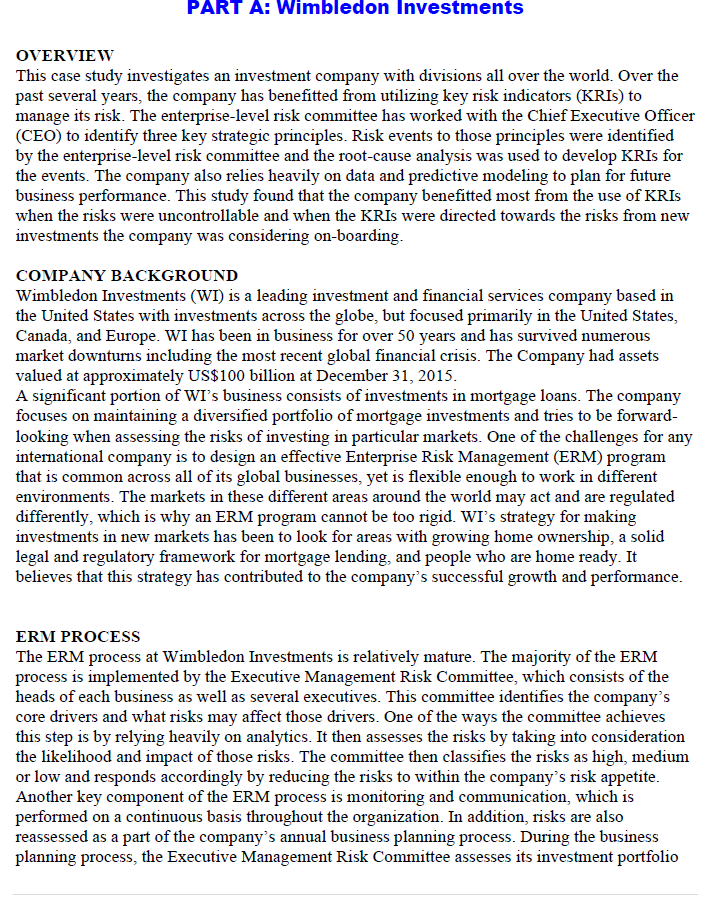

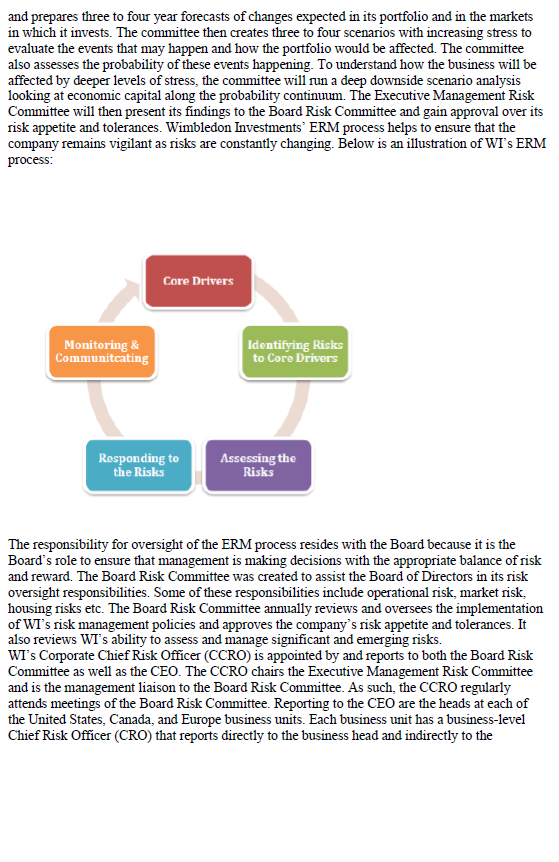

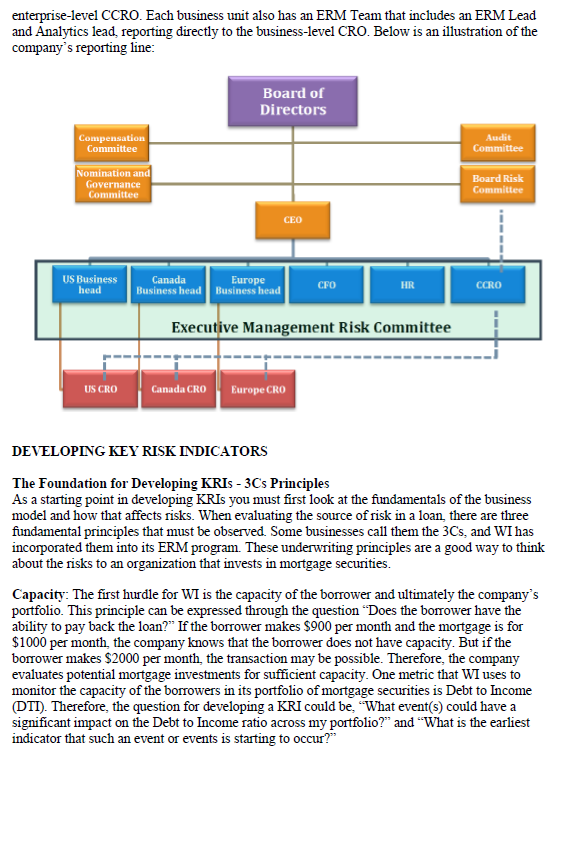

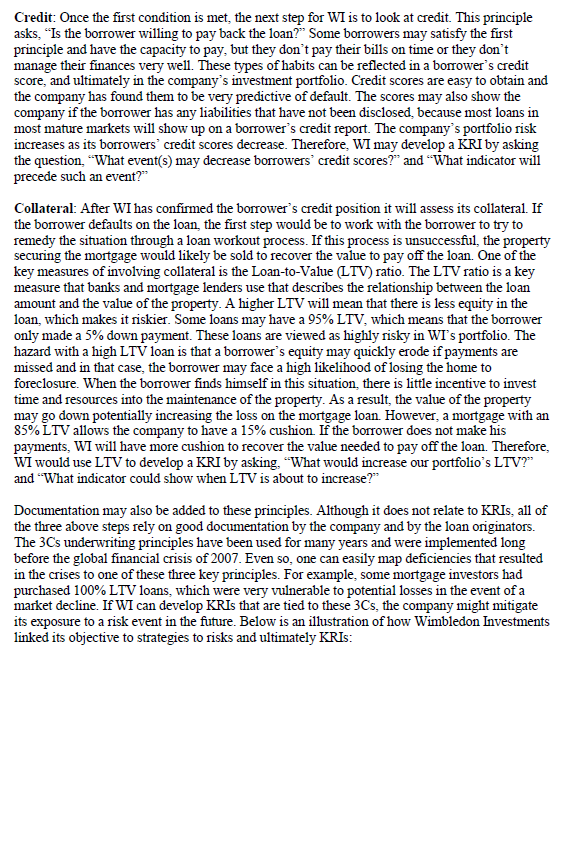

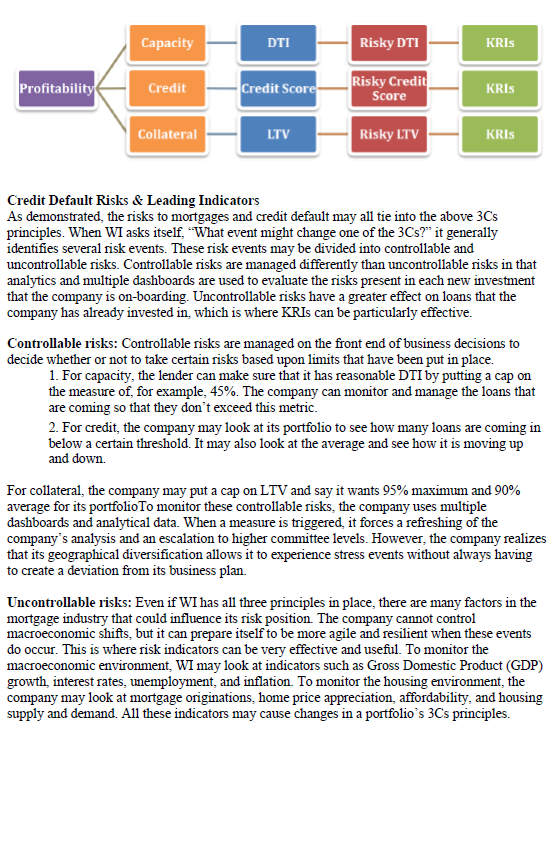

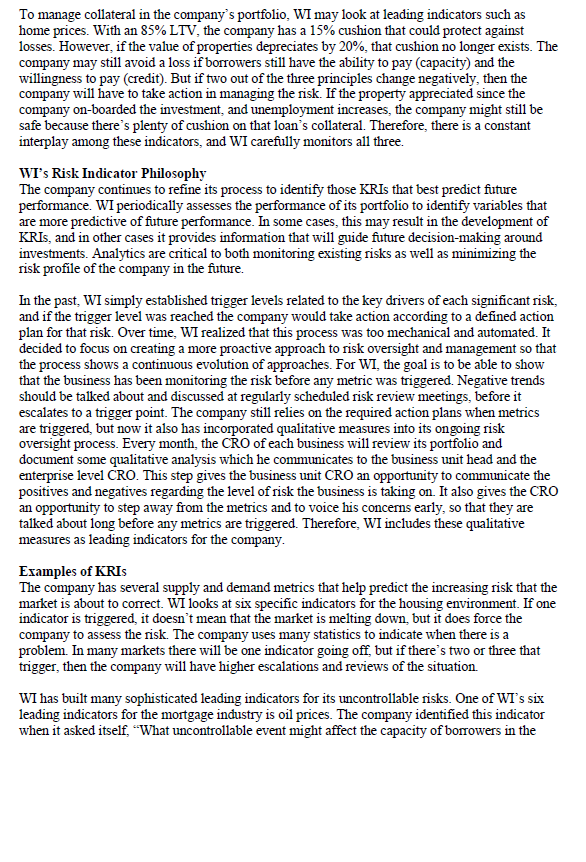

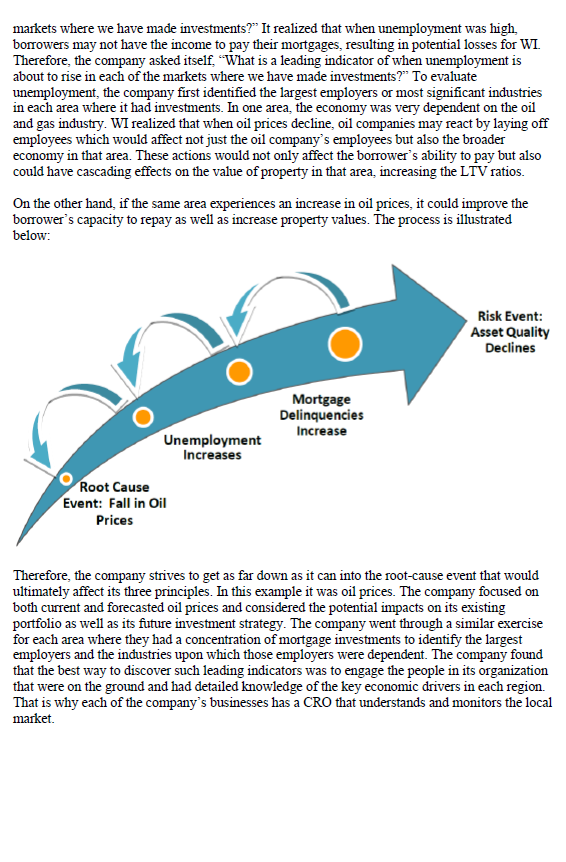

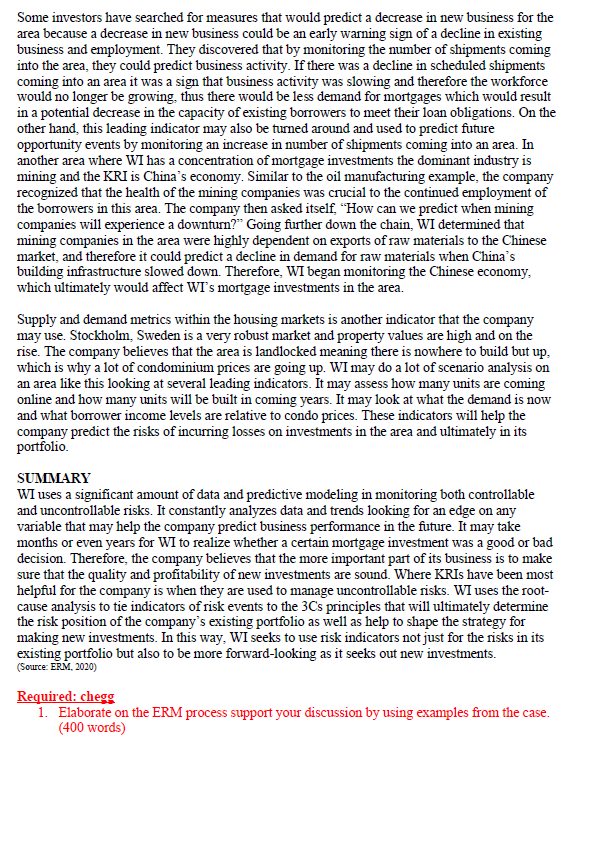

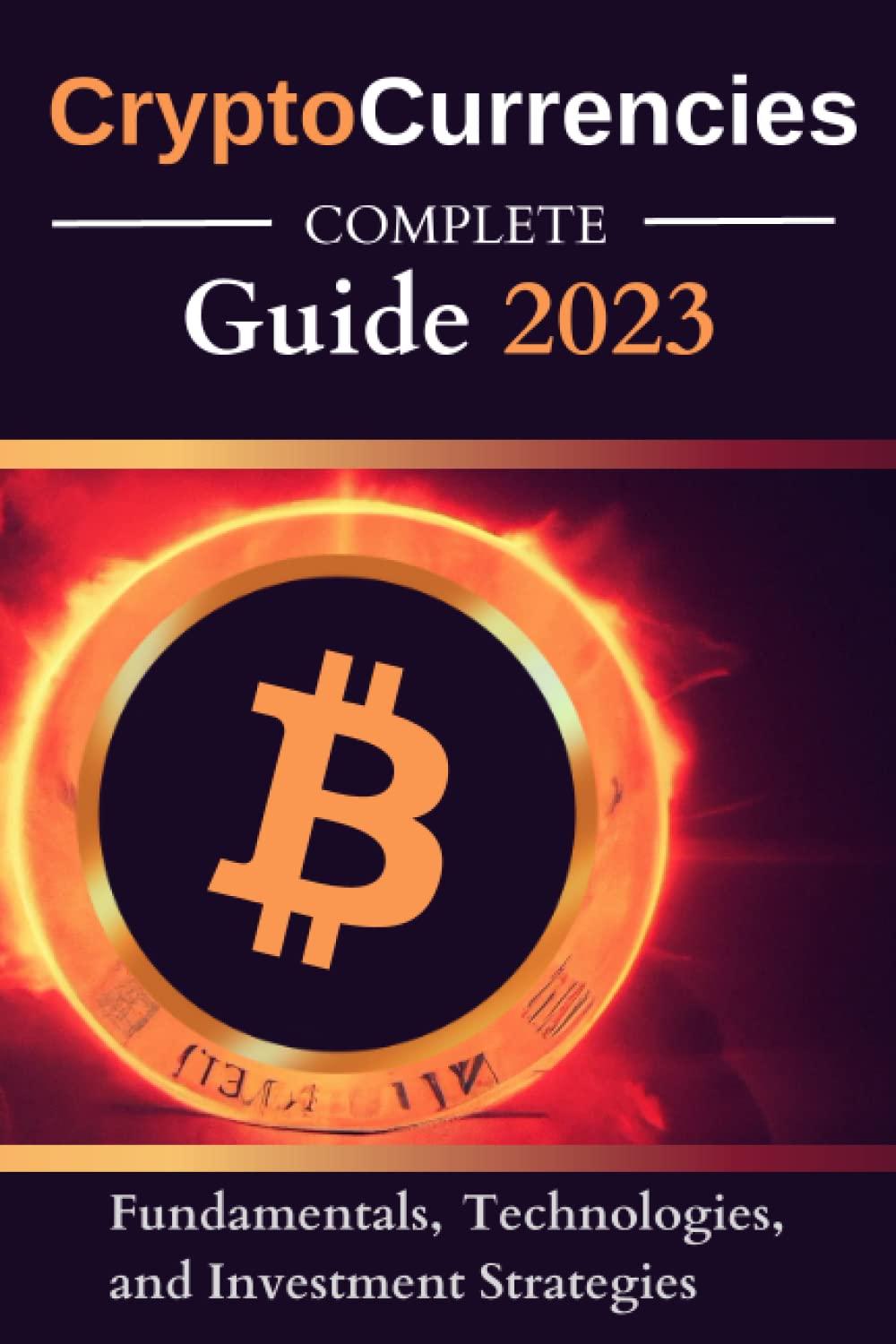

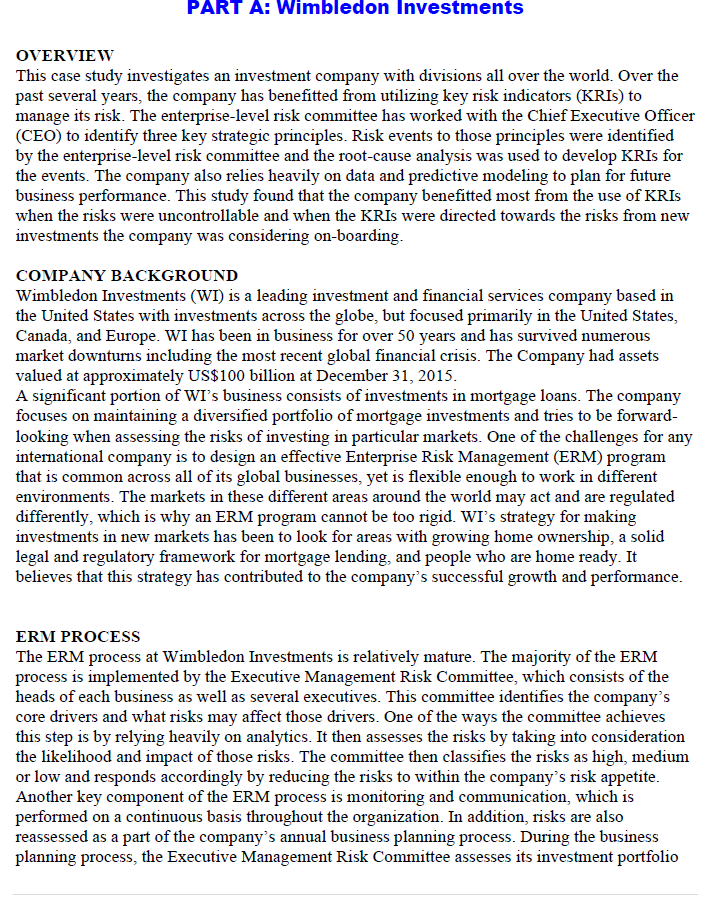

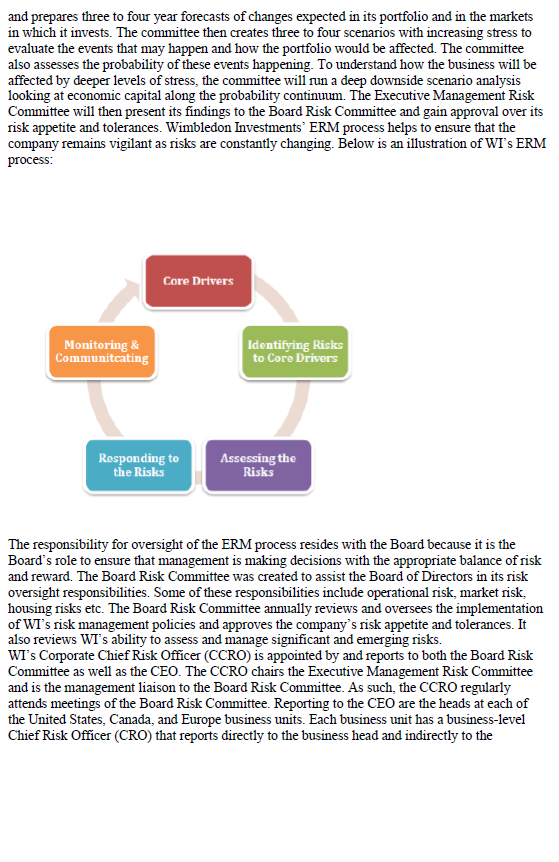

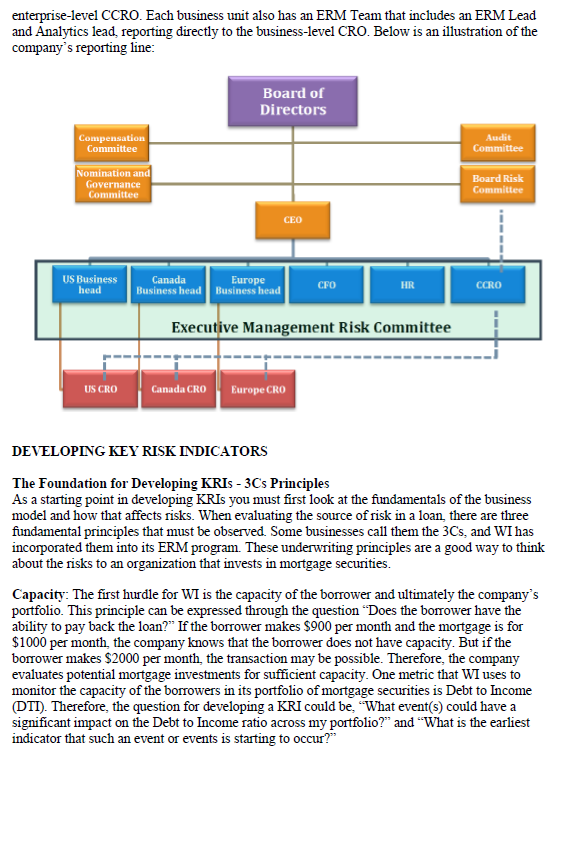

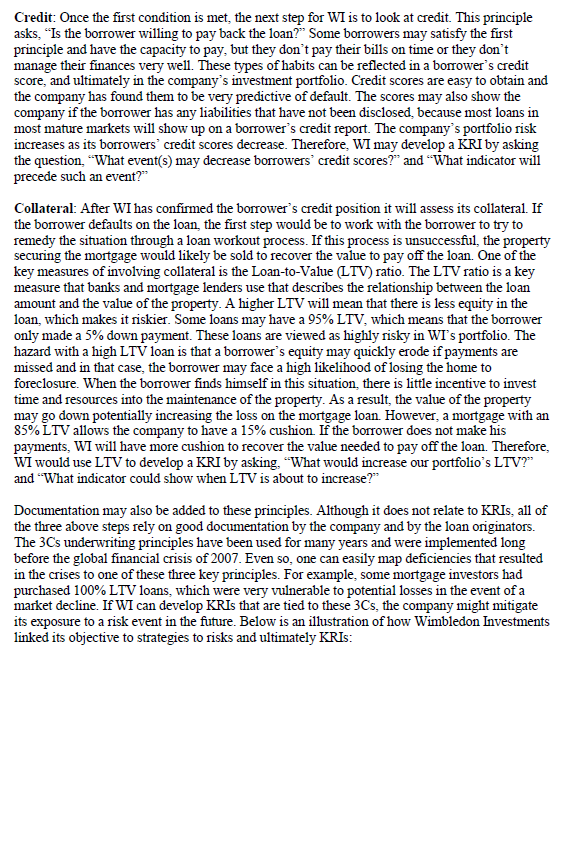

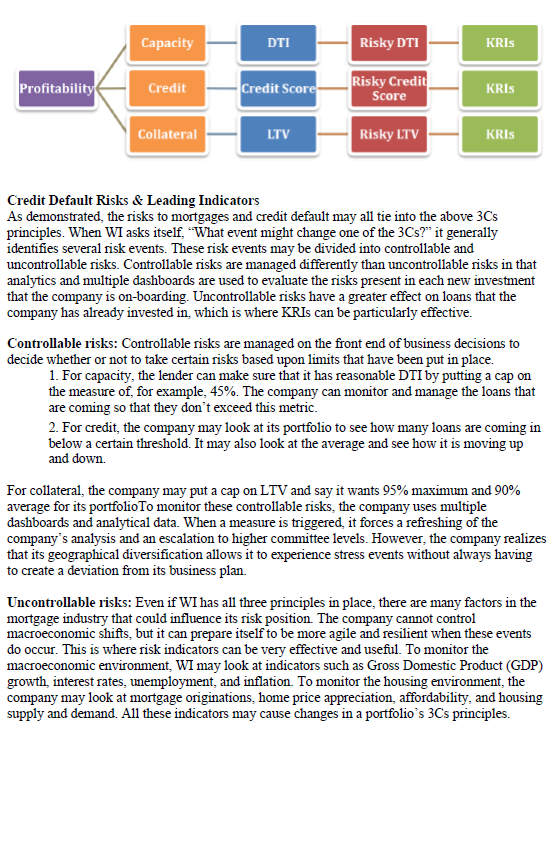

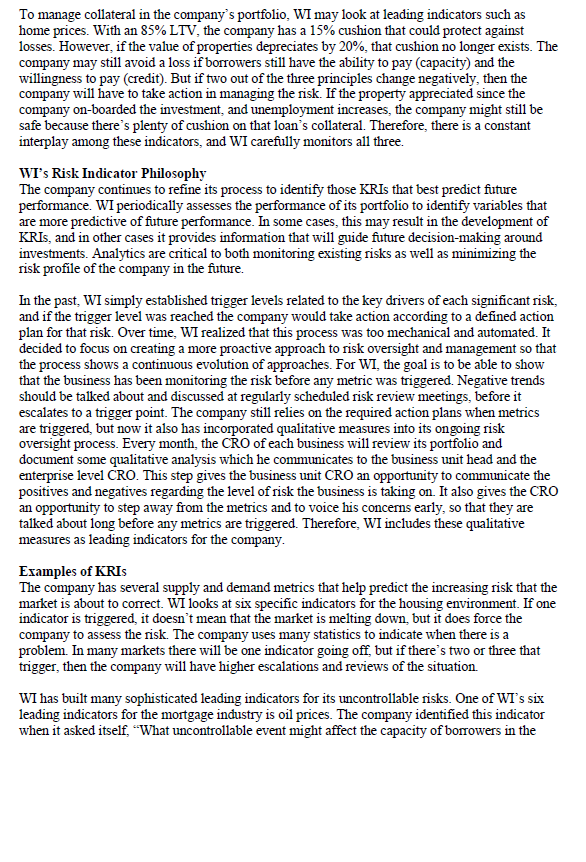

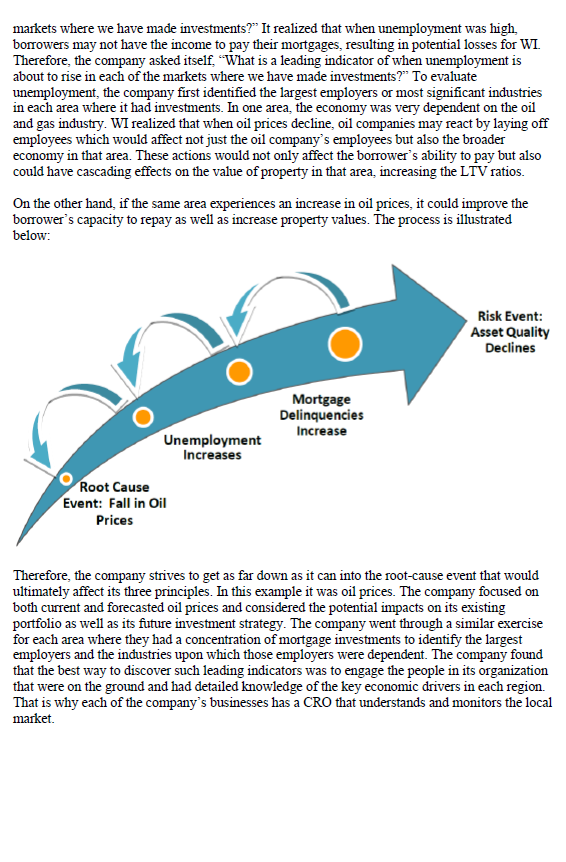

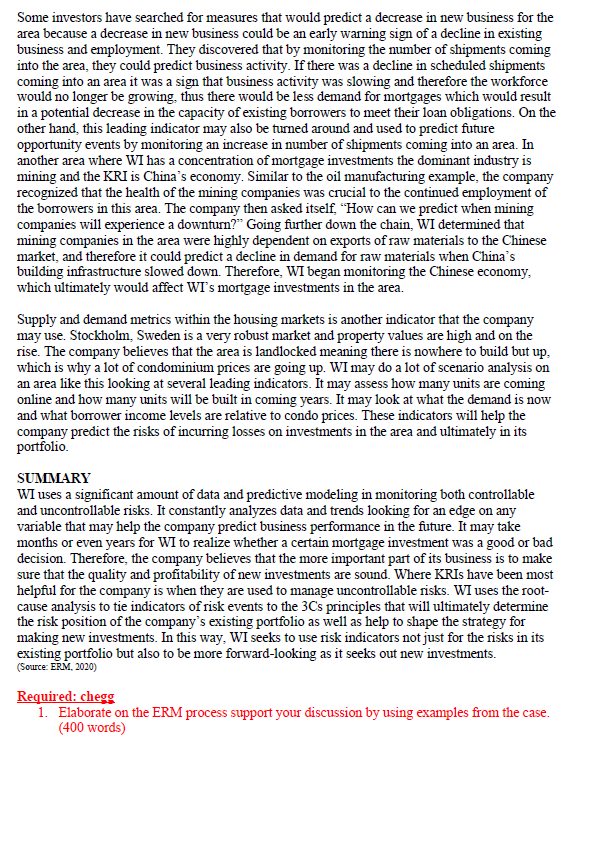

PART A: Wimbledon Investments OVERVIEW This case study investigates an investment company with divisions all over the world. Over the past several years, the company has benefitted from utilizing key risk indicators (KRIS) to manage its risk. The enterprise-level risk committee has worked with the Chief Executive Officer (CEO) to identify three key strategic principles. Risk events to those principles were identified by the enterprise-level risk committee and the root-cause analysis was used to develop KRIs for the events. The company also relies heavily on data and predictive modeling to plan for future business performance. This study found that the company benefitted most from the use of KRIS when the risks were uncontrollable and when the KRIs were directed towards the risks from new investments the company was considering on-boarding. COMPANY BACKGROUND Wimbledon Investments (WI) is a leading investment and financial services company based in the United States with investments across the globe, but focused primarily in the United States, Canada, and Europe. WI has been in business for over 50 years and has survived numerous market downturns including the most recent global financial crisis. The Company had assets valued at approximately US$100 billion at December 31, 2015. A significant portion of WI's business consists of investments in mortgage loans. The company focuses on maintaining a diversified portfolio of mortgage investments and tries to be forward- looking when assessing the risks of investing in particular markets. One of the challenges for any international company is to design an effective Enterprise Risk Management (ERM) program that is common across all of its global businesses, yet is flexible enough to work in different environments. The markets in these different areas around the world may act and are regulated differently, which is why an ERM program cannot be too rigid. WI's strategy for making investments in new markets has been to look for areas with growing home ownership, a solid legal and regulatory framework for mortgage lending, and people who are home ready. It believes that this strategy has contributed to the company's successful growth and performance. ERM PROCESS The ERM process at Wimbledon Investments is relatively mature. The majority of the ERM process is implemented by the Executive Management Risk Committee, which consists of the heads of each business as well as several executives. This committee identifies the company's core drivers and what risks may affect those drivers. One of the ways the committee achieves this step is by relying heavily on analytics. It then assesses the risks by taking into consideration the likelihood and impact of those risks. The committee then classifies the risks as high, medium or low and responds accordingly by reducing the risks to within the company's risk appetite. Another key component of the ERM process is monitoring and communication, which is performed on a continuous basis throughout the organization. In addition, risks are also reassessed as a part of the company's annual business planning process. During the business planning process, the Executive Management Risk Committee assesses its investment portfolio and prepares three to four year forecasts of changes expected in its portfolio and in the markets in which it invests. The committee then creates three to four scenarios with increasing stress to evaluate the events that may happen and how the portfolio would be affected. The committee also assesses the probability of these events happening. To understand how the business will be affected by deeper levels of stress, the committee will run a deep downside scenario analysis looking at economic capital along the probability continuum. The Executive Management Risk Committee will then present its findings to the Board Risk Committee and gain approval over its risk appetite and tolerances. Wimbledon Investments ERM process helps to ensure that the company remains vigilant as risks are constantly changing. Below is an illustration of WI's ERM process: Core Drivers Monitoring & Communitcating Identifying Risks to Core Drivers Responding to the Risks Assessing the Risks The responsibility for oversight of the ERM process resides with the Board because it is the Board's role to ensure that management is making decisions with the appropriate balance of risk and reward. The Board Risk Committee was created to assist the Board of Directors in its risk oversight responsibilities. Some of these responsibilities include operational risk, market risk. housing risks etc. The Board Risk Committee annually reviews and oversees the implementation of Wi's risk management policies and approves the company's risk appetite and tolerances. It also reviews Wi's ability to assess and manage significant and emerging risks. WI's Corporate Chief Risk Officer (CCRO) is appointed by and reports to both the Board Risk Committee as well as the CEO. The CCRO chairs the Executive Management Risk Committee and is the management liaison to the Board Risk Committee. As such, the CCRO regularly attends meetings of the Board Risk Committee. Reporting to the CEO are the heads at each of the United States, Canada, and Europe business units. Each business unit has a business-level Chief Risk Officer (CRO) that reports directly to the business head and indirectly to the enterprise-level CCRO. Each business unit also has an ERM Team that includes an ERM Lead and Analytics lead reporting directly to the business-level CRO. Below is an illustration of the company's reporting line: Board of Directors Audit Committee Compensation Committee Nomination and Governance Committee Board Risk Committee CEO US Business head Canada Europe Business head Business head CFO HR CORO Executive Management Risk Committee US CRO Canada CRO Europe CRO DEVELOPING KEY RISK INDICATORS The Foundation for Developing KRIS - 3Cs Principles As a starting point in developing KRIs you must first look at the fundamentals of the business model and how that affects risks. When evaluating the source of risk in a loan, there are three fundamental principles that must be observed. Some businesses call them the 3Cs, and WI has incorporated them into its ERM program. These underwriting principles are a good way to think about the risks to an organization that invests in mortgage securities. Capacity: The first hurdle for WI is the capacity of the borrower and ultimately the company's portfolio. This principle can be expressed through the question "Does the borrower have the ability to pay back the loan?" If the borrower makes $900 per month and the mortgage is for $1000 per month, the company knows that the borrower does not have capacity. But if the borrower makes $2000 per month the transaction may be possible. Therefore, the company evaluates potential mortgage investments for sufficient capacity. One metric that WI uses to monitor the capacity of the borrowers in its portfolio of mortgage securities is Debt to Income (DTI). Therefore, the question for developing a KRI could be "What event(s) could have a significant impact on the Debt to Income ratio across my portfolio?" and "What is the earliest indicator that such an event or events is starting to occur?" Credit: Once the first condition is met the next step for WI is to look at credit. This principle asks, "Is the borrower willing to pay back the loan?" Some borrowers may satisfy the first principle and have the capacity to pay, but they don't pay their bills on time or they don't manage their finances very well. These types of habits can be reflected in a borrower's credit score, and ultimately in the company's investment portfolio. Credit scores are easy to obtain and the company has found them to be very predictive of default. The scores may also show the company if the borrower has any liabilities that have not been disclosed, because most loans in most mature markets will show up on a borrower's credit report. The company's portfolio risk increases as its borrowers' credit scores decrease. Therefore, WI may develop a KRI by asking the question, "What event(s) may decrease borrowers' credit scores?" and "What indicator will precede such an event?" Collateral: After WI has confirmed the borrower's credit position it will assess its collateral. If the borrower defaults on the loan, the first step would be to work with the borrower to try to remedy the situation through a loan workout process. If this process is unsuccessful , the property securing the mortgage would likely be sold to recover the value to pay off the loan. One of the key measures of involving collateral is the Loan-to-Value (LTV) ratio. The LTV ratio is a key measure that banks and mortgage lenders use that describes the relationship between the loan amount and the value of the property. A higher LTV will mean that there is less equity in the loan, which makes it riskier. Some loans may have a 95% LTV, which means that the borrower only made a 5% down payment. These loans are viewed as highly risky in WI's portfolio. The hazard with a high LTV loan is that a borrower's equity may quickly erode if payments are missed and in that case, the borrower may face a high likelihood of losing the home to foreclosure. When the borrower finds himself in this situation, there is little incentive to invest time and resources into the maintenance of the property. As a result , the value of the property may go down potentially increasing the loss on the mortgage loan. However, a mortgage with an 85% LTV allows the company to have a 15% cushion If the borrower does not make his payments, WI will have more cushion to recover the value needed to pay off the loan. Therefore, WI would use LTV to develop a KRI by asking. "What would increase our portfolio's LTV?" and "What indicator could show when LTV is about to increase?" Documentation may also be added to these principles. Although it does not relate to KRIs, all of the three above steps rely on good documentation by the company and by the loan originators. The 3Cs underwriting principles have been used for many years and were implemented long before the global financial crisis of 2007. Even so, one can easily map deficiencies that resulted in the crises to one of these three key principles. For example, some mortgage investors had purchased 100% LTV loans, which were very vulnerable to potential losses in the event of a market decline. If WI can develop KRIs that are tied to these 3Cs, the company might mitigate its exposure to a risk event in the future. Below is an illustration of how Wimbledon Investments linked its objective to strategies to risks and ultimately KRIS: Capacity DTI Risky DTI KRIS Profitability Credit Credit Score Risky Credit Score KRIS Collateral LTV Risky LTV KRIS Credit Default Risks & Leading Indicators As demonstrated, the risks to mortgages and credit default may all tie into the above 3Cs principles. When WI asks itself, "What event might change one of the 3Cs?" it generally identifies several risk events. These risk events may be divided into controllable and uncontrollable risks. Controllable risks are managed differently than uncontrollable risks in that analytics and multiple dashboards are used to evaluate the risks present in each new investment that the company is on-boarding. Uncontrollable risks have a greater effect on loans that the company has already invested in, which is where KRIs can be particularly effective. Controllable risks: Controllable risks are managed on the front end of business decisions to decide whether or not to take certain risks based upon limits that have been put in place. 1. For capacity, the lender can make sure that it has reasonable DTI by putting a cap on the measure of, for example, 45%. The company can monitor and manage the loans that are coming so that they don't exceed this metric. 2. For credit, the company may look at its portfolio to see how many loans are coming in below a certain threshold. It may also look at the average and see how it is moving up and down For collateral, the company may put a cap on LTV and say it wants 95% maximum and 90% average for its portfolio To monitor these controllable risks, the company uses multiple dashboards and analytical data. When a measure is triggered, it forces a refreshing of the company's analysis and an escalation to higher committee levels. However, the company realizes that its geographical diversification allows it to experience stress events without always having to create a deviation from its business plan. Uncontrollable risks: Even if WI has all three principles in place, there are many factors in the mortgage industry that could influence its risk position. The company cannot control macroeconomic shifts, but it can prepare itself to be more agile and resilient when these events do occur. This is where risk indicators can be very effective and useful. To monitor the macroeconomic environment, WI may look at indicators such as Gross Domestic Product (GDP) growth, interest rates, unemployment, and inflation. To monitor the housing environment, the company may look at mortgage originations, home price appreciation, affordability, and housing supply and demand. All these indicators may cause changes in a portfolio's 3Cs principles. To manage collateral in the company's portfolio, WI may look at leading indicators such as home prices. With an 85% LTV, the company has a 15% cushion that could protect against losses. However, if the value of properties depreciates by 20%, that cushion no longer exists. The company may still avoid a loss if borrowers still have the ability to pay (capacity) and the willingness to pay (credit). But if two out of the three principles change negatively, then the company will have to take action in managing the risk. If the property appreciated since the company on-boarded the investment, and unemployment increases, the company might still be safe because there's plenty of cushion on that loan's collateral. Therefore, there is a constant interplay among these indicators, and WI carefully monitors all three. WI's Risk Indicator Philosophy The company continues to refine its process to identify those KRIs that best predict future performance. WI periodically assesses the performance of its portfolio to identify variables that are more predictive of future performance. In some cases, this may result in the development of KRIs, and in other cases it provides information that will guide future decision-making around investments. Analytics are critical to both monitoring existing risks as well as minimizing the risk profile of the company in the future. In the past, WI simply established trigger levels related to the key drivers of each significant risk, and if the trigger level was reached the company would take action according to a defined action plan for that risk. Over time, WI realized that this process was too mechanical and automated. It decided to focus on creating a more proactive approach to risk oversight and management so that the process shows a continuous evolution of approaches. For WI, the goal is to be able to show that the business has been monitoring the risk before any metric was triggered. Negative trends should be talked about and discussed at regularly scheduled risk review meetings, before it escalates to a trigger point. The company still relies on the required action plans when metrics are triggered, but now it also has incorporated qualitative measures into its ongoing risk oversight process. Every month, the CRO of each business will review its portfolio and document some qualitative analysis which he communicates to the business unit head and the enterprise level CRO. This step gives the business unit CRO an opportunity to communicate the positives and negatives regarding the level of risk the business is taking on. It also gives the CRO an opportunity to step away from the metrics and to voice his concerns early, so that they are talked about long before any metrics are triggered. Therefore, WI includes these qualitative measures as leading indicators for the company. Examples of KRIS The company has several supply and demand metrics that help predict the increasing risk that the market is about to correct. WI looks at six specific indicators for the housing environment. If one indicator is triggered, it doesn't mean that the market is melting down, but it does force the company to assess the risk. The company uses many statistics to indicate when there is a problem. In many markets there will be one indicator going off, but if there's two or three that trigger, then the company will have higher escalations and reviews of the situation WI has built many sophisticated leading indicators for its uncontrollable risks. One of WI's six leading indicators for the mortgage industry is oil prices. The company identified this indicator when it asked itself, "What uncontrollable event might affect the capacity of borrowers in the markets where we have made investments?" It realized that when unemployment was high borrowers may not have the income to pay their mortgages, resulting in potential losses for WI. Therefore, the company asked itself, "What is a leading indicator of when unemployment is about to rise in each of the markets where we have made investments?" To evaluate unemployment, the company first identified the largest employers or most significant industries in each area where it had investments. In one area, the economy was very dependent on the oil and gas industry. WI realized that when oil prices decline, oil companies may react by laying off employees which would affect not just the oil company's employees but also the broader economy in that area. These actions would not only affect the borrower's ability to pay but also could have cascading effects on the value of property in that area, increasing the LTV ratios. On the other hand, if the same area experiences an increase in oil prices, it could improve the borrower's capacity to repay as well as increase property values. The process is illustrated below: Risk Event: Asset Quality Declines Mortgage Delinquencies Increase Unemployment Increases Root Cause Event: Fall in Oil Prices Therefore, the company strives to get as far down as it can into the root-cause event that would ultimately affect its three principles. In this example it was oil prices. The company focused on both current and forecasted oil prices and considered the potential impacts on its existing portfolio as well as its future investment strategy. The company went through a similar exercise for each area where they had a concentration of mortgage investments to identify the largest employers and the industries upon which those employers were dependent. The company found that the best way to discover such leading indicators was to engage the people in its organization that were on the ground and had detailed knowledge of the key economic drivers in each region. That is why each of the company's businesses has a CRO that understands and monitors the local market. Some investors have searched for measures that would predict a decrease in new business for the area because a decrease in new business could be an early warning sign of a decline in existing business and employment. They discovered that by monitoring the number of shipments coming into the area, they could predict business activity. If there was a decline in scheduled shipments coming into an area it was a sign that business activity was slowing and therefore the workforce would no longer be growing, thus there would be less demand for mortgages which would result in a potential decrease in the capacity of existing borrowers to meet their loan obligations. On the other hand, this leading indicator may also be turned around and used to predict future opportunity events by monitoring an increase in number of shipments coming into an area. In another area where WI has a concentration of mortgage investments the dominant industry is mining and the KRI is China's economy. Similar to the oil manufacturing example, the company recognized that the health of the mining companies was crucial to the continued employment of the borrowers in this area. The company then asked itself, "How can we predict when mining companies will experience a downturn?" Going further down the chain, WI determined that mining companies in the area were highly dependent on exports of raw materials to the Chinese market, and therefore it could predict a decline in demand for raw materials when China's building infrastructure slowed down. Therefore, WI began monitoring the Chinese economy, which ultimately would affect WI's mortgage investments in the area. Supply and demand metrics within the housing markets is another indicator that the company may use. Stockholm, Sweden is a very robust market and property values are high and on the rise. The company believes that the area is landlocked meaning there is nowhere to build but up, which is why a lot of condominium prices are going up. WI may do a lot of scenario analysis on an area like this looking at several leading indicators. It may assess how many units are coming online and how many units will be built in coming years. It may look at what the demand is now and what borrower income levels are relative to condo prices. These indicators will help the company predict the risks of incurring losses on investments in the area and ultimately in its portfolio SUMMARY WI uses a significant amount of data and predictive modeling in monitoring both controllable and uncontrollable risks. It constantly analyzes data and trends looking for an edge on any variable that may help the company predict business performance in the future. It may take months or even years for WI to realize whether a certain mortgage investment was a good or bad decision. Therefore, the company believes that the more important part of its business is to make sure that the quality and profitability of new investments are sound. Where KRIs have been most helpful for the company is when they are used to manage uncontrollable risks. WI uses the root- cause analysis to tie indicators of risk events to the 3Cs principles that will ultimately determine the risk position of the company's existing portfolio as well as help to shape the strategy for making new investments. In this way, WI seeks to use risk indicators not just for the risks in its existing portfolio but also to be more forward-looking as it seeks out new investments. (Source: ERM, 2020) Required: chegg 1. Elaborate on the ERM process support your discussion by using examples from the case. (400 words) 2. Discuss the importance of the Key Risk indicators, support your discussion by using examples from the case. (120 words) 3. Elaborate on the difference between the Key Performance Indicators and the Key Risk Indicators. (180 words) 4. Elaborate on other types of risks that the company may face. (200 words) PART A: Wimbledon Investments OVERVIEW This case study investigates an investment company with divisions all over the world. Over the past several years, the company has benefitted from utilizing key risk indicators (KRIS) to manage its risk. The enterprise-level risk committee has worked with the Chief Executive Officer (CEO) to identify three key strategic principles. Risk events to those principles were identified by the enterprise-level risk committee and the root-cause analysis was used to develop KRIs for the events. The company also relies heavily on data and predictive modeling to plan for future business performance. This study found that the company benefitted most from the use of KRIS when the risks were uncontrollable and when the KRIs were directed towards the risks from new investments the company was considering on-boarding. COMPANY BACKGROUND Wimbledon Investments (WI) is a leading investment and financial services company based in the United States with investments across the globe, but focused primarily in the United States, Canada, and Europe. WI has been in business for over 50 years and has survived numerous market downturns including the most recent global financial crisis. The Company had assets valued at approximately US$100 billion at December 31, 2015. A significant portion of WI's business consists of investments in mortgage loans. The company focuses on maintaining a diversified portfolio of mortgage investments and tries to be forward- looking when assessing the risks of investing in particular markets. One of the challenges for any international company is to design an effective Enterprise Risk Management (ERM) program that is common across all of its global businesses, yet is flexible enough to work in different environments. The markets in these different areas around the world may act and are regulated differently, which is why an ERM program cannot be too rigid. WI's strategy for making investments in new markets has been to look for areas with growing home ownership, a solid legal and regulatory framework for mortgage lending, and people who are home ready. It believes that this strategy has contributed to the company's successful growth and performance. ERM PROCESS The ERM process at Wimbledon Investments is relatively mature. The majority of the ERM process is implemented by the Executive Management Risk Committee, which consists of the heads of each business as well as several executives. This committee identifies the company's core drivers and what risks may affect those drivers. One of the ways the committee achieves this step is by relying heavily on analytics. It then assesses the risks by taking into consideration the likelihood and impact of those risks. The committee then classifies the risks as high, medium or low and responds accordingly by reducing the risks to within the company's risk appetite. Another key component of the ERM process is monitoring and communication, which is performed on a continuous basis throughout the organization. In addition, risks are also reassessed as a part of the company's annual business planning process. During the business planning process, the Executive Management Risk Committee assesses its investment portfolio and prepares three to four year forecasts of changes expected in its portfolio and in the markets in which it invests. The committee then creates three to four scenarios with increasing stress to evaluate the events that may happen and how the portfolio would be affected. The committee also assesses the probability of these events happening. To understand how the business will be affected by deeper levels of stress, the committee will run a deep downside scenario analysis looking at economic capital along the probability continuum. The Executive Management Risk Committee will then present its findings to the Board Risk Committee and gain approval over its risk appetite and tolerances. Wimbledon Investments ERM process helps to ensure that the company remains vigilant as risks are constantly changing. Below is an illustration of WI's ERM process: Core Drivers Monitoring & Communitcating Identifying Risks to Core Drivers Responding to the Risks Assessing the Risks The responsibility for oversight of the ERM process resides with the Board because it is the Board's role to ensure that management is making decisions with the appropriate balance of risk and reward. The Board Risk Committee was created to assist the Board of Directors in its risk oversight responsibilities. Some of these responsibilities include operational risk, market risk. housing risks etc. The Board Risk Committee annually reviews and oversees the implementation of Wi's risk management policies and approves the company's risk appetite and tolerances. It also reviews Wi's ability to assess and manage significant and emerging risks. WI's Corporate Chief Risk Officer (CCRO) is appointed by and reports to both the Board Risk Committee as well as the CEO. The CCRO chairs the Executive Management Risk Committee and is the management liaison to the Board Risk Committee. As such, the CCRO regularly attends meetings of the Board Risk Committee. Reporting to the CEO are the heads at each of the United States, Canada, and Europe business units. Each business unit has a business-level Chief Risk Officer (CRO) that reports directly to the business head and indirectly to the enterprise-level CCRO. Each business unit also has an ERM Team that includes an ERM Lead and Analytics lead reporting directly to the business-level CRO. Below is an illustration of the company's reporting line: Board of Directors Audit Committee Compensation Committee Nomination and Governance Committee Board Risk Committee CEO US Business head Canada Europe Business head Business head CFO HR CORO Executive Management Risk Committee US CRO Canada CRO Europe CRO DEVELOPING KEY RISK INDICATORS The Foundation for Developing KRIS - 3Cs Principles As a starting point in developing KRIs you must first look at the fundamentals of the business model and how that affects risks. When evaluating the source of risk in a loan, there are three fundamental principles that must be observed. Some businesses call them the 3Cs, and WI has incorporated them into its ERM program. These underwriting principles are a good way to think about the risks to an organization that invests in mortgage securities. Capacity: The first hurdle for WI is the capacity of the borrower and ultimately the company's portfolio. This principle can be expressed through the question "Does the borrower have the ability to pay back the loan?" If the borrower makes $900 per month and the mortgage is for $1000 per month, the company knows that the borrower does not have capacity. But if the borrower makes $2000 per month the transaction may be possible. Therefore, the company evaluates potential mortgage investments for sufficient capacity. One metric that WI uses to monitor the capacity of the borrowers in its portfolio of mortgage securities is Debt to Income (DTI). Therefore, the question for developing a KRI could be "What event(s) could have a significant impact on the Debt to Income ratio across my portfolio?" and "What is the earliest indicator that such an event or events is starting to occur?" Credit: Once the first condition is met the next step for WI is to look at credit. This principle asks, "Is the borrower willing to pay back the loan?" Some borrowers may satisfy the first principle and have the capacity to pay, but they don't pay their bills on time or they don't manage their finances very well. These types of habits can be reflected in a borrower's credit score, and ultimately in the company's investment portfolio. Credit scores are easy to obtain and the company has found them to be very predictive of default. The scores may also show the company if the borrower has any liabilities that have not been disclosed, because most loans in most mature markets will show up on a borrower's credit report. The company's portfolio risk increases as its borrowers' credit scores decrease. Therefore, WI may develop a KRI by asking the question, "What event(s) may decrease borrowers' credit scores?" and "What indicator will precede such an event?" Collateral: After WI has confirmed the borrower's credit position it will assess its collateral. If the borrower defaults on the loan, the first step would be to work with the borrower to try to remedy the situation through a loan workout process. If this process is unsuccessful , the property securing the mortgage would likely be sold to recover the value to pay off the loan. One of the key measures of involving collateral is the Loan-to-Value (LTV) ratio. The LTV ratio is a key measure that banks and mortgage lenders use that describes the relationship between the loan amount and the value of the property. A higher LTV will mean that there is less equity in the loan, which makes it riskier. Some loans may have a 95% LTV, which means that the borrower only made a 5% down payment. These loans are viewed as highly risky in WI's portfolio. The hazard with a high LTV loan is that a borrower's equity may quickly erode if payments are missed and in that case, the borrower may face a high likelihood of losing the home to foreclosure. When the borrower finds himself in this situation, there is little incentive to invest time and resources into the maintenance of the property. As a result , the value of the property may go down potentially increasing the loss on the mortgage loan. However, a mortgage with an 85% LTV allows the company to have a 15% cushion If the borrower does not make his payments, WI will have more cushion to recover the value needed to pay off the loan. Therefore, WI would use LTV to develop a KRI by asking. "What would increase our portfolio's LTV?" and "What indicator could show when LTV is about to increase?" Documentation may also be added to these principles. Although it does not relate to KRIs, all of the three above steps rely on good documentation by the company and by the loan originators. The 3Cs underwriting principles have been used for many years and were implemented long before the global financial crisis of 2007. Even so, one can easily map deficiencies that resulted in the crises to one of these three key principles. For example, some mortgage investors had purchased 100% LTV loans, which were very vulnerable to potential losses in the event of a market decline. If WI can develop KRIs that are tied to these 3Cs, the company might mitigate its exposure to a risk event in the future. Below is an illustration of how Wimbledon Investments linked its objective to strategies to risks and ultimately KRIS: Capacity DTI Risky DTI KRIS Profitability Credit Credit Score Risky Credit Score KRIS Collateral LTV Risky LTV KRIS Credit Default Risks & Leading Indicators As demonstrated, the risks to mortgages and credit default may all tie into the above 3Cs principles. When WI asks itself, "What event might change one of the 3Cs?" it generally identifies several risk events. These risk events may be divided into controllable and uncontrollable risks. Controllable risks are managed differently than uncontrollable risks in that analytics and multiple dashboards are used to evaluate the risks present in each new investment that the company is on-boarding. Uncontrollable risks have a greater effect on loans that the company has already invested in, which is where KRIs can be particularly effective. Controllable risks: Controllable risks are managed on the front end of business decisions to decide whether or not to take certain risks based upon limits that have been put in place. 1. For capacity, the lender can make sure that it has reasonable DTI by putting a cap on the measure of, for example, 45%. The company can monitor and manage the loans that are coming so that they don't exceed this metric. 2. For credit, the company may look at its portfolio to see how many loans are coming in below a certain threshold. It may also look at the average and see how it is moving up and down For collateral, the company may put a cap on LTV and say it wants 95% maximum and 90% average for its portfolio To monitor these controllable risks, the company uses multiple dashboards and analytical data. When a measure is triggered, it forces a refreshing of the company's analysis and an escalation to higher committee levels. However, the company realizes that its geographical diversification allows it to experience stress events without always having to create a deviation from its business plan. Uncontrollable risks: Even if WI has all three principles in place, there are many factors in the mortgage industry that could influence its risk position. The company cannot control macroeconomic shifts, but it can prepare itself to be more agile and resilient when these events do occur. This is where risk indicators can be very effective and useful. To monitor the macroeconomic environment, WI may look at indicators such as Gross Domestic Product (GDP) growth, interest rates, unemployment, and inflation. To monitor the housing environment, the company may look at mortgage originations, home price appreciation, affordability, and housing supply and demand. All these indicators may cause changes in a portfolio's 3Cs principles. To manage collateral in the company's portfolio, WI may look at leading indicators such as home prices. With an 85% LTV, the company has a 15% cushion that could protect against losses. However, if the value of properties depreciates by 20%, that cushion no longer exists. The company may still avoid a loss if borrowers still have the ability to pay (capacity) and the willingness to pay (credit). But if two out of the three principles change negatively, then the company will have to take action in managing the risk. If the property appreciated since the company on-boarded the investment, and unemployment increases, the company might still be safe because there's plenty of cushion on that loan's collateral. Therefore, there is a constant interplay among these indicators, and WI carefully monitors all three. WI's Risk Indicator Philosophy The company continues to refine its process to identify those KRIs that best predict future performance. WI periodically assesses the performance of its portfolio to identify variables that are more predictive of future performance. In some cases, this may result in the development of KRIs, and in other cases it provides information that will guide future decision-making around investments. Analytics are critical to both monitoring existing risks as well as minimizing the risk profile of the company in the future. In the past, WI simply established trigger levels related to the key drivers of each significant risk, and if the trigger level was reached the company would take action according to a defined action plan for that risk. Over time, WI realized that this process was too mechanical and automated. It decided to focus on creating a more proactive approach to risk oversight and management so that the process shows a continuous evolution of approaches. For WI, the goal is to be able to show that the business has been monitoring the risk before any metric was triggered. Negative trends should be talked about and discussed at regularly scheduled risk review meetings, before it escalates to a trigger point. The company still relies on the required action plans when metrics are triggered, but now it also has incorporated qualitative measures into its ongoing risk oversight process. Every month, the CRO of each business will review its portfolio and document some qualitative analysis which he communicates to the business unit head and the enterprise level CRO. This step gives the business unit CRO an opportunity to communicate the positives and negatives regarding the level of risk the business is taking on. It also gives the CRO an opportunity to step away from the metrics and to voice his concerns early, so that they are talked about long before any metrics are triggered. Therefore, WI includes these qualitative measures as leading indicators for the company. Examples of KRIS The company has several supply and demand metrics that help predict the increasing risk that the market is about to correct. WI looks at six specific indicators for the housing environment. If one indicator is triggered, it doesn't mean that the market is melting down, but it does force the company to assess the risk. The company uses many statistics to indicate when there is a problem. In many markets there will be one indicator going off, but if there's two or three that trigger, then the company will have higher escalations and reviews of the situation WI has built many sophisticated leading indicators for its uncontrollable risks. One of WI's six leading indicators for the mortgage industry is oil prices. The company identified this indicator when it asked itself, "What uncontrollable event might affect the capacity of borrowers in the markets where we have made investments?" It realized that when unemployment was high borrowers may not have the income to pay their mortgages, resulting in potential losses for WI. Therefore, the company asked itself, "What is a leading indicator of when unemployment is about to rise in each of the markets where we have made investments?" To evaluate unemployment, the company first identified the largest employers or most significant industries in each area where it had investments. In one area, the economy was very dependent on the oil and gas industry. WI realized that when oil prices decline, oil companies may react by laying off employees which would affect not just the oil company's employees but also the broader economy in that area. These actions would not only affect the borrower's ability to pay but also could have cascading effects on the value of property in that area, increasing the LTV ratios. On the other hand, if the same area experiences an increase in oil prices, it could improve the borrower's capacity to repay as well as increase property values. The process is illustrated below: Risk Event: Asset Quality Declines Mortgage Delinquencies Increase Unemployment Increases Root Cause Event: Fall in Oil Prices Therefore, the company strives to get as far down as it can into the root-cause event that would ultimately affect its three principles. In this example it was oil prices. The company focused on both current and forecasted oil prices and considered the potential impacts on its existing portfolio as well as its future investment strategy. The company went through a similar exercise for each area where they had a concentration of mortgage investments to identify the largest employers and the industries upon which those employers were dependent. The company found that the best way to discover such leading indicators was to engage the people in its organization that were on the ground and had detailed knowledge of the key economic drivers in each region. That is why each of the company's businesses has a CRO that understands and monitors the local market. Some investors have searched for measures that would predict a decrease in new business for the area because a decrease in new business could be an early warning sign of a decline in existing business and employment. They discovered that by monitoring the number of shipments coming into the area, they could predict business activity. If there was a decline in scheduled shipments coming into an area it was a sign that business activity was slowing and therefore the workforce would no longer be growing, thus there would be less demand for mortgages which would result in a potential decrease in the capacity of existing borrowers to meet their loan obligations. On the other hand, this leading indicator may also be turned around and used to predict future opportunity events by monitoring an increase in number of shipments coming into an area. In another area where WI has a concentration of mortgage investments the dominant industry is mining and the KRI is China's economy. Similar to the oil manufacturing example, the company recognized that the health of the mining companies was crucial to the continued employment of the borrowers in this area. The company then asked itself, "How can we predict when mining companies will experience a downturn?" Going further down the chain, WI determined that mining companies in the area were highly dependent on exports of raw materials to the Chinese market, and therefore it could predict a decline in demand for raw materials when China's building infrastructure slowed down. Therefore, WI began monitoring the Chinese economy, which ultimately would affect WI's mortgage investments in the area. Supply and demand metrics within the housing markets is another indicator that the company may use. Stockholm, Sweden is a very robust market and property values are high and on the rise. The company believes that the area is landlocked meaning there is nowhere to build but up, which is why a lot of condominium prices are going up. WI may do a lot of scenario analysis on an area like this looking at several leading indicators. It may assess how many units are coming online and how many units will be built in coming years. It may look at what the demand is now and what borrower income levels are relative to condo prices. These indicators will help the company predict the risks of incurring losses on investments in the area and ultimately in its portfolio SUMMARY WI uses a significant amount of data and predictive modeling in monitoring both controllable and uncontrollable risks. It constantly analyzes data and trends looking for an edge on any variable that may help the company predict business performance in the future. It may take months or even years for WI to realize whether a certain mortgage investment was a good or bad decision. Therefore, the company believes that the more important part of its business is to make sure that the quality and profitability of new investments are sound. Where KRIs have been most helpful for the company is when they are used to manage uncontrollable risks. WI uses the root- cause analysis to tie indicators of risk events to the 3Cs principles that will ultimately determine the risk position of the company's existing portfolio as well as help to shape the strategy for making new investments. In this way, WI seeks to use risk indicators not just for the risks in its existing portfolio but also to be more forward-looking as it seeks out new investments. (Source: ERM, 2020) Required: chegg 1. Elaborate on the ERM process support your discussion by using examples from the case. (400 words) 2. Discuss the importance of the Key Risk indicators, support your discussion by using examples from the case. (120 words) 3. Elaborate on the difference between the Key Performance Indicators and the Key Risk Indicators. (180 words) 4. Elaborate on other types of risks that the company may face. (200 words)