Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A The following data which are based on the research conducted by Deakin ( 1 9 7 2 ) present the means of several

PART A

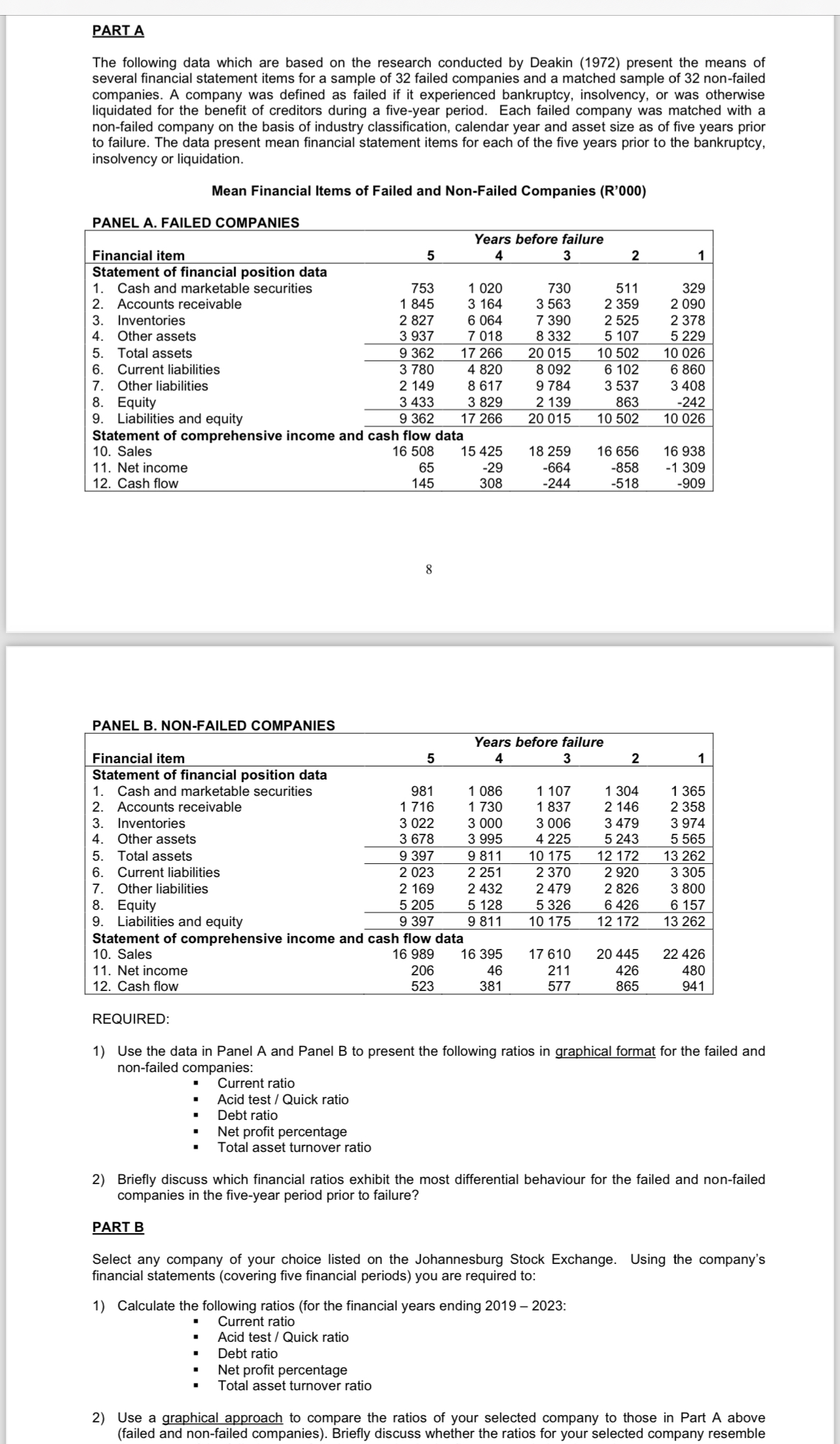

The following data which are based on the research conducted by Deakin present the means of several financial statement items for a sample of failed companies and a matched sample of nonfailed companies. A company was defined as failed if it experienced bankruptcy, insolvency, or was otherwise liquidated for the benefit of creditors during a fiveyear period. Each failed company was matched with a nonfailed company on the basis of industry classification, calendar year and asset size as of five years prior to failure. The data present mean financial statement items for each of the five years prior to the bankruptcy, insolvency or liquidation.

Mean Financial Items of Failed and NonFailed Companies R

PANEL A FAILED COMPANIES

tableYears before failure,,Financial item,Statement of financial position data, Cash and marketable securities Accounts receivable, Inventories, Other assets, Total assets, Current liabilities, Other liabilities, Equity, Liabilities and equity,Statement of comprehensive income and cash flow data,,,,,,, Sales, Net income, Cash flow,

PANEL B NONFAILED COMPANIES

tableYears before failure,,Financial item,Statement of financial position data, Cash and marketable securities Accounts receivable, Inventories, Other assets, Total assets, Current liabilities, Other liabilities, Equity, Liabilities and equity,Statement of comprehensive income and cash flow data,,,,,,, Sales, Net income, Cash flow,

REQUIRED:

Use the data in Panel A and Panel to present the following ratios in graphical format for the failed and nonfailed companies:

Current ratio

Acid test Quick ratio

Debt ratio

Net profit percentage

Total asset turnover ratio

Briefly discuss which financial ratios exhibit the most differential behaviour for the failed and nonfailed companies in the fiveyear period prior to failure?

PART B

Select any company of your choice listed on the Johannesburg Stock Exchange. Using the company's financial statements covering five financial periods you are required to:

Calculate the following ratios for the financial years ending :

Current ratio

Acid test Quick ratio

Debt ratio

Net profit percentage

Total asset turnover ratio

Use a graphical approach to compare the ratios of your selected company to those in Part A above failed and nonfailed companies Briefly discuss whether the ratios for your selected company resemble

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started