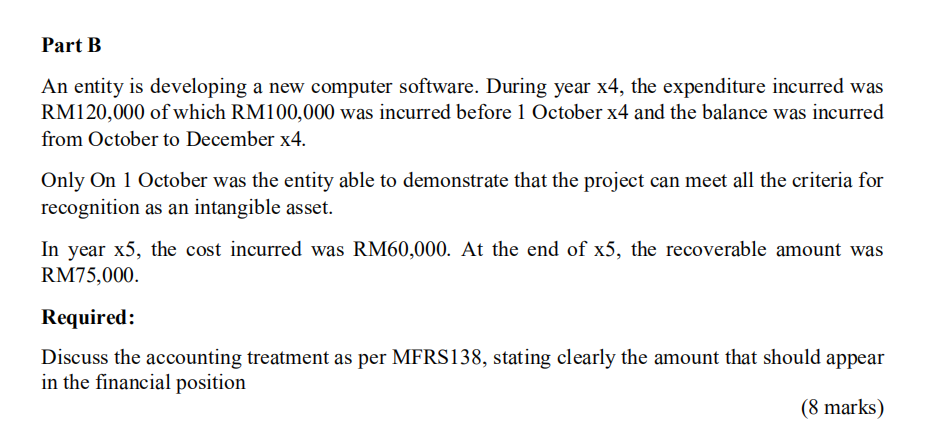

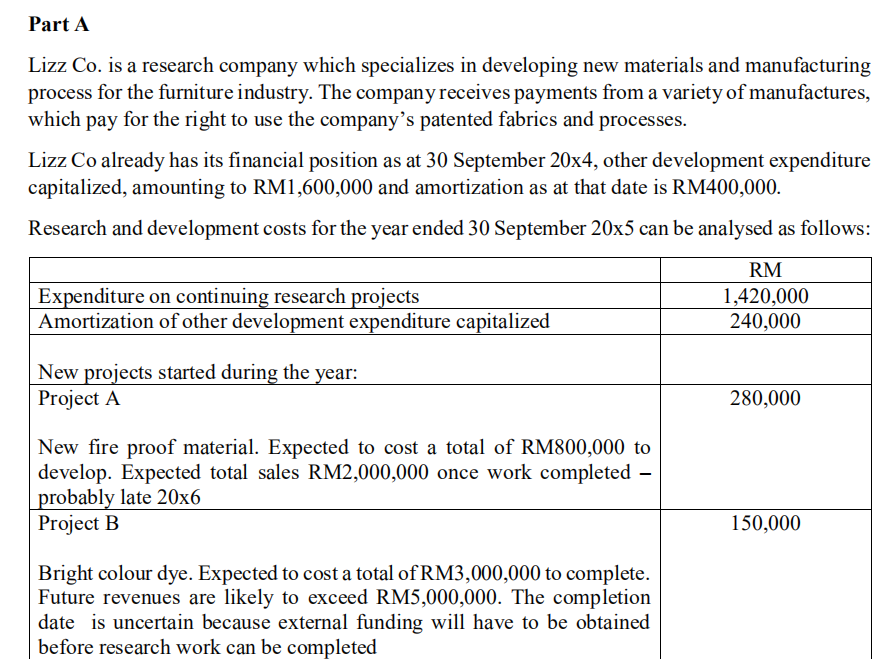

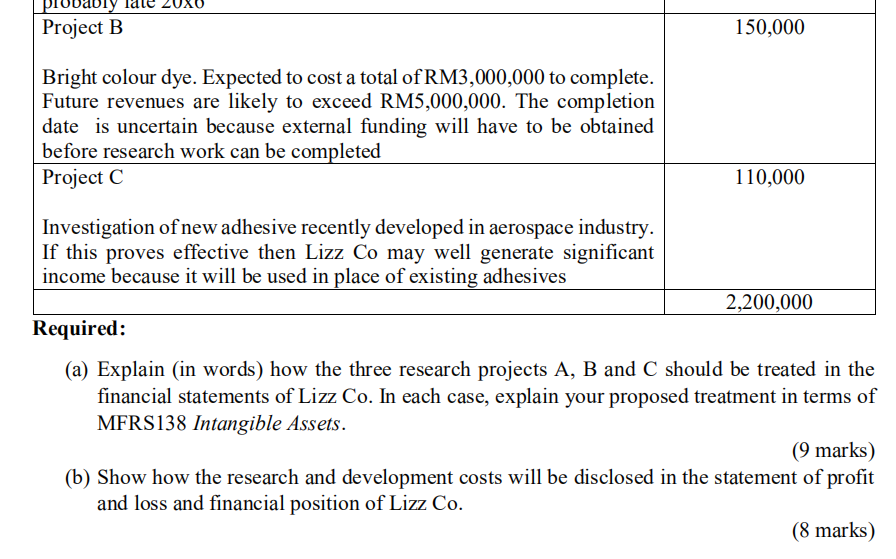

Part B An entity is developing a new computer software. During year x4, the expenditure incurred was RM120,000 of which RM100,000 was incurred before 1 October x4 and the balance was incurred from October to December x4. Only On 1 October was the entity able to demonstrate that the project can meet all the criteria for recognition as an intangible asset. In year x5, the cost incurred was RM60,000. At the end of x5, the recoverable amount was RM75,000. Required: Discuss the accounting treatment as per MFRS138, stating clearly the amount that should appear in the financial position (8 marks)Part A Lizz Co. is a research company which specializes in developing new materials and manufacturing process for the furniture industry. The company receives payments from a variety of manufactures, which pay for the right to use the company's patented fabrics and processes. Lizz Co already has its financial position as at 30 September 20x4, other development expenditure capitalized, amounting to RM1,600,000 and amortization as at that date is RM400,000. Research and development costs for the year ended 30 September 20x5 can be analysed as follows: RM Expenditure on continuing research projects 1,420,000 Amortization of other development expenditure capitalized 240,000 New projects started during the year: Project A 280,000 New fire proof material. Expected to cost a total of RM800,000 to develop. Expected total sales RM2,000,000 once work completed - probably late 20x6 Project B 150,000 Bright colour dye. Expected to cost a total of RM3,000,000 to complete. Future revenues are likely to exceed RM5,000,000. The completion date is uncertain because external funding will have to be obtained before research work can be completedprobably late ZUXO Project B 150,000 Bright colour dye. Expected to cost a total of RM3,000,000 to complete. Future revenues are likely to exceed RM5,000,000. The completion date is uncertain because external funding will have to be obtained before research work can be completed Project C 1 10,000 Investigation of new adhesive recently developed in aerospace industry. If this proves effective then Lizz Co may well generate significant income because it will be used in place of existing adhesives 2,200,000 Required: (a) Explain (in words) how the three research projects A, B and C should be treated in the financial statements of Lizz Co. In each case, explain your proposed treatment in terms of MFRS138 Intangible Assets. (9 marks) (b) Show how the research and development costs will be disclosed in the statement of profit and loss and financial position of Lizz Co. (8 marks)