Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B plz, with specific steps 2. (10 points) BlackRock, Inc. is an American global investment management corporation based in New York City. Founded in

Part B plz, with specific steps

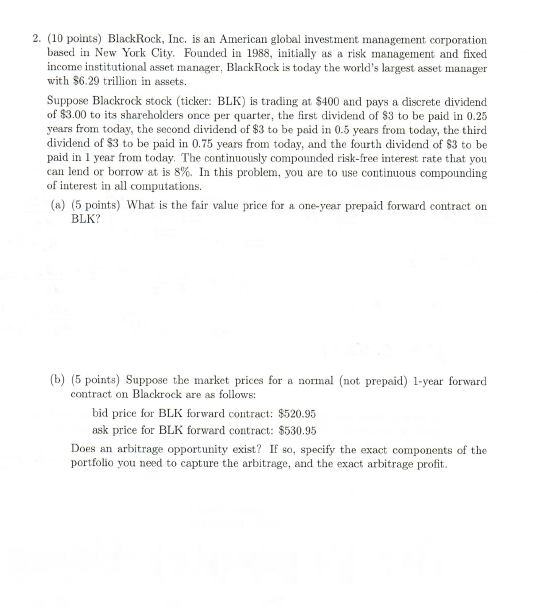

2. (10 points) BlackRock, Inc. is an American global investment management corporation based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is today the world's largest asset manager with $6.29 trillion in assets. Suppose Blackrock stock (ticker: BLK) is trading at $400 and pays a discrete dividend of $3.00 to its shareholders once per quarter, the first dividend of $3 to be paid in 0.25 years from today, the second dividend of $3 to be paid in 0.5 years from today, the third dividend of $3 to be paid in 0.75 years from today, and the fourth dividend of $3 to be paid in 1 year from today. The continuously compounded risk-free interest rate that you can lend or borrow at is 8%. In this problem, you are to use continuous compounding of interest in all computations. (a) (5 points) What is the fair value price for a one-year prepaid forward contract on BLK? (b) (5 points) Suppose the market prices for a normal (not prepaid) 1-year forward contract on Blackrock are as follows: bid price for BLK forward contract: $520.95 ask price for BLK forward contract: $530.95 Does an arbitrage opportunity exist? If so, specify the exact components of the portfolio you need to capture the arbitrage, and the exact arbitrage profit. 2. (10 points) BlackRock, Inc. is an American global investment management corporation based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is today the world's largest asset manager with $6.29 trillion in assets. Suppose Blackrock stock (ticker: BLK) is trading at $400 and pays a discrete dividend of $3.00 to its shareholders once per quarter, the first dividend of $3 to be paid in 0.25 years from today, the second dividend of $3 to be paid in 0.5 years from today, the third dividend of $3 to be paid in 0.75 years from today, and the fourth dividend of $3 to be paid in 1 year from today. The continuously compounded risk-free interest rate that you can lend or borrow at is 8%. In this problem, you are to use continuous compounding of interest in all computations. (a) (5 points) What is the fair value price for a one-year prepaid forward contract on BLK? (b) (5 points) Suppose the market prices for a normal (not prepaid) 1-year forward contract on Blackrock are as follows: bid price for BLK forward contract: $520.95 ask price for BLK forward contract: $530.95 Does an arbitrage opportunity exist? If so, specify the exact components of the portfolio you need to capture the arbitrage, and the exact arbitrage profitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started