (5 marks) Part B Koch Company owns equipment that cost 110,000 when purchased on January 1, 2018. It has been depreciated using the straight-line method based on estimated residual value of 10,000 and an estimated useful life of 5 years. Instructions Prepare Koch Company's journal entries to record the sale of the equipment in these 2 independent situations. 17 out of 25 points (a) Sold for 56,000 on January 1, 2021. 6 marks (b) Sold for 56,000 on April 1, 2021. 8 marks Part C (BONUS) Equipment was acquired on January 1, 2018, at a cost of V2,000,000. The equipment was originally estimated to have a residual value of V100,000 and an estimated life of 10 years. Depreciation has been recorded through December 31, 2021, using the straight-line method. On January 1, 2022, the estimated residual value was revised to V140,000 and the useful life was revised to a total of 8 years. Instructions Determine the Depreciation Expense for 2022 (5 marks)

Step by Step Solution

★★★★★

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Part A 1 2 3 4 5 6 8 9 10 11 12 13 14 15 16 10 17 18 19 20 21 22 1 2 3 4 5 6 7 8 9 10 11 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started