Answered step by step

Verified Expert Solution

Question

1 Approved Answer

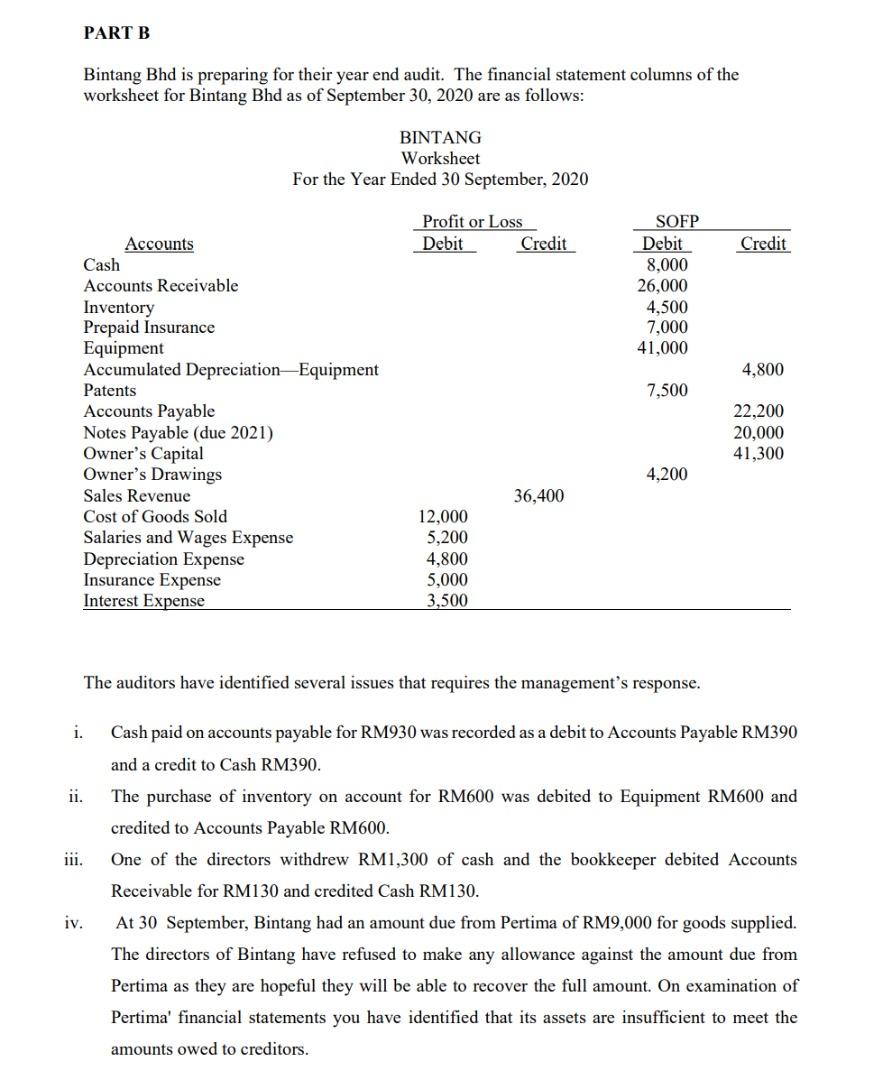

PART B Bintang Bhd is preparing for their year end audit. The financial statement columns of the worksheet for Bintang Bhd as of September 30,

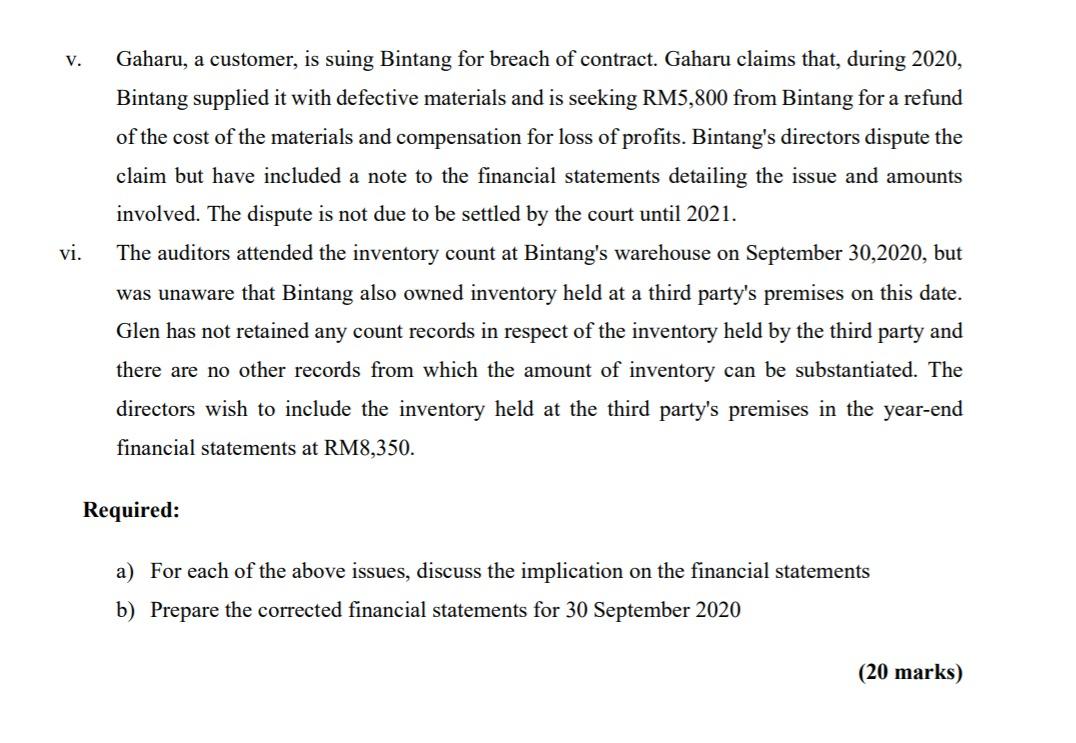

PART B Bintang Bhd is preparing for their year end audit. The financial statement columns of the worksheet for Bintang Bhd as of September 30, 2020 are as follows: BINTANG Worksheet For the Year Ended 30 September, 2020 Profit or Loss Debit Credit Credit SOFP Debit 8,000 26,000 4,500 7,000 41,000 4,800 7,500 Accounts Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Equipment Patents Accounts Payable Notes Payable (due 2021) Owner's Capital Owner's Drawings Sales Revenue Cost of Goods Sold Salaries and Wages Expense Depreciation Expense Insurance Expense Interest Expense 22,200 20,000 41,300 4,200 36,400 12,000 5,200 4,800 5,000 3,500 The auditors have identified several issues that requires the management's response. i. ii. iii. Cash paid on accounts payable for RM930 was recorded as a debit to Accounts Payable RM390 and a credit to Cash RM390. The purchase of inventory on account for RM600 was debited to Equipment RM600 and credited to Accounts Payable RM600. One of the directors withdrew RM1,300 of cash and the bookkeeper debited Accounts Receivable for RM130 and credited Cash RM130. At 30 September, Bintang had an amount due from Pertima of RM9,000 for goods supplied. The directors of Bintang have refused to make any allowance against the amount due from Pertima as they are hopeful they will be able to recover the full amount. On examination of Pertima' financial statements you have identified that its assets are insufficient to meet the amounts owed to creditors. iv. V. vi. Gaharu, a customer, is suing Bintang for breach of contract. Gaharu claims that, during 2020, Bintang supplied it with defective materials and is seeking RM5,800 from Bintang for a refund of the cost of the materials and compensation for loss of profits. Bintang's directors dispute the claim but have included a note to the financial statements detailing the issue and amounts involved. The dispute is not due to be settled by the court until 2021. The auditors attended the inventory count at Bintang's warehouse on September 30,2020, but was unaware that Bintang also owned inventory held at a third party's premises on this date. Glen has not retained any count records in respect of the inventory held by the third party and there are no other records from which the amount of inventory can be substantiated. The directors wish to include the inventory held at the third party's premises in the year-end financial statements at RM8,350. Required: a) For each of the above issues, discuss the implication on the financial statements b) Prepare the corrected financial statements for 30 September 2020 (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started