Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A Singher Limited is a leading manufacturer of African inspired handbags and headwear. The company has a 31 March year-end. A new embroidery

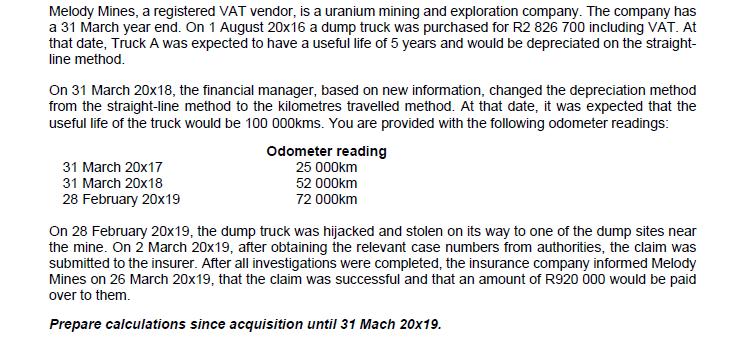

PART A Singher Limited is a leading manufacturer of African inspired handbags and headwear. The company has a 31 March year-end. A new embroidery machine was ordered on 1 November 20x18. Delivery took place on 1 December 20x18. The machine had to be specially assembled upon delivery. However, due to the fact the factory would close over December and re-open only on 2 January 20x19, the owner of Singher Ltd decided that the machine would be put into use on 2 January 20x19. Singher Ltd and the supplier of the machine are both VAT vendors. The following expenditure in relation to the machine were incurred: Purchase price paid to the supplier Transport cost to deliver the machine to the factory Customs and import duties Assembly cost Initial operating losses Training costs* R 782 000 1 150 14 720 2 645 20 000 15 000 *The chief seamstress had to be trained to use the machine as she was not familiar with how the new model operates. Singher Ltd provides the training at an additional cost The company intends to depreciate the machine at 20% per annum on the straight-line method. The machine is expected to have a residual value of R20 000 at the end of its useful life. Prepare calculations since acquisition to 31 March 20x20. PART B Afro Chique is an exclusive design house in Johannesburg, specialising in the manufacturing and sale of bespoke household furniture. You are provided with the following information relating to a machine owned by Afro Chique. Afro Chique has a 31 December year end. The machine (model X Line 2000) was ordered on 1 February 20x16. The machine was purchased for R552 000 including VAT. Delivery, which took place on 15 March 20x16, was invoiced at R1 150 including VAT. Assembly and testing of the machine took place on 31 March 20x16 after which the machine was available for use. The cost for the assembly and testing was including in the purchase price. It is the policy of Afro Chique to depreciate machinery on the straight-line method over 10 years. The machine will have no residual value. As at 30 December 2018, the owner assessed the technological advancements in the industry due to the increased use of artificial intelligence to manufacture furniture and came up with the following figures, exclusive of VAT, for the machine: R Value in use Fair value 280 500 316 000 1 000 Disposal costs Prepare calculations since acquisition until 31 December 20x19. PART C Melody Mines, a registered VAT vendor, is a uranium mining and exploration company. The company has a 31 March year end. On 1 August 20x16 a dump truck was purchased for R2 826 700 including VAT. At that date, Truck A was expected to have a useful life of 5 years and would be depreciated on the straight- line method. On 31 March 20x18, the financial manager, based on new information, changed the depreciation method from the straight-line method to the kilometres travelled method. At that date, it was expected that the useful life of the truck would be 100 000kms. You are provided with the following odometer readings: 31 March 20x17 31 March 20x18 28 February 20x19 Odometer reading 25 000km 52 000km 72 000km On 28 February 20x19, the dump truck was hijacked and stolen on its way to one of the dump sites near the mine. On 2 March 20x19, after obtaining the relevant case numbers from authorities, the claim was submitted to the insurer. After all investigations were completed, the insurance company informed Melody Mines on 26 March 20x19, that the claim was successful and that an amount of R920 000 would be paid over to them. Prepare calculations since acquisition until 31 Mach 20x19.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

PART A Singher Limited 1 Total Cost of Machine Purchase price paid to the supplier R782000 Transport ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started