Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART B and PART A FULLY COMPLETE PLEASE. Part A (5 marks) Tesla is considering investing in a new car model today which will cost

PART B and PART A FULLY COMPLETE PLEASE.

PART B and PART A FULLY COMPLETE PLEASE.

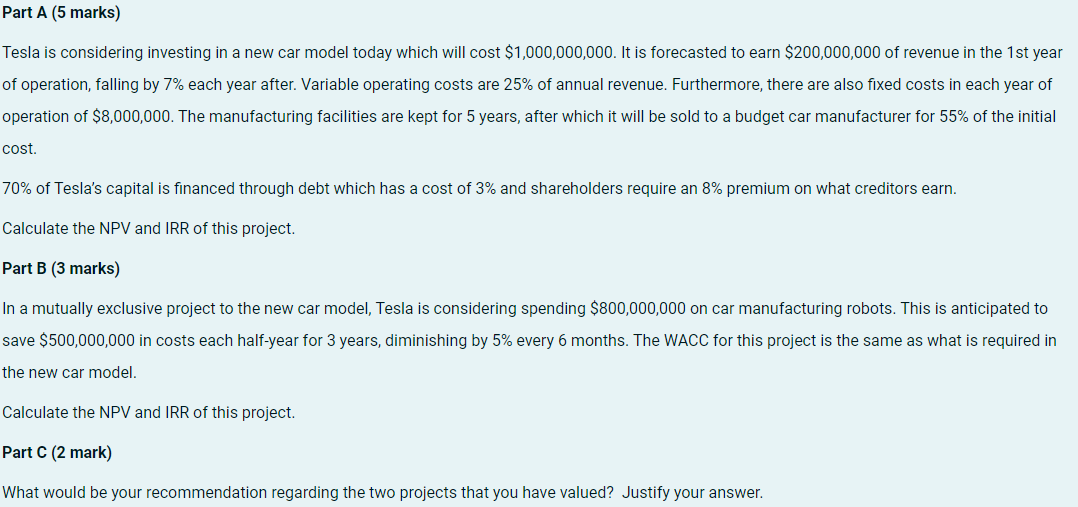

Part A (5 marks) Tesla is considering investing in a new car model today which will cost $1,000,000,000. It is forecasted to earn $200,000,000 of revenue in the 1st year of operation, falling by 7% each year after. Variable operating costs are 25% of annual revenue. Furthermore, there are also fixed costs in each year of operation of $8,000,000. The manufacturing facilities are kept for 5 years, after which it will be sold to a budget car manufacturer for 55% of the initial cost. 70% of Tesla's capital is financed through debt which has a cost of 3% and shareholders require an 8% premium on what creditors earn. Calculate the NPV and IRR of this project. Part B (3 marks) In a mutually exclusive project to the new car model, Tesla is considering spending $800,000,000 on car manufacturing robots. This is anticipated to save $500,000,000 in costs each half-year for 3 years, diminishing by 5% every 6 months. The WACC for this project is the same as what is required in the new car model. Calculate the NPV and IRR of this project. Part C (2 mark) What would be your recommendation regarding the two projects that you have valued? Justify your answer. Part A (5 marks) Tesla is considering investing in a new car model today which will cost $1,000,000,000. It is forecasted to earn $200,000,000 of revenue in the 1st year of operation, falling by 7% each year after. Variable operating costs are 25% of annual revenue. Furthermore, there are also fixed costs in each year of operation of $8,000,000. The manufacturing facilities are kept for 5 years, after which it will be sold to a budget car manufacturer for 55% of the initial cost. 70% of Tesla's capital is financed through debt which has a cost of 3% and shareholders require an 8% premium on what creditors earn. Calculate the NPV and IRR of this project. Part B (3 marks) In a mutually exclusive project to the new car model, Tesla is considering spending $800,000,000 on car manufacturing robots. This is anticipated to save $500,000,000 in costs each half-year for 3 years, diminishing by 5% every 6 months. The WACC for this project is the same as what is required in the new car model. Calculate the NPV and IRR of this project. Part C (2 mark) What would be your recommendation regarding the two projects that you have valued? Justify your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started