Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B: Project Evaluation (Total 55 marks) Asif Enterprise Ltd produces Steel scaffolding structures for domestic residential property markets. Due to high demand they

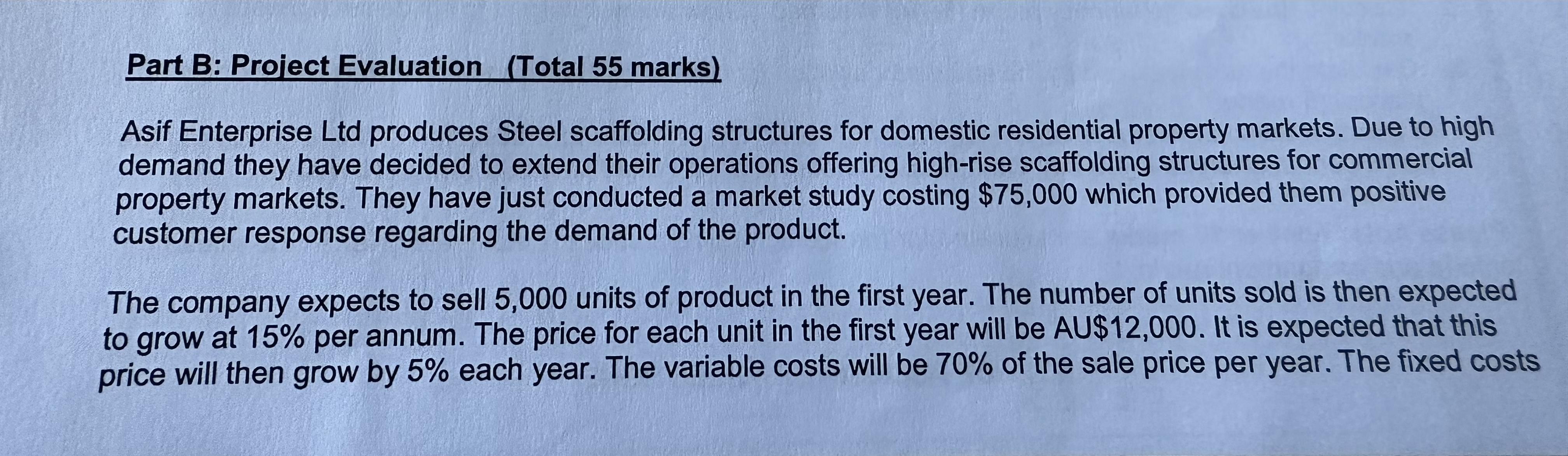

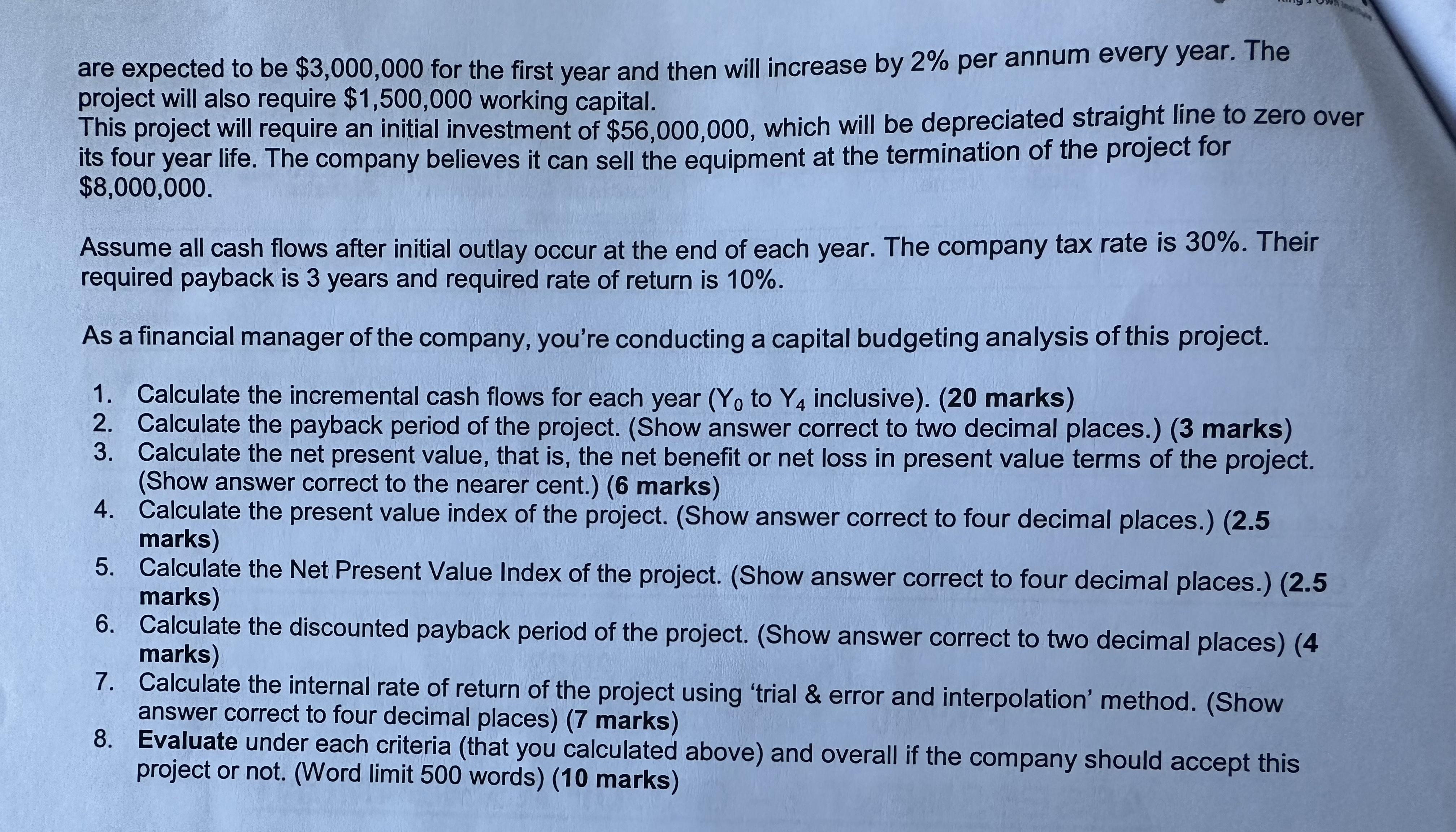

Part B: Project Evaluation (Total 55 marks) Asif Enterprise Ltd produces Steel scaffolding structures for domestic residential property markets. Due to high demand they have decided to extend their operations offering high-rise scaffolding structures for commercial property markets. They have just conducted a market study costing $75,000 which provided them positive customer response regarding the demand of the product. The company expects to sell 5,000 units of product in the first year. The number of units sold is then expected to grow at 15% per annum. The price for each unit in the first year will be AU$12,000. It is expected that this price will then grow by 5% each year. The variable costs will be 70% of the sale price per year. The fixed costs are expected to be $3,000,000 for the first year and then will increase by 2% per annum every year. The project will also require $1,500,000 working capital. This project will require an initial investment of $56,000,000, which will be depreciated straight line to zero over its four year life. The company believes it can sell the equipment at the termination of the project for $8,000,000. Assume all cash flows after initial outlay occur at the end of each year. The company tax rate is 30%. Their required payback is 3 years and required rate of return is 10%. As a financial manager of the company, you're conducting a capital budgeting analysis of this project. 1. Calculate the incremental cash flows for each year (Yo to Y4 inclusive). (20 marks) 2. 3. Calculate the payback period of the project. (Show answer correct to two decimal places.) (3 marks) Calculate the net present value, that is, the net benefit or net loss in present value terms of the project. (Show answer correct to the nearer cent.) (6 marks) 4. Calculate the present value index of the project. (Show answer correct to four decimal places.) (2.5 marks) 5. Calculate the Net Present Value Index of the project. (Show answer correct to four decimal places.) (2.5 marks) 6. Calculate the discounted payback period of the project. (Show answer correct to two decimal places) (4 marks) 7. Calculate the internal rate of return of the project using 'trial & error and interpolation' method. (Show answer correct to four decimal places) (7 marks) 8. Evaluate under each criteria (that you calculated above) and overall if the company should accept this project or not. (Word limit 500 words) (10 marks)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Part B Project Evaluation 1 Calculate the incremental cash flows for each year Y1 to Y4 inclusive Year 1 Sales 5000 units x 12000 per unit 60...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started