Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The trial balance of Freyja Ltd on 14 July 20X1, the date on which the court ordered that the company be wound up, is

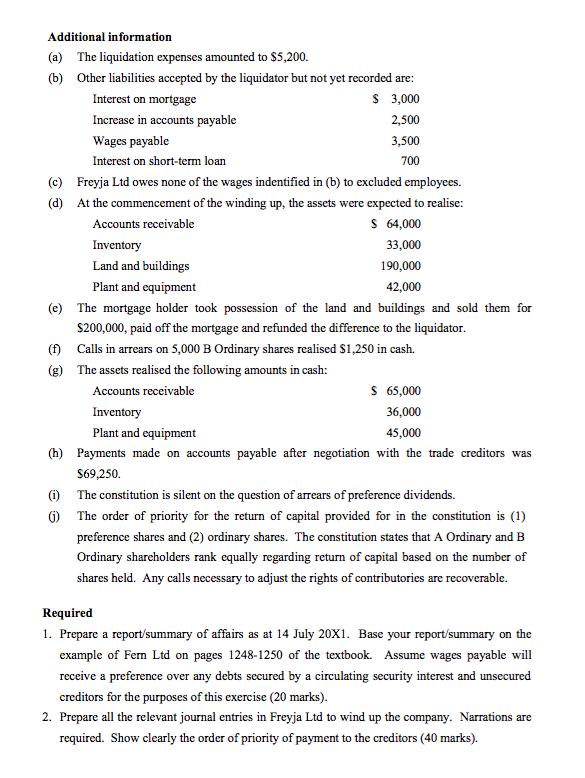

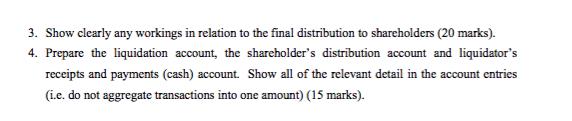

The trial balance of Freyja Ltd on 14 July 20X1, the date on which the court ordered that the company be wound up, is presented below. FREYJA LIMITED TRIAL BALANCE as at 14 July 20X1 Debit Credit Cash S 1,800 Accounts receivable 72,000 Allowance for bad debts $ 5,000 Inventory 35,000 Goodwill 30,000 Land 150,000 Buildings 300,000 Accumulated depreciation: Buildings 150,000 Plant and equipment 210,000 Accumulated depreciation: Plant and equipment 160,000 Accounts payable 70,000 Tax payable 49,000 Short-term loan (unsecured) 15,000 Preference dividend payable 7,500 Mortgage on land and buildings 110,000 Retained earnings 179,950 General reserve 38,500 75,000 Preference shares issued at $1 fully paid 75,000 150,000 A Ordinary shares issued for $2, paid to $1.50 225,000 100,000 B Ordinary shares issued for $1, called to 75 75,000 Call in arrears: 5,000 B Ordinary shares @ 25 1,250 S 980,000 S 980,000 Additional information (a) The liquidation expenses amounted to $5,200. (b) Other liabilities accepted by the liquidator but not yet recorded are: Interest on mortgage S 3,000 Increase in accounts payable 2,500 Wages payable 3,500 Interest on short-term loan 700 (c) Freyja Ltd owes none of the wages indentified in (b) to excluded employees. (d) At the commencement of the winding up, the assets were expected to realise: S 64,000 Accounts receivable Inventory 33,000 Land and buildings 190,000 Plant and equipment 42,000 (e) The mortgage holder took possession of the land and buildings and sold them for $200,000, paid off the mortgage and refunded the difference to the liquidator. () Calls in arrears on 5,000 B Ordinary shares realised S1,250 in cash. (g) The assets realised the following amounts in cash: Accounts receivable S 6,000 Inventory 36,000 Plant and equipment 45,000 (h) Payments made on accounts payable after negotiation with the trade creditors was S69,250. O The constitution is silent on the question of arrears of preference dividends. ) The order of priority for the return of capital provided for in the constitution is (1) preference shares and (2) ordinary shares. The constitution states that A Ordinary and B Ordinary shareholders rank equally regarding return of capital based on the number of shares held. Any calls necessary to adjust the rights of contributories are recoverable. Required 1. Prepare a report/summary of affairs as at 14 July 20X1. Base your report/summary on the example of Ferm Ltd on pages 1248-1250 of the textbook. Assume wages payable will receive a preference over any debts secured by a circulating security interest and unsecured creditors for the purposes of this exercise (20 marks). 2. Prepare all the relevant journal entries in Freyja Ltd to wind up the company. Narrations are required. Show clearly the order of priority of payment to the creditors (40 marks). 3. Show clearly any workings in relation to the final distribution to shareholders (20 marks). 4. Prepare the liquidation account, the shareholder's distribution account and liquidator's receipts and payments (cash) account. Show all of the relevant detail in the account entries (i.e. do not aggregate transactions into one amount) (15 marks).

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

statement of affline on ruth july 20xl the date of winding up 65ooo 36...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started