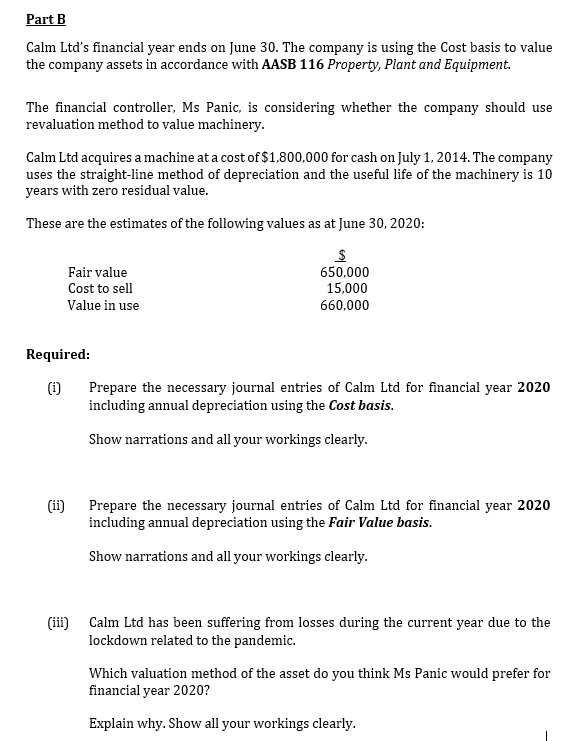

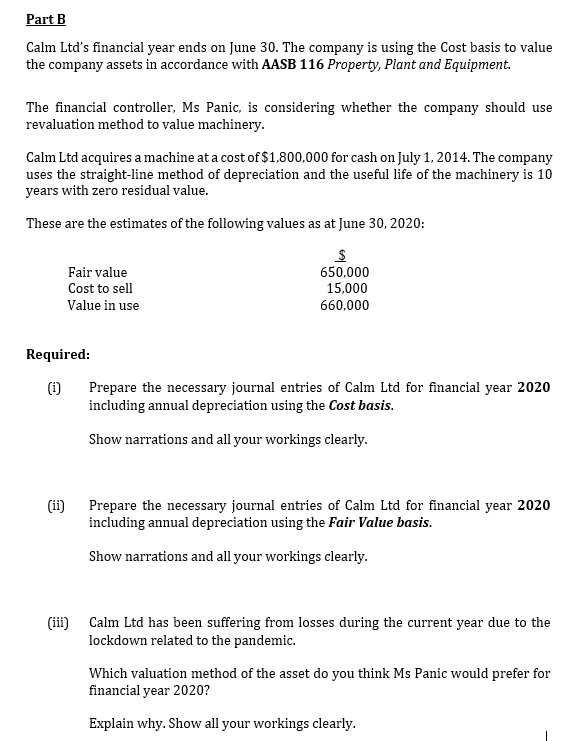

Part B Calm Ltd's financial year ends on June 30. The company is using the Cost basis to value the company assets in accordance with AASB 116 Property, Plant and Equipment. The financial controller, Ms Panic, is considering whether the company should use revaluation method to value machinery. Calm Ltd acquires a machine at a cost of $1,800,000 for cash on July 1, 2014. The company uses the straight-line method of depreciation and the useful life of the machinery is 10 years with zero residual value. These are the estimates of the following values as at June 30, 2020: Fair value Cost to sell Value in use $ 650,000 15,000 660,000 Required: (i) Prepare the necessary journal entries of Calm Ltd for financial year 2020 including annual depreciation using the Cost basis. Show narrations and all your workings clearly. (ii) Prepare the necessary journal entries of Calm Ltd for financial year 2020 including annual depreciation using the Fair Value basis. Show narrations and all your workings clearly. (iii) Calm Ltd has been suffering from losses during the current year due to the lockdown related to the pandemic. Which valuation method of the asset do you think Ms Panic would prefer for financial year 2020? Explain why. Show all your workings clearly. Part B Calm Ltd's financial year ends on June 30. The company is using the Cost basis to value the company assets in accordance with AASB 116 Property, Plant and Equipment. The financial controller, Ms Panic, is considering whether the company should use revaluation method to value machinery. Calm Ltd acquires a machine at a cost of $1,800,000 for cash on July 1, 2014. The company uses the straight-line method of depreciation and the useful life of the machinery is 10 years with zero residual value. These are the estimates of the following values as at June 30, 2020: Fair value Cost to sell Value in use $ 650,000 15,000 660,000 Required: (i) Prepare the necessary journal entries of Calm Ltd for financial year 2020 including annual depreciation using the Cost basis. Show narrations and all your workings clearly. (ii) Prepare the necessary journal entries of Calm Ltd for financial year 2020 including annual depreciation using the Fair Value basis. Show narrations and all your workings clearly. (iii) Calm Ltd has been suffering from losses during the current year due to the lockdown related to the pandemic. Which valuation method of the asset do you think Ms Panic would prefer for financial year 2020? Explain why. Show all your workings clearly