Answered step by step

Verified Expert Solution

Question

1 Approved Answer

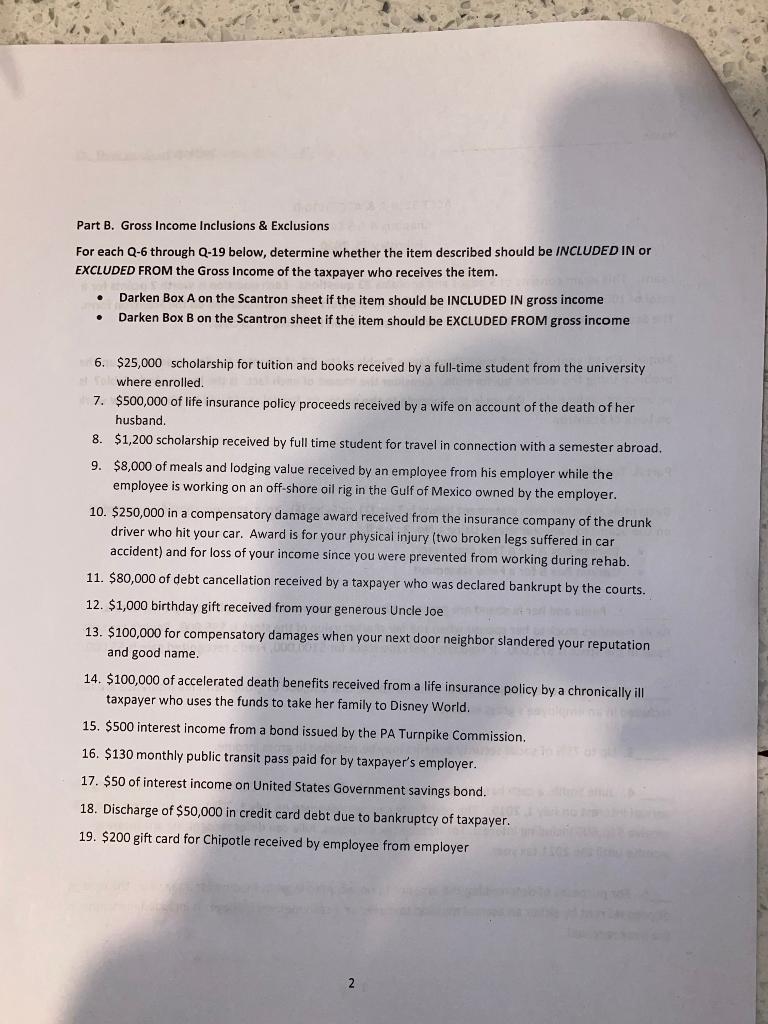

Part B. Gross Income Inclusions & Exclusions For each Q-6 through Q-19 below, determine whether the item described should be INCLUDED IN or EXCLUDED

Part B. Gross Income Inclusions & Exclusions For each Q-6 through Q-19 below, determine whether the item described should be INCLUDED IN or EXCLUDED FROM the Gross Income of the taxpayer who receives the item. Darken Box A on the Scantron sheet if the item should be INCLUDED IN gross income Darken Box B on the Scantron sheet if the item should be EXCLUDED FROM gross income 6. $25,000 scholarship for tuition and books received by a full-time student from the university where enrolled. 7. $500,000 of life insurance policy proceeds received by a wife on account of the death of her husband. 8. $1,200 scholarship received by full time student for travel in connection with a semester abroad. 9. $8,000 of meals and lodging value received by an employee from his employer while the employee is working on an off-shore oil rig in the Gulf of Mexico owned by the employer. 10. $250,000 in a compensatory damage award received from the insurance company of the drunk driver who hit your car. Award is for your physical injury (two broken legs suffered in car accident) and for loss of your income since you were prevented from working during rehab. 11. $80,000 of debt cancellation received by a taxpayer who was declared bankrupt by the courts. 12. $1,000 birthday gift received from your generous Uncle Joe 13. $100,000 for compensatory damages when your next door neighbor slandered your reputation and good name. 14. $100,000 of accelerated death benefits received from a life insurance policy by a chronically ill taxpayer who uses the funds to take her family to Disney World. 15. $500 interest income from a bond issued by the PA Turnpike Commission. 16. $130 monthly public transit pass paid for by taxpayer's employer. 17. $50 of interest income on United States Government savings bond. 18. Discharge of $50,000 in credit card debt due to bankruptcy of taxpayer. 19. $200 gift card for Chipotle received by employee from employer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the determinations for each item 6 INCLUDED IN gross income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started