Answered step by step

Verified Expert Solution

Question

1 Approved Answer

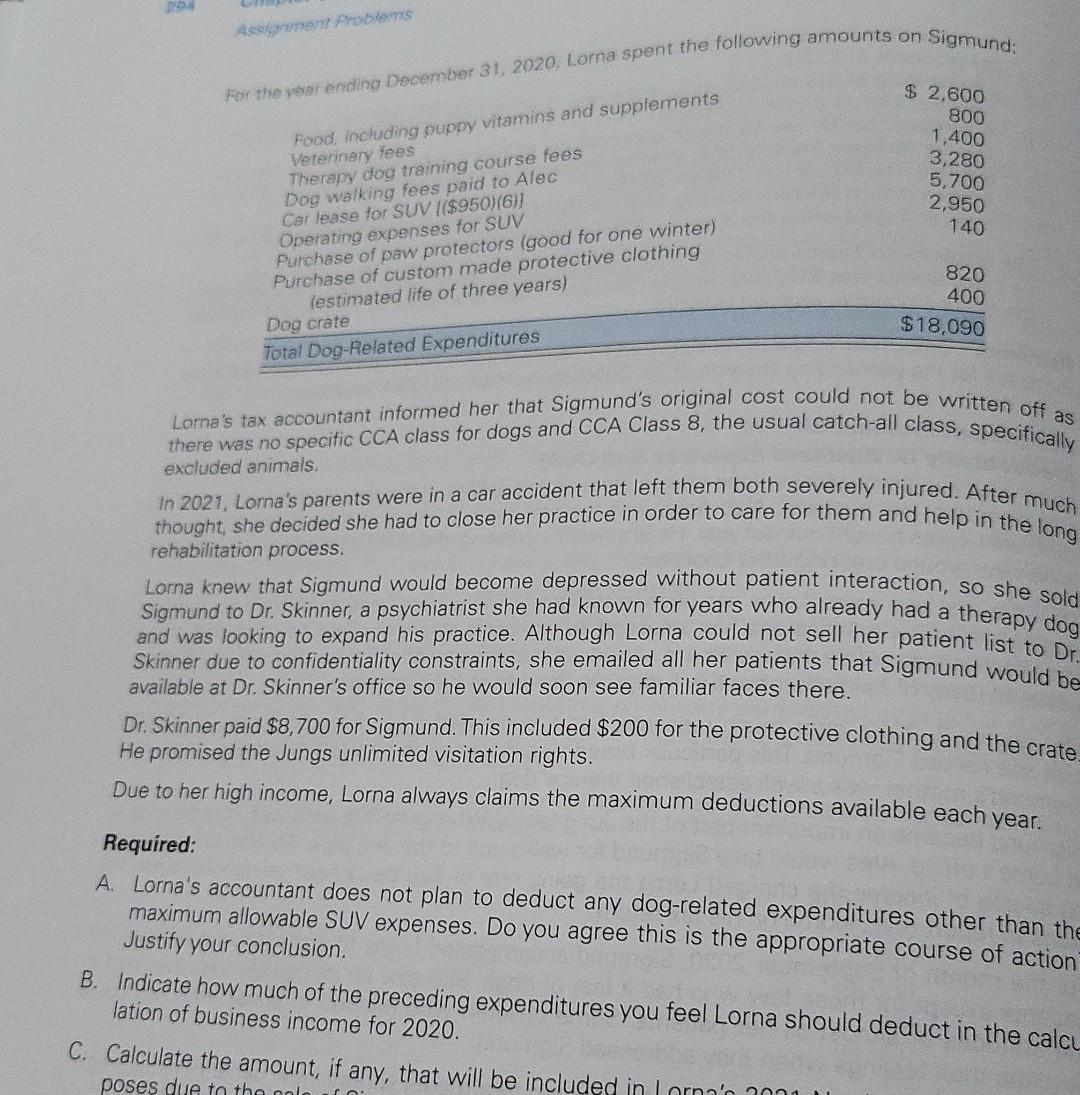

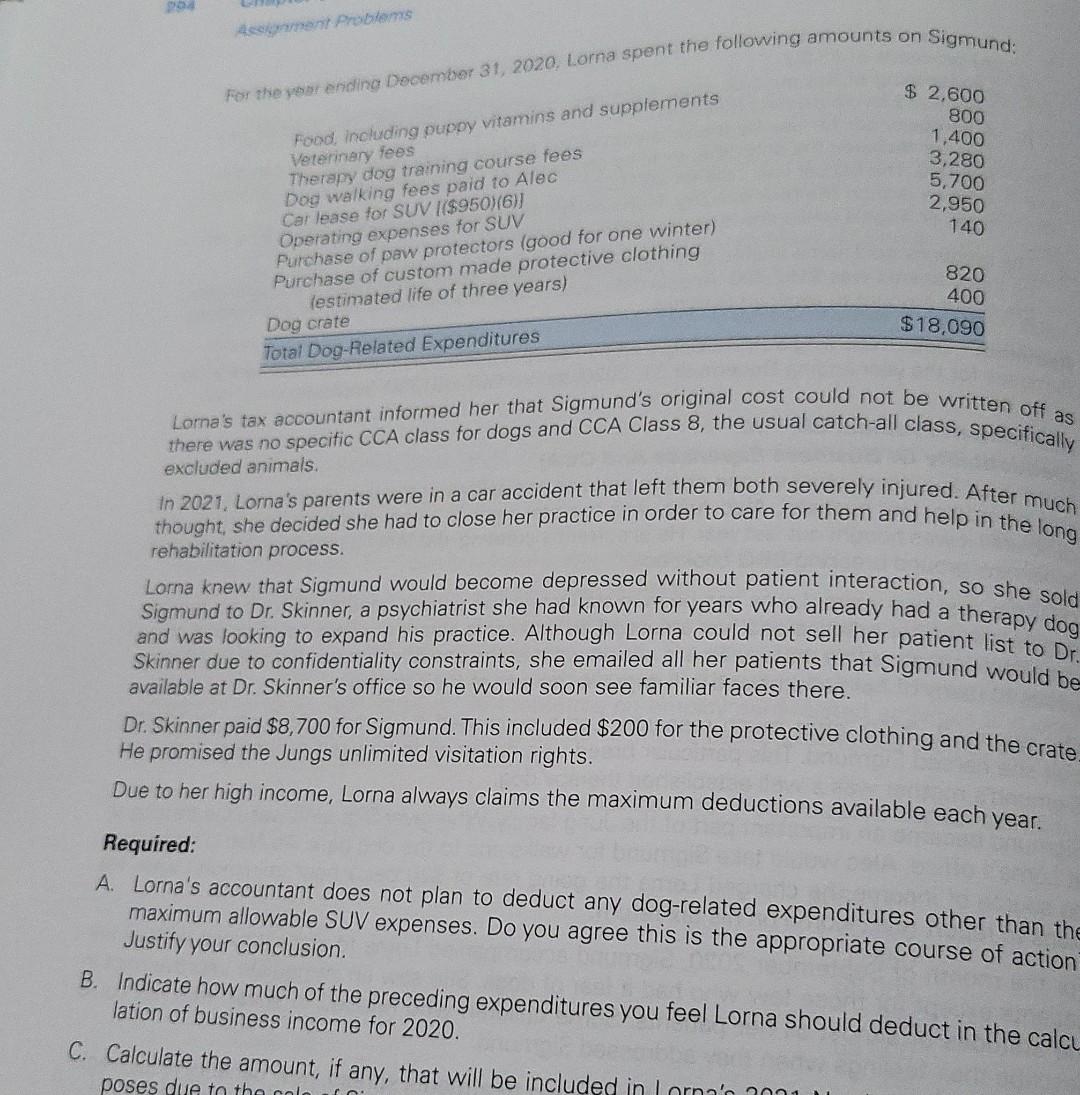

part B & C Aestuarit Problems For the ending December 31, 2020, Lorna spent the following amounts on Sigmund: $ 2,600 800 1,400 3,280 5,700

part B & C

Aestuarit Problems For the ending December 31, 2020, Lorna spent the following amounts on Sigmund: $ 2,600 800 1,400 3,280 5,700 2,950 140 Food, including puppy vitamins and supplements Veterinary fees Therapy dog training course fees Dog walking fees paid to Alec Car lease for SUV 1/$950)(6)] Operating expenses for SUV Purchase of paw protectors (good for one winter) Purchase of custom made protective clothing (estimated life of three years) Dog crete Total Dog-Related Expenditures 820 400 $18,090 Lorna's tax accountant informed her that Sigmund's original cost could not be written off as there was no specific CCA class for dogs and CCA Class 8, the usual catch-all class, specifically excluded animals. thought, she decided she had to close her practice in order to care for them and help in the long In 2021, Lorna's parents were in a car accident that left them both severely injured. After much rehabilitation process. Lorna knew that Sigmund would become depressed without patient interaction, so she sold Sigmund to Dir. Skinner, a psychiatrist she had known for years, who already had a therapy dog and was looking to expand his practice. Although Lorna could not sell her patient list to of Skinner due to confidentiality constraints, she emailed all her patients that Sigmund would be available at Dr. Skinner's office so he would soon see familiar faces there. Dr. Skinner paid $8,700 for Sigmund. This included $200 for the protective clothing and the crate He promised the Jungs unlimited visitation rights. Due to her high income, Lorna always claims the maximum deductions available each year. Required: A. Lorna's accountant does not plan to deduct any dog-related expenditures other than the maximum allowable SUV expenses. Do you agree this is the appropriate course of action Justify your conclusion. B. Indicate how much of the preceding expenditures you feel Lorna should deduct in the calcu lation of business income for 2020. C. Calculate the amount, if any, that will be included in Lornan 2001 poses due to the coloStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started