part b

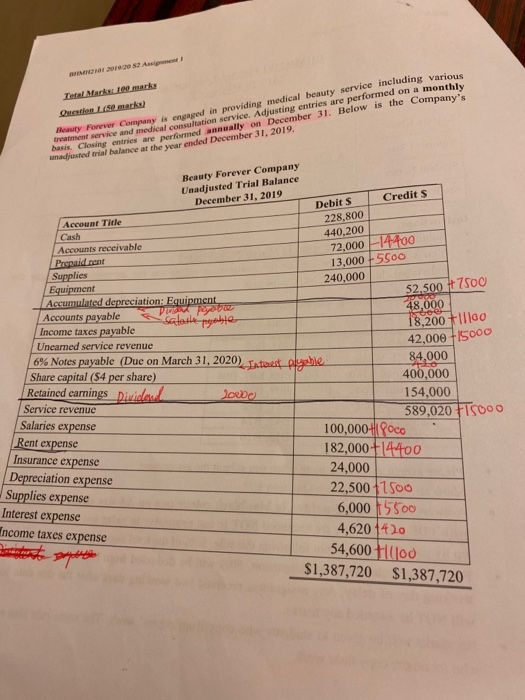

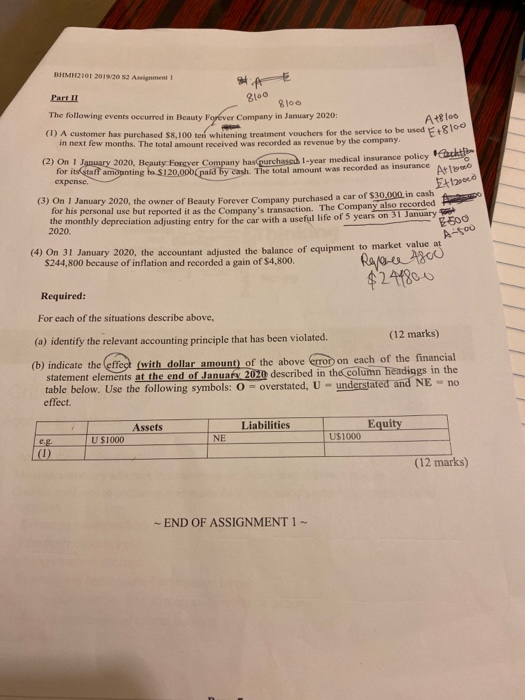

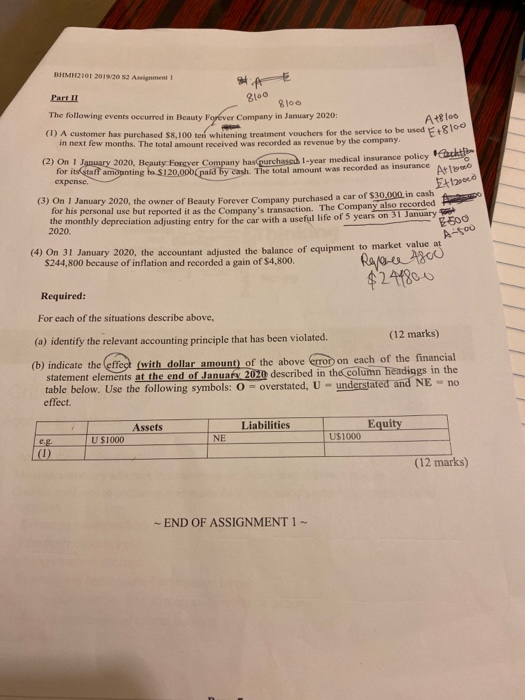

BHMH2101 2019202 Assignment 8100 Soo The following events occurred in Beauty Forever Company in January 2020: (1) A customer has purchased 58.100 ton whitening treatment vouchers for the service to be used in next few months. The total amount received was recorded as revenue by the company. Atloo + 10 (2) On 1 January 2020, Beauty Forever Company hasCourchase 1-year medical insurance policy for itstall amounting to $120.000 paid by cash. The total amount was recorded as insurance M expense. caus oto Ettoo (3) On 1 January 2020, the owner of Beauty Forever Company purchased a car of $30.000. in cash for his personal use but reported it as the Company's transaction. The Company also recorded the monthly depreciation adjusting entry for the car with a useful life of 5 years on 31 January 2020. And (4) On 31 January 2020, the accountant adiusted the balance of equipment to market value at $244,800 because of inflation and recorded a gain of $4,800. Regence 4800 $244800 Required: For each of the situations describe above, (12 marks) (a) identify the relevant accounting principle that has been violated. (b) indicate the effect (with dollar amount) of the above erron on each of the financial statement elements at the end of January 2020 described in the column headings in the table below. Use the following symbols: O = overstated, U- understated and NE - no effect. Assets Liabilities Equity - egU (1) S1000 NE U$1000 (12 marks) -END OF ASSIGNMENT 1 - ! 2019 202 Assi Teral Marks 100 marks Quan lemark) Hauty Forever Company and in providing medical beauty service including various Creatment service and medical consultation service. Adjusting entries are performed on a monthly Base Closing entries are performed annually on December 31. Below is the Company's udsted trial balance at the year ended December 31, 2019. Beauty Forever Company Unadjusted Trial Balance December 31, 2019 Account Title Debits Credits 228,800 440,200 72,000-14400 13,000 5500 240,000 $2.500 + 7500 Accounts receivable President Supplies Equipment Accumulated depreciation: Equipment 48,000 VITENDO Accounts payable claim 18,200+llloo Income taxes payable 42,000 15000 Unearned service revenue 6% Notes payable (Due on March 31, 2020). Lataet Alushie 84.000 Share capital (94 per share) 400,000 Retained earnings Divider l ede 154,000 Service revenue 589,020 F15000 Salaries expense 100,000+ oco Rent expense 182,000+14400 Insurance expense 24,000 Depreciation expense Supplies expense 22,500 1500 Interest expense 6,000 5500 4,620 1420 54,600 Hoo $1,387,720 $1,387,720 Income taxes expense BHMH2101 2019202 Assignment 8100 Soo The following events occurred in Beauty Forever Company in January 2020: (1) A customer has purchased 58.100 ton whitening treatment vouchers for the service to be used in next few months. The total amount received was recorded as revenue by the company. Atloo + 10 (2) On 1 January 2020, Beauty Forever Company hasCourchase 1-year medical insurance policy for itstall amounting to $120.000 paid by cash. The total amount was recorded as insurance M expense. caus oto Ettoo (3) On 1 January 2020, the owner of Beauty Forever Company purchased a car of $30.000. in cash for his personal use but reported it as the Company's transaction. The Company also recorded the monthly depreciation adjusting entry for the car with a useful life of 5 years on 31 January 2020. And (4) On 31 January 2020, the accountant adiusted the balance of equipment to market value at $244,800 because of inflation and recorded a gain of $4,800. Regence 4800 $244800 Required: For each of the situations describe above, (12 marks) (a) identify the relevant accounting principle that has been violated. (b) indicate the effect (with dollar amount) of the above erron on each of the financial statement elements at the end of January 2020 described in the column headings in the table below. Use the following symbols: O = overstated, U- understated and NE - no effect. Assets Liabilities Equity - egU (1) S1000 NE U$1000 (12 marks) -END OF ASSIGNMENT 1 - ! 2019 202 Assi Teral Marks 100 marks Quan lemark) Hauty Forever Company and in providing medical beauty service including various Creatment service and medical consultation service. Adjusting entries are performed on a monthly Base Closing entries are performed annually on December 31. Below is the Company's udsted trial balance at the year ended December 31, 2019. Beauty Forever Company Unadjusted Trial Balance December 31, 2019 Account Title Debits Credits 228,800 440,200 72,000-14400 13,000 5500 240,000 $2.500 + 7500 Accounts receivable President Supplies Equipment Accumulated depreciation: Equipment 48,000 VITENDO Accounts payable claim 18,200+llloo Income taxes payable 42,000 15000 Unearned service revenue 6% Notes payable (Due on March 31, 2020). Lataet Alushie 84.000 Share capital (94 per share) 400,000 Retained earnings Divider l ede 154,000 Service revenue 589,020 F15000 Salaries expense 100,000+ oco Rent expense 182,000+14400 Insurance expense 24,000 Depreciation expense Supplies expense 22,500 1500 Interest expense 6,000 5500 4,620 1420 54,600 Hoo $1,387,720 $1,387,720 Income taxes expense

part b

part b