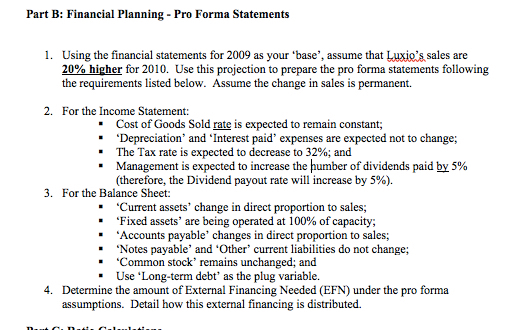

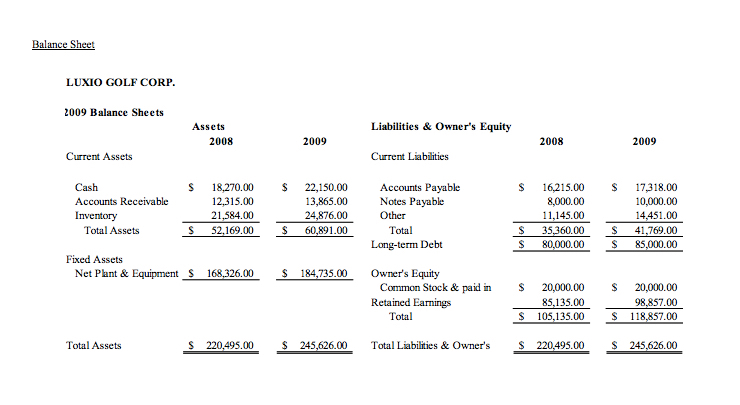

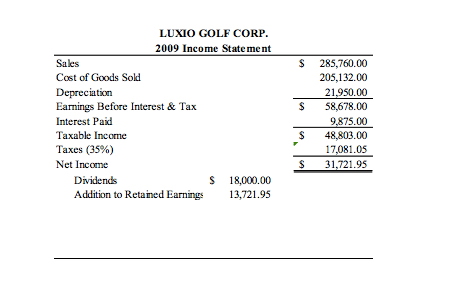

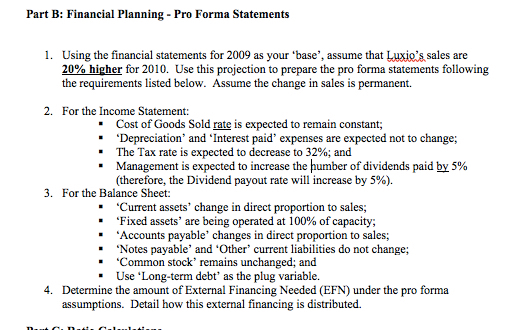

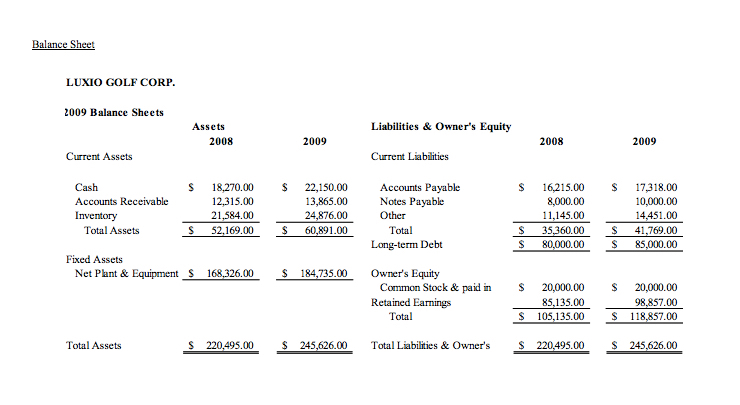

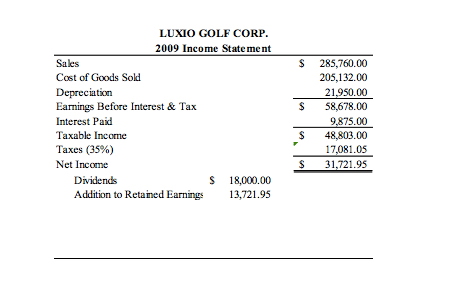

Part B: Financial Planning - Pro Forma Statements 1. Using the financial statements for 2009 as your 'base', assume that Luxio's sales are 20% higher for 2010. Use this projection to prepare the pro forma statements following the requirements listed below. Assume the change in sales is permanent. 2. For the Income Statement: Cost of Goods Sold rate is expected to remain constant; 'Depreciation' and 'Interest paid' expenses are expected not to change; The Tax rate is expected to decrease to 32%; and Management is expected to increase the umber of dividends paid by 5% (therefore, the Dividend payout rate will increase by 5%). 3. For the Balance Sheet: "Current assets' change in direct proportion to sales; 'Fixed assets' are being operated at 100% of capacity; 'Accounts payable changes in direct proportion to sales; Notes payable' and 'Other current liabilities do not change; 'Common stock remains unchanged; and Use 'Long-term debt' as the plug variable. 4. Determine the amount of External Financing Needed (EFN) under the pro forma assumptions. Detail how this external financing is distributed. Balance Sheet LUXIO GOLF CORP. 2009 Balance Sheets Assets 2008 Liabilities & Owner's Equity 2009 2008 2009 Current Assets Current Liabilities S $ $ s Cash Accounts Receivable Inventory Total Assets 18,270.00 12,315.00 21,584.00 52,169.00 22,150.00 13,865.00 24,876.00 60,891.00 Accounts Payable Notes Payable Other Total Long-term Debt 16,215.00 8,000.00 11,145.00 35,360.00 80,000.00 17,318.00 10,000.00 14,451.00 41,769.00 85,000.00 $ $ s s S S Fixed Assets Net Plant & Equipments 168,326.00 $ 184,735.00 s $ Owner's Equity Common Stock & paid in Retained Earnings Total 20,000.00 85,135.00 105,135.00 20,000.00 98.857.00 118,857.00 s S Total Assets $ 220,495.00 $ 245,626.00 Total Liabilities & Owner's $ 220,495.00 $ 245,626.00 $ $ LUXIO GOLF CORP. 2009 Income Statement Sales Cost of Goods Sold Depreciation Earnings Before Interest & Tax Interest Paid Taxable income Taxes (35%) Net Income Dividends $ 18,000.00 Addition to Retained Earnings 13,721.95 285,760.00 205,132.00 21,950.00 58,678.00 9,875.00 48,803.00 17,081.05 31,721.95 $ $