PART B EXCEL PRACTICAL

Question 3

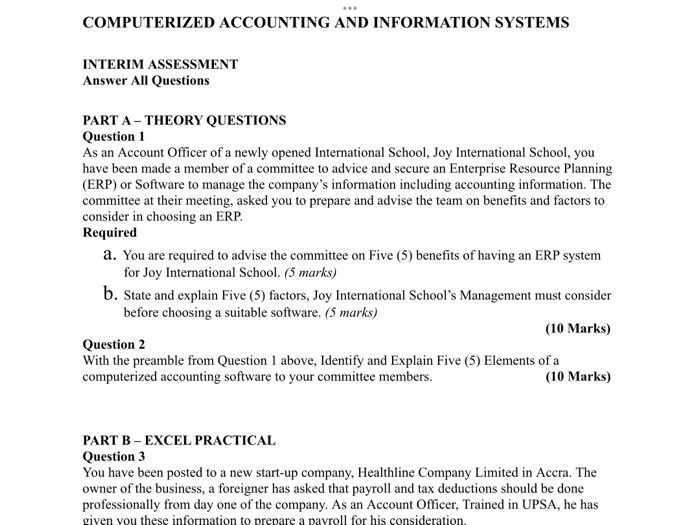

You have been posted to a new start-up company, Healthline Company Limited in Accra. The owner of the business, a foreigner has asked that payroll and tax deductions should be done professionally from day one of the company. As an Account Officer, Trained in UPSA, he has given you these information to prepare a payroll for his consideration.

Kofi Nkrabea and Efia Pokua will have pending monthly staff deductions of GHS960 and GHS720 respectively for their accommodation.

Note: Assume a Flat Pay As You Earn tax of 15% for other staff and 22% for Robert Sey and Kofi Nkrabea

Required:

You are required to prepare a payroll based on Ghanas Tax Laws for the consideration of the investors. (10 Marks)

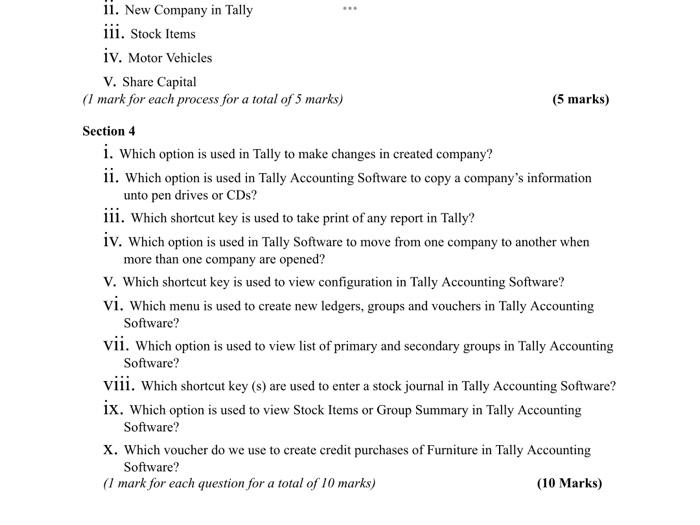

COMPUTERIZED ACCOUNTING AND INFORMATION SYSTEMS INTERIM ASSESSMENT Answer All Questions PART A-THEORY QUESTIONS Question 1 As an Account Officer of a newly opened International School, Joy International School, you have been made a member of a committee to advice and secure an Enterprise Resource Planning (ERP) or Software to manage the company's information including accounting information. The committee at their meeting, asked you to prepare and advise the team on benefits and factors to consider in choosing an ERP. Required a. You are required to advise the committee on Five (5) benefits of having an ERP system for Joy International School. (5 marks) b. State and explain Five (5) factors, Joy International School's Management must consider before choosing a suitable software. (5 marks) (10 Marks) Question 2 With the preamble from Question 1 above, Identify and Explain Five (5) Elements of a computerized accounting software to your committee members. (10 Marks) PART B - EXCEL PRACTICAL Question 3 You have been posted to a new start-up company, Healthline Company Limited in Accra. The owner of the business, a foreigner has asked that payroll and tax deductions should be done professionally from day one of the company. As an Account Officer, Trained in UPSA, he has given vou these information to prepare a payroll for his consideration PART B - EXCEL PRACTICAL Question 3 You have been posted to a new start-up company, Healthline Company Limited in Accra. The owner of the business, a foreigner has asked that payroll and tax deductions should be done professionally from day one of the company. As an Account Officer, Trained in UPSA, he has given you these information to prepare a payroll for his consideration. Name of Staff SSNIT Numbers Basic Salary Allowances Charles Nkumsah FK000197812 1,950.00 450.00 Mabel Ackom BC000142594 3,650.00 300.00 Efia Pokuaa EF000732596 4,963.00 0.00 Martin Chris MS000187613 5,746.00 0.00 Robert Sey KN781714631 20,140.00 750.00 Kofi Nkrabea NE784441361 11,860.00 0.001 Kofi Nkrabea and Efia Pokua will have pending monthly staff deductions of GHS960 and GHS720 respectively for their accommodation. Note: Assume a Flat Pay As You Earn tax of 15% for other staff and 22% for Robert Sey and Kofi Nkrabea Required: You are required to prepare a payroll based on Ghana's Tax Laws for the consideration of the investors. (10 Marks) PART C - TALLY ACCOUNTING SOFTWARE QUESTIONS Answer All Questions from this Section Section 1 Outline the processes of generating/viewing the following reports from Tally Accounting PART C - TALLY ACCOUNTING SOFTWARE QUESTIONS Answer All Questions from this Section Section 1 Outline the processes of generating/viewing the following reports from Tally Accounting Software i. Bank Book ii. Purchase Register iii. Journal Register iv. Debit Note Register V. Receivables Ledger (1 mark for each process for a total of 5 Marks) (5 Marks) Section 2 Indicate the ledgers, vouchers and the double entry processes of entering the following transactions in Tally Accounting Software i. Nana Kwame started Universal Solutions Business Limited with his personal cash of GHS60,000.00 ii. Universal Solutions Business Limited opened a current account with GCB Bank Limited with GHS40,000 cash iii. Universal Solutions Limited paid for an office rent with GHS12,000 with a cheque iv. Universal Solutions Limited bought office Furniture for GHS6,000, Computers for GHS12,000 and Office Equipment for GHS3,000 on credit from CompuGhana Ltd V. Universal Solutions Limited received consultancy fees of GHS50,000 cheque from a client (2 marks for each question for a total of 10 marks) (10 Marks) Section 3 Outline the processes of creating the following Masters Information in the Tally Accounting Software i. Units of Measure ii. New Company in Tally iii. Stock Items iv. Motor Vehicles V. Share Capital (1 mark for each process for a total of 5 marks) (5 marks) Section 4 i. Which option is used in Tally to make changes in created company? ii. Which option is used in Tally Accounting Software to copy a company's information unto pen drives or CDs? iii. Which shortcut key is used to take print of any report in Tally? iv. Which option is used in Tally Software to move from one company to another when more than one company are opened? V. Which shortcut key is used to view configuration in Tally Accounting Software? vi. Which menu is used to create new ledgers, groups and vouchers in Tally Accounting Software? vii. Which option is used to view list of primary and secondary groups in Tally Accounting Software? viii. Which shortcut key (s) are used to enter a stock journal in Tally Accounting Software? ix. Which option is used to view Stock Items or Group Summary in Tally Accounting Software? Which voucher do we use to create credit purchases of Furniture in Tally Accounting ... 11. New Company in Tally iii. Stock Items iv. Motor Vehicles V. Share Capital (1 mark for each process for a total of 5 marks) (5 marks) Section 4 i. Which option is used in Tally to make changes in created company? ii. Which option is used in Tally Accounting Software to copy a company's information unto pen drives or CDs? iii. Which shortcut key is used to take print of any report in Tally? iv. Which option is used in Tally Software to move from one company to another when more than one company are opened? V. Which shortcut key is used to view configuration in Tally Accounting Software? vi. Which menu is used to create new ledgers, groups and vouchers in Tally Accounting Software? vii. Which option is used to view list of primary and secondary groups in Tally Accounting Software? viii. Which shortcut key (s) are used to enter a stock journal in Tally Accounting Software? ix. Which option is used to view Stock Items or Group Summary in Tally Accounting Software? X. Which voucher do we use to create credit purchases of Furniture in Tally Accounting Software? (1 mark for each question for a total of 10 marks) (10 Marks)