Question

Part B (80 marks) As she prepared to enter Mary's office, Siobhan pulled her summary sheets from her briefcase and quickly reviewed the details of

Part B (80 marks)

As she prepared to enter Mary's office, Siobhan pulled her summary sheets from her briefcase and quickly reviewed the details of the four projects, all of which she considered to be equally risky.

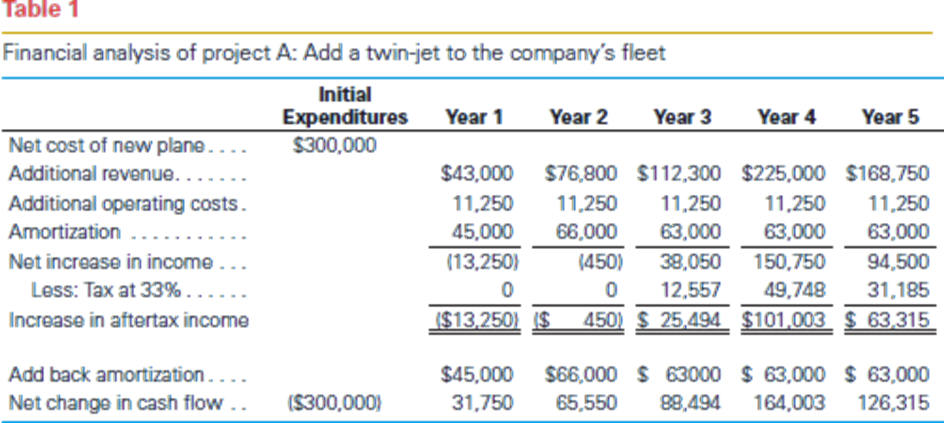

- A proposal to add a jet to the company's fleet. The plane was only six years old and was considered a good buy at $300,000. In return, the plane would bring over $600,000 in additional revenue during the next five years with only about $56,000 in operating costs. (See Table 1 for details.)

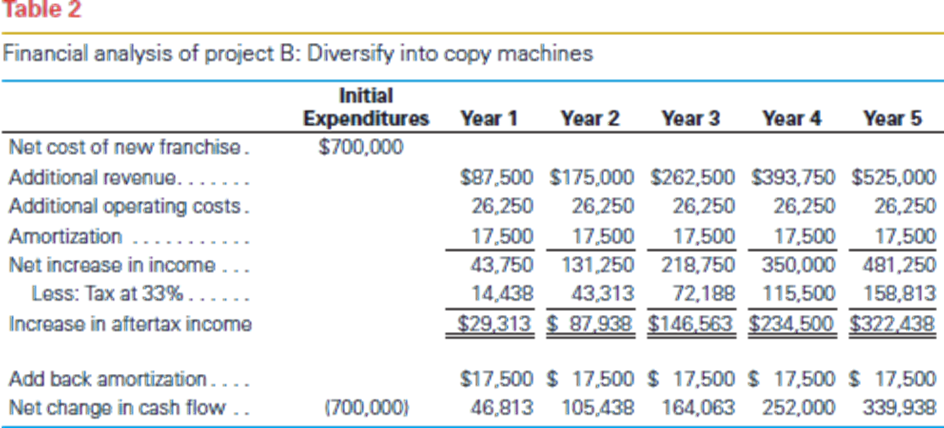

- A proposal to diversify into copy machines. The franchise was to cost $700,000, which would be amortized over a 40-year period. The new business was expected to generate over $1.4 million in sales over the next five years, and over $800,000 in after tax earnings. (See Table 2 for details.)

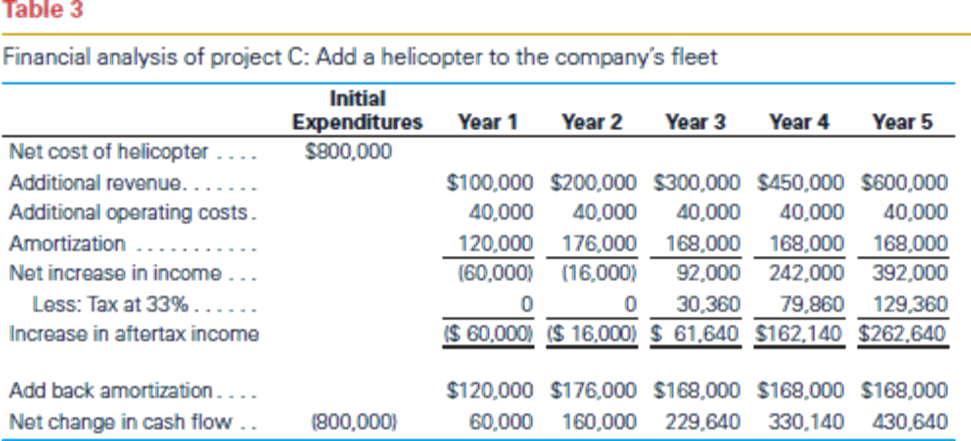

- A proposal to buy a helicopter. The machine was expensive and, counting additional training and licensing requirements, would cost $40,000 a year to operate. However, the versatility that the helicopter was expected to provide would generate over $1.5 million in additional revenue, and it would give the company access to a wider market as well. (See Table 3 for details.)

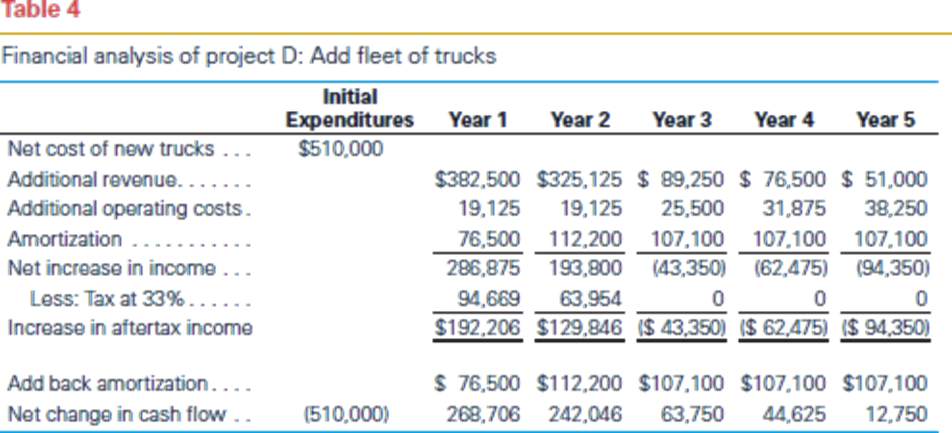

- A proposal to begin operating a fleet of trucks. Ten could be bought for only $51,000 each, and the additional business would bring in almost $700,000 in new sales in the first two years alone. (See Table 4 for details.)

In her mind, Siobhan quickly went over the evaluation methods she had used in the past: payback period, internal rate of return, and net present value. Siobhan knew that Mary would add a fourth, size of reported earnings, but she hoped she could talk Mary out of using it this time. Siobhan herself favoured the net present value method, but she had always had a tough time getting Mary to understand it.

Table 1 Financial andysis of project A: Add a twin jet to the company's fileet Initial Expenditures Year 1 Year 2 Year's Year 4 Year B Not east of new plans. Additional revenLOR. $13,000 $78,800 $112,300 $225,000 $168,750 Additional operating costs... Amorikation 11,230 11,250 11,250 11,250 11,250 45,000 19,000 *3000 Not Increase In Incarne...... Less::Text30%........ Increase In aftertex Income Kdback amerikailon..... Notchange In Basinflow... IST:3:2001 IS 4500 $ 25494 STOLDOS S 84315 $15,000 $88,000 $ 18000 SF000 S EQ,000. 31,750 BR.484 164008 128,315 M4500 0 38,050 150-770 $4,500 12,551 31,185

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started