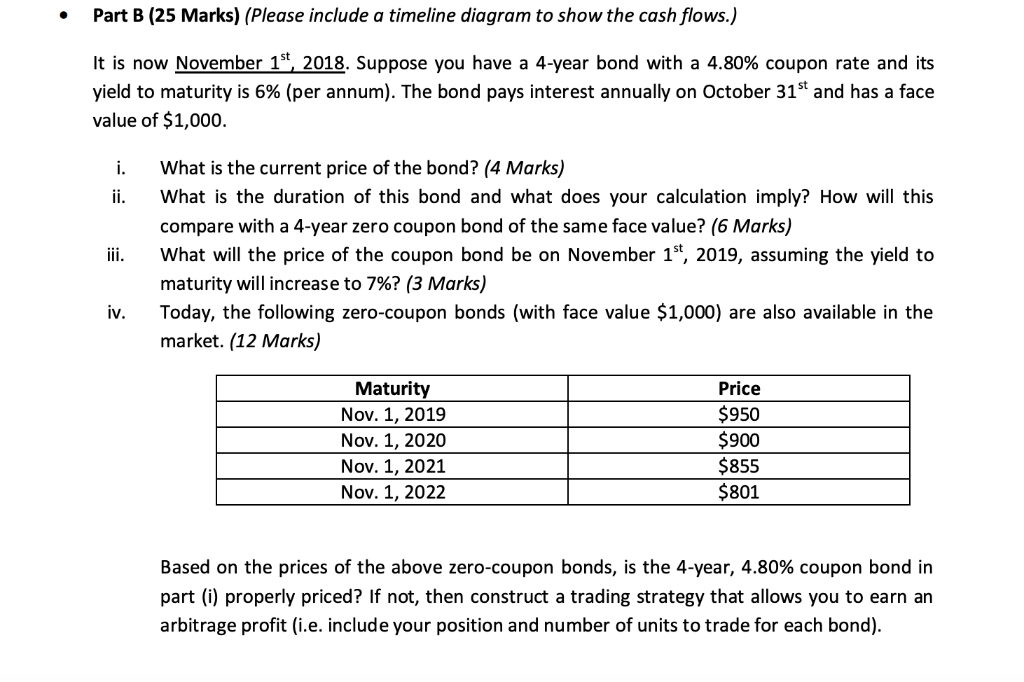

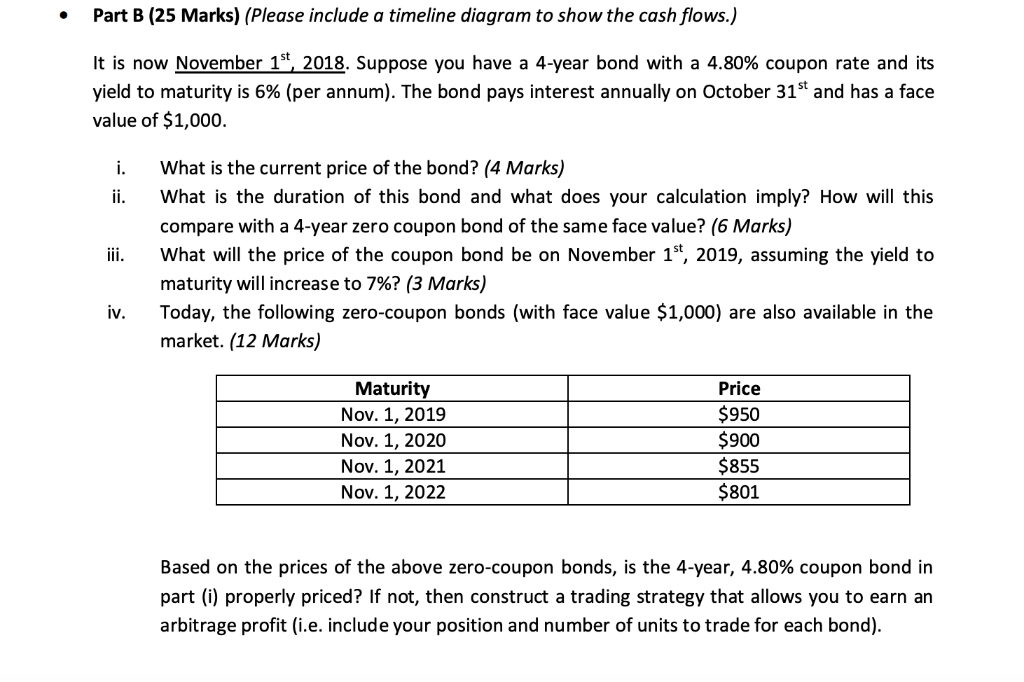

Part B (25 Marks) (Please include a timeline diagram to show the cash flows.) . It is now November 1st,2018. Suppose you have a 4-year bond with a 4.80% coupon rate and its yield to maturity is 6% (per annum). The bond pays interest annually on October 31st and has a face value of $1,000. i. What is the current price of the bond? (4 Marks) ". what is the duration of this bond and what does your calculation imply? How will this ii. What will the price of the coupon bond be on November 15t, 2019, assuming the yield to iv. Today, the following zero-coupon bonds (with face value $1,000) are also available in the compare with a 4-year zero coupon bond of the same face value? (6 Marks) maturity will increase to 7%? (3 Marks) market. (12 Marks) Maturity Nov. 1,2019 Nov. 1, 2020 Nov. 1, 2021 Nov. 1, 2022 Price $950 $900 $855 $801 Based on the prices of the above zero-coupon bonds, is the 4-year, 4.80% coupon bond in part (i) properly priced? If not, then construct a trading strategy that allows you to earn an arbitrage profit (i.e. include your position and number of units to trade for each bond) Part B (25 Marks) (Please include a timeline diagram to show the cash flows.) . It is now November 1st,2018. Suppose you have a 4-year bond with a 4.80% coupon rate and its yield to maturity is 6% (per annum). The bond pays interest annually on October 31st and has a face value of $1,000. i. What is the current price of the bond? (4 Marks) ". what is the duration of this bond and what does your calculation imply? How will this ii. What will the price of the coupon bond be on November 15t, 2019, assuming the yield to iv. Today, the following zero-coupon bonds (with face value $1,000) are also available in the compare with a 4-year zero coupon bond of the same face value? (6 Marks) maturity will increase to 7%? (3 Marks) market. (12 Marks) Maturity Nov. 1,2019 Nov. 1, 2020 Nov. 1, 2021 Nov. 1, 2022 Price $950 $900 $855 $801 Based on the prices of the above zero-coupon bonds, is the 4-year, 4.80% coupon bond in part (i) properly priced? If not, then construct a trading strategy that allows you to earn an arbitrage profit (i.e. include your position and number of units to trade for each bond)