Question

Part A (Solution) Impaired goodwill means that the difference between the assets and liability was overvalued. This amount of $ 5,000 should be written off

Part A (Solution)

Impaired goodwill means that the difference between the assets and liability was overvalued.

This amount of $ 5,000 should be written off as a loss in the income statement .It should be debited in the good will account.

In the income statement it was debited meaning it was treated as an expense. This reduced the total income hence the amount of $5000 dollars should be added back.

On 30 June 2020 Galway bought an inventory from Dublin costing $25,000

Dublin had bought the inventory at 22,000

To get the profit that Dublin made we will take the difference between the buying price of inventory by Dublin we deduct it from its selling price.

25,000-22,000=$3,000

Dublin had made a profit of $3,000

Galway sold 75% of this inventory externally

75% of 25,000=$18,750

The remaining inventory for Galway as at 30 June 2020 is the difference between the total cost of buying the inventory and the amount sold.

25,000-18,750= $6,250 Galway solid an equipment to Dublin at 160,000. Galway had bought the item at 120,000.

Selling it at this amount he made a loss of 160,000-120,000=$40,000 In the income statement the $40,000 is recorded under Dublin instead of being recorded under Galway. Recording it under Dublin reduces its total liabilities and equity.

The amount of 40,000 should be deducted from Galway total liabilities and equity.

The amount calculated for depreciation is

Take the cost of the equipment divide by its useful time For Galway he had bought it at 160,000.

The expected useful life was 10 years.

The depreciation per year will be

160,000/10=$16,000

For Dublin

The depreciation will be the cost of buying it which is 120,000

The remaining useful life will be

10 years - 2year= 8 years

The two years are deducted because Galway had used the equipment for only two years. Depreciation for Dublin will be

120,000/8=$15,000 per year.

Galway charged Dublin $90,000 for surface fees

At 30 June 2020 90% of this was paid

90%90,000=81,000

Galway should record the amount not paid as a debt in the income statement. The debt will be the difference between the amount charged and the amount paid

90,000-81,000=$9,000

Calculation of consolidated total assets on the date of acquisition is shown below

Cash will be 70,000 we add 50,600 this will total to $120,600

Inventory will be

45,000 we add the inventory of 32,000

This will sum up to $ 77,000 which the total inventory as at 30 June 2020

Land will be equal to 130,000 we add 87,000 to its value for appreciation. This will sum to $217,000 Plant will be 210,000 we add 127,000. It will sum up to $337,000 we less depreciation which is

130,000+22000=$152,000

The consolidated total assets will be $599,600.

Part B

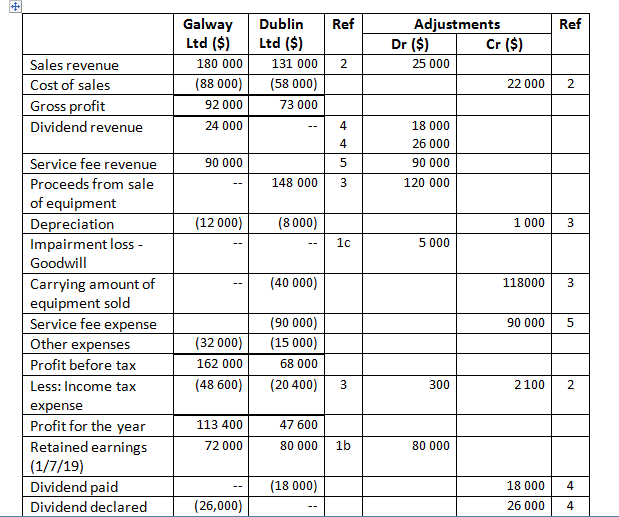

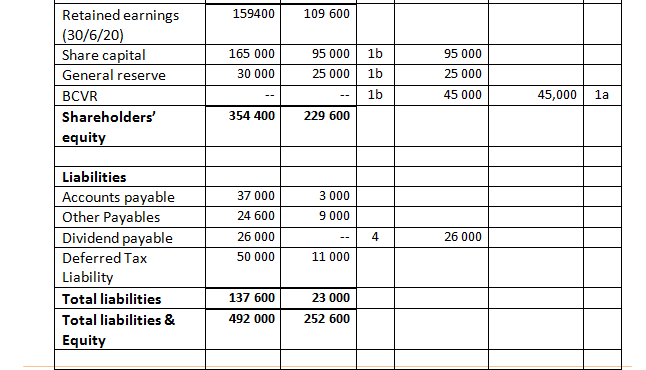

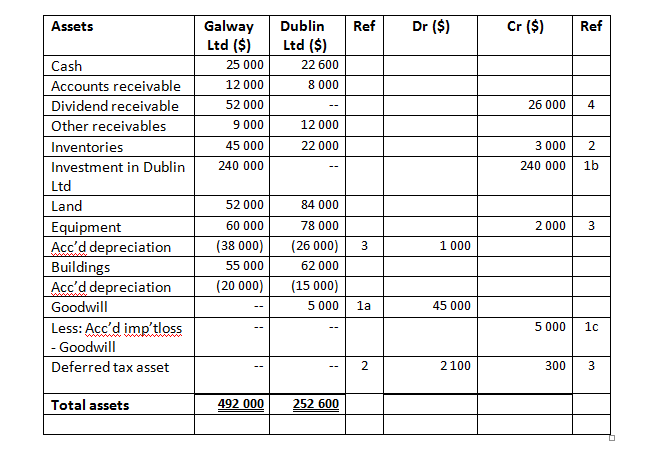

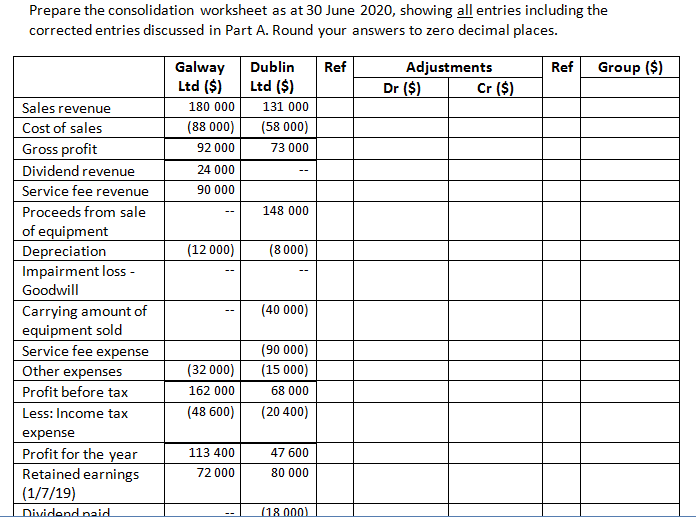

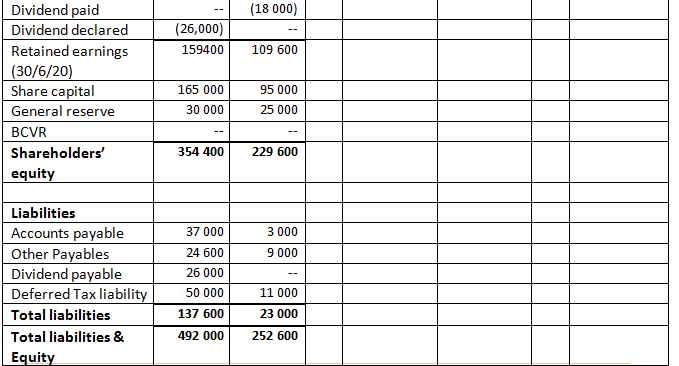

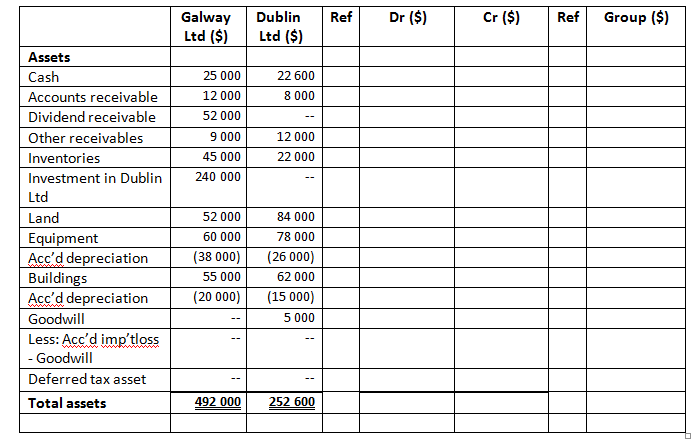

Ref Ref Galway Ltd ($) 180 000 (88 000) 92 000 Dublin Ltd ($) 131 000 (58 000) 73 000 Adjustments Dr ($) Cr ($) 25 000 22 000 Sales revenue Cost of sales Gross profit Dividend revenue 2 2 24 000 4 4 18 000 26 000 90 000 120 000 90 000 w | 148 000 (12 000) (8 000) 1 000 3 1c 5000 (40 000) 118000 3 90 000 5 Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee expense Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) Dividend paid Dividend declared (32 000) 162 000 (48 600) (90 000) (15 000) 68 000 (20 400) 3 300 2 100 2 113 400 47 600 72 000 80 000 1b 80 000 (18 000) 4 18 000 26 000 (26,000) 4 159400 109 600 165 000 1b 95 000 Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity 95 000 25 000 30 000 1 b 25 000 45 000 1 b 45,000 la 354 400 229 600 37 000 3 000 9 000 24 600 26 000 50 000 4 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax Liability Total liabilities Total liabilities & Equity 26 000 11 000 137 600 492 000 23 000 252 600 Assets Ref Dr ($) Cr ($) Ref Dublin Ltd ($) 22 600 8 000 Galway Ltd ($) 25 000 12 000 52 000 9 000 45 000 240 000 26 000 4 12 000 22 000 3 000 2 240 000 1b Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imp'tloss - Goodwill Deferred tax asset 2 000 3 52 000 60 000 (38 000) 55 000 (20 000) 3 1 000 84 000 78 000 (26 000) 62 000 (15 000) 5 000 1a 45 000 5 000 1c . 2 2 100 300 3 Total assets 492 000 252 600 Prepare the consolidation worksheet as at 30 June 2020, showing all entries including the corrected entries discussed in Part A. Round your answers to zero decimal places. Ref Ref Group ($) Adjustments Dr ($) Cr ($) Galway Ltd ($) 180 000 (88 000) 92 000 24 000 90 000 Dublin Ltd ($) 131 000 (58 000) 73 000 148 000 (12 000) (8 000) Sales revenue Cost of sales Gross profit Dividend revenue Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee expense Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) (40 000) (32 000) 162 000 (48 600) (90 000) (15 000) 68 000 (20400) 113 400 72 000 47 600 80 000 Dividend naid (18000) (18 000) (26,000) 159400 109 600 Dividend paid Dividend declared Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity 165 000 30 000 95 000 25 000 354 400 229 600 37 000 3 000 9 000 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax liability Total liabilities Total liabilities & Equity 24 600 26 000 50 000 137 600 11 000 23 000 252 600 492 000 Ref Dr ($) Cr ($) Ref Galway Ltd ($) Dublin Ltd ($) Group ($) 22 600 8 000 25 000 12 000 52 000 9 000 45 000 240 000 12 000 22 000 Assets Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imptloss - Goodwill Deferred tax asset Total assets 52 000 60 000 (38 000) 55 000 (20 000) 84 000 78 000 (26 000) 62 000 (15 000) 5000 492 000 252 600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started