Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART B [14 MARKS] A business started trading on 1 January 2017. During the two years ended 31 December 2017 and 2018 the following debts

PART B [14 MARKS]

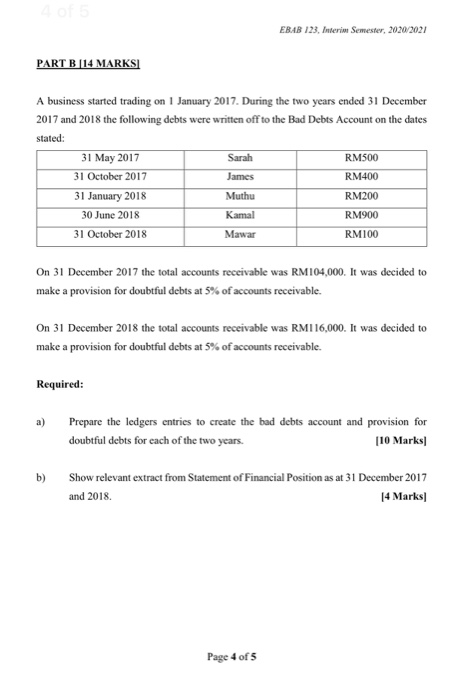

A business started trading on 1 January 2017. During the two years ended 31 December 2017 and 2018 the following debts were written off to the Bad Debts Account on the dates stated:

31 May 2017 31 October 2017 31 January 2018 30 June 2018 31 October 2018

Sarah James Muthu Kamal Mawar

RM500 RM400 RM200 RM900 RM100

EBAB 123, Interim Semester, 2020/2021

On 31 December 2017 the total accounts receivable was RM104,000. It was decided to make a provision for doubtful debts at 5% of accounts receivable.

On 31 December 2018 the total accounts receivable was RM116,000. It was decided to make a provision for doubtful debts at 5% of accounts receivable.

Required:

a) Prepare the ledgers entries to create the bad debts account and provision for doubtful debts for each of the two years. [10 Marks]

b) Show relevant extract from Statement of Financial Position as at 31 December 2017

and 2018.

[4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started