Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B Hajar owns a shop selling batik merchandises in Kuala Pilah. During the financial year ended 31 December 2020, the following occurrences had

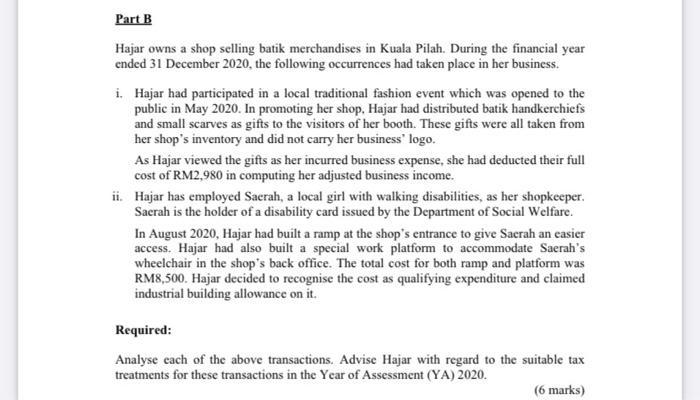

Part B Hajar owns a shop selling batik merchandises in Kuala Pilah. During the financial year ended 31 December 2020, the following occurrences had taken place in her business. i. Hajar had participated in a local traditional fashion event which was opened to the public in May 2020. In promoting her shop, Hajar had distributed batik handkerchiefs and small scarves as gifts to the visitors of her booth. These gifts were all taken from her shop's inventory and did not carry her business' logo. As Hajar viewed the gifts as her incurred business expense, she had deducted their full cost of RM2,980 in computing her adjusted business income. ii. Hajar has employed Saerah, a local girl with walking disabilities, as her shopkeeper. Saerah is the holder of a disability card issued by the Department of Social Welfare. In August 2020, Hajar had built a ramp at the shop's entrance to give Saerah an easier access. Hajar had also built a special work platform to accommodate Saerah's wheelchair in the shop's back office. The total cost for both ramp and platform was RM8,500. Hajar decided to recognise the cost as qualifying expenditure and claimed industrial building allowance on it. Required: Analyse each of the above transactions. Advise Hajar with regard to the suitable tax treatments for these transactions in the Year of Assessment (YA) 2020. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Situation 1 Analysis Hajar distributed handkerchiefs and small Scarves as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started