Answered step by step

Verified Expert Solution

Question

1 Approved Answer

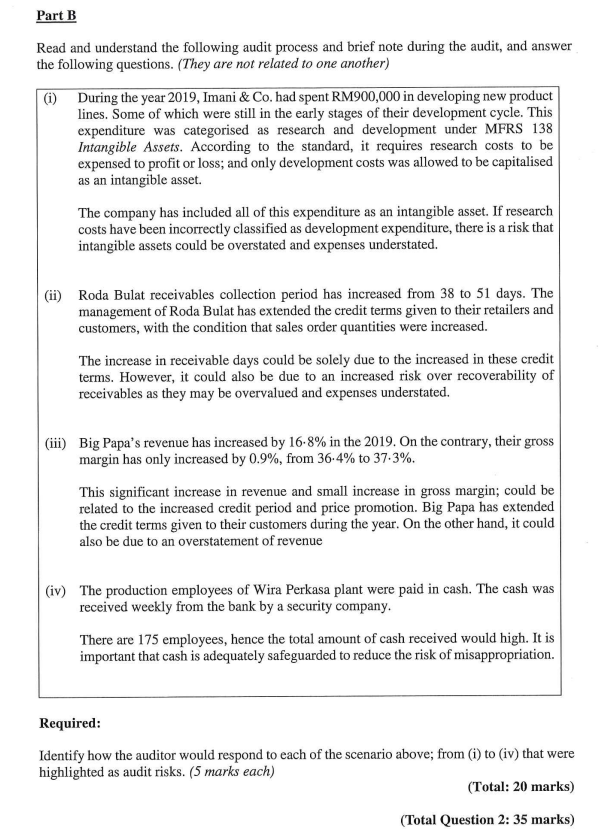

Part B Read and understand the following audit process and brief note during the audit, and answer the following questions. (They are not related

Part B Read and understand the following audit process and brief note during the audit, and answer the following questions. (They are not related to one another) (i) During the year 2019, Imani & Co. had spent RM900,000 in developing new product lines. Some of which were still in the early stages of their development cycle. This expenditure was categorised as research and development under MFRS 138 Intangible Assets. According to the standard, it requires research costs to be expensed to profit or loss; and only development costs was allowed to be capitalised as an intangible asset. The company has included all of this expenditure as an intangible asset. If research costs have been incorrectly classified as development expenditure, there is a risk that intangible assets could be overstated and expenses understated. (ii) Roda Bulat receivables collection period has increased from 38 to 51 days. The management of Roda Bulat has extended the credit terms given to their retailers and customers, with the condition that sales order quantities were increased. The increase in receivable days could be solely due to the increased in these credit terms. However, it could also be due to an increased risk over recoverability of receivables as they may be overvalued and expenses understated. (iii) Big Papa's revenue has increased by 16.8% in the 2019. On the contrary, their gross margin has only increased by 0.9%, from 36.4% to 37.3%. This significant increase in revenue and small increase in gross margin; could be related to the increased credit period and price promotion. Big Papa has extended the credit terms given to their customers during the year. On the other hand, it could also be due to an overstatement of revenue (iv) The production employees of Wira Perkasa plant were paid in cash. The cash was received weekly from the bank by a security company. There are 175 employees, hence the total amount of cash received would high. It is important that cash is adequately safeguarded to reduce the risk of misappropriation. Required: Identify how the auditor would respond to each of the scenario above; from (i) to (iv) that were highlighted as audit risks. (5 marks each) (Total: 20 marks) (Total Question 2: 35 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started