Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B: (12 marks) Zain, Inc., is developing flexible budgets for each department as part of its plan to use standard costs. Normal monthly

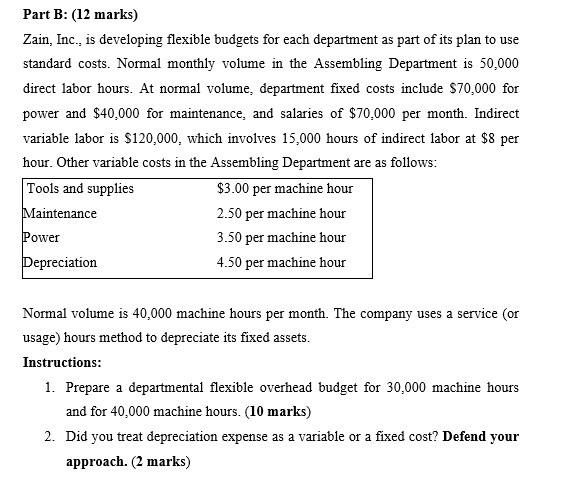

Part B: (12 marks) Zain, Inc., is developing flexible budgets for each department as part of its plan to use standard costs. Normal monthly volume in the Assembling Department is 50,000 direct labor hours. At normal volume, department fixed costs include $70,000 for power and $40,000 for maintenance, and salaries of $70,000 per month. Indirect variable labor is $120,000, which involves 15,000 hours of indirect labor at $8 per hour. Other variable costs in the Assembling Department are as follows: Tools and supplies Maintenance Power Depreciation $3.00 per machine hour 2.50 per machine hour 3.50 per machine hour 4.50 per machine hour Normal volume is 40,000 machine hours per month. The company uses a service (or usage) hours method to depreciate its fixed assets. Instructions: 1. Prepare a departmental flexible overhead budget for 30,000 machine hours and for 40,000 machine hours. (10 marks) 2. Did you treat depreciation expense as a variable or a fixed cost? Defend your approach. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started