Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named FSA Groups Work due

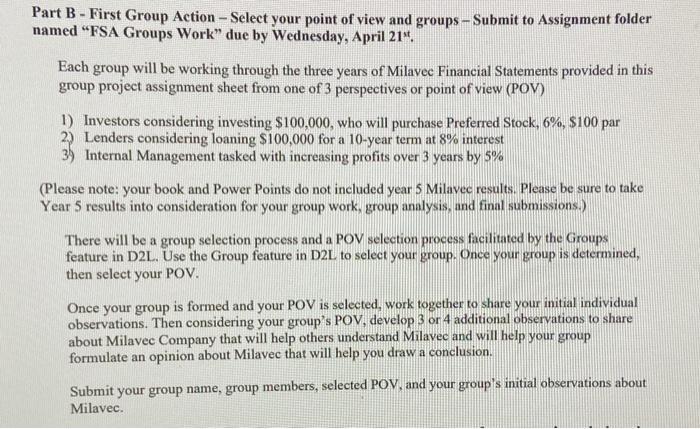

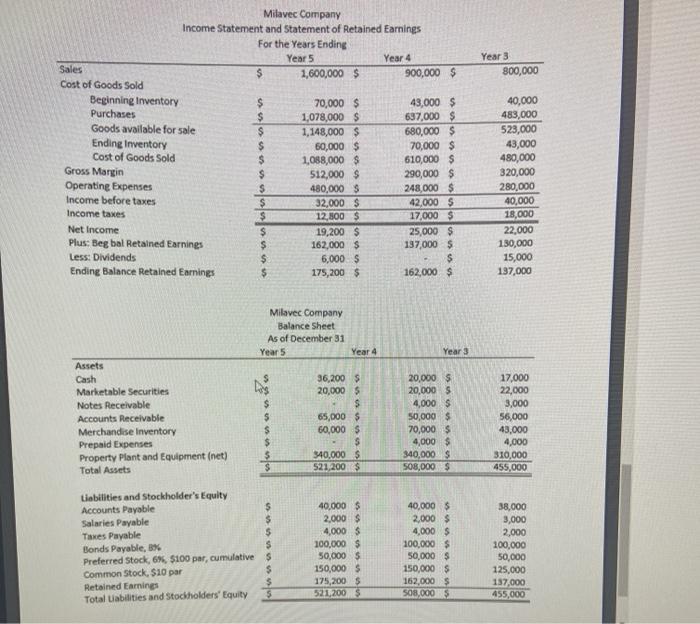

Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named "FSA Groups Work" due by Wednesday, April 21". Each group will be working through the three years of Milavec Financial Statements provided in this group project assignment sheet from one of 3 perspectives or point of view (POV) 1) Investors considering investing $100,000, who will purchase Preferred Stock, 6%, $100 par 2) Lenders considering loaning $100,000 for a 10-year term at 8% interest 39 Internal Management tasked with increasing profits over 3 years by 5% (Please note: your book and Power Points do not included year 5 Milavec results. Please be sure to take Year 5 results into consideration for your group work, group analysis, and final submissions.) There will be a group selection process and a POV selection process facilitated by the Groups feature in D2L. Use the Group feature in D2L to select your group. Once your group is determined, then select your POV. Once your group is formed and your POV is selected, work together to share your initial individual observations. Then considering your group's POV, develop 3 or 4 additional observations to share about Milavec Company that will help others understand Milavec and will help your group formulate an opinion about Milavec that will help you draw a conclusion. Submit your group name, group members, selected POV, and your group's initial observations about Milavec. Sales Cost of Goods Sold Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of Goods Sold Gross Margin Operating Expenses Income before taxes Income taxes Milavec Company Income Statement and Statement of Retained Earnings For the Years Ending Year 5 Net Income Plus: Beg bal Retained Earnings Less: Dividends Ending Balance Retained Earnings Assets Cash Marketable Securities Notes Receivable Accounts Receivable Merchandise Inventory Prepaid Expenses Property Plant and Equipment (net) Total Assets $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,600,000 $ Liabilities and Stockholder's Equity Accounts Payable Salaries Payable Taxes Payable Bonds Payable, 8% $ Preferred Stock, 6%, $100 par, cumulative S Common Stock, $10 par Retained Earnings Total Liabilities and Stockholders' Equity 70,000 $ 1,078,000 $ 1,148,000 $ 60,000 $ 1,088,000 $ 512,000 $ 480,000 $ Milavec Company Balance Sheet $ $ 32,000 $ 12,800 $ As of December 31 Year 5 19,200 $ 162,000 $ 6,000 $ 175,200 $ Year 4 36,200 $ 20,000 $ $ 65,000 $ 60,000 $ $ 340,000 $ 521,200 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 175,200 $ 521,200 $ Year 4 900,000 $ 43,000 $ 637,000 $ 680,000 $ 70,000 $ 610,000 $ 290,000 $ 248,000 $ 42,000 $ 17,000 $ 25,000 $ 137,000 $ $ 162,000 $ Year 3 20,000 $ 20,000 $ 4,000 $ 50,000 $ 70,000 $ 4,000 $ 340,000 $ 508,000 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 162,000 $ 508,000 $ Year 3 800,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18,000 22,000 130,000 15,000 137,000 17,000 22,000 3,000 56,000 43,000 4,000 310,000 455,000 38,000 3,000 2,000 100,000 50,000 125,000 137,000 455,000 Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named "FSA Groups Work" due by Wednesday, April 21". Each group will be working through the three years of Milavec Financial Statements provided in this group project assignment sheet from one of 3 perspectives or point of view (POV) 1) Investors considering investing $100,000, who will purchase Preferred Stock, 6%, $100 par 2) Lenders considering loaning $100,000 for a 10-year term at 8% interest 39 Internal Management tasked with increasing profits over 3 years by 5% (Please note: your book and Power Points do not included year 5 Milavec results. Please be sure to take Year 5 results into consideration for your group work, group analysis, and final submissions.) There will be a group selection process and a POV selection process facilitated by the Groups feature in D2L. Use the Group feature in D2L to select your group. Once your group is determined, then select your POV. Once your group is formed and your POV is selected, work together to share your initial individual observations. Then considering your group's POV, develop 3 or 4 additional observations to share about Milavec Company that will help others understand Milavec and will help your group formulate an opinion about Milavec that will help you draw a conclusion. Submit your group name, group members, selected POV, and your group's initial observations about Milavec. Sales Cost of Goods Sold Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of Goods Sold Gross Margin Operating Expenses Income before taxes Income taxes Milavec Company Income Statement and Statement of Retained Earnings For the Years Ending Year 5 Net Income Plus: Beg bal Retained Earnings Less: Dividends Ending Balance Retained Earnings Assets Cash Marketable Securities Notes Receivable Accounts Receivable Merchandise Inventory Prepaid Expenses Property Plant and Equipment (net) Total Assets $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,600,000 $ Liabilities and Stockholder's Equity Accounts Payable Salaries Payable Taxes Payable Bonds Payable, 8% $ Preferred Stock, 6%, $100 par, cumulative S Common Stock, $10 par Retained Earnings Total Liabilities and Stockholders' Equity 70,000 $ 1,078,000 $ 1,148,000 $ 60,000 $ 1,088,000 $ 512,000 $ 480,000 $ Milavec Company Balance Sheet $ $ 32,000 $ 12,800 $ As of December 31 Year 5 19,200 $ 162,000 $ 6,000 $ 175,200 $ Year 4 36,200 $ 20,000 $ $ 65,000 $ 60,000 $ $ 340,000 $ 521,200 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 175,200 $ 521,200 $ Year 4 900,000 $ 43,000 $ 637,000 $ 680,000 $ 70,000 $ 610,000 $ 290,000 $ 248,000 $ 42,000 $ 17,000 $ 25,000 $ 137,000 $ $ 162,000 $ Year 3 20,000 $ 20,000 $ 4,000 $ 50,000 $ 70,000 $ 4,000 $ 340,000 $ 508,000 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 162,000 $ 508,000 $ Year 3 800,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18,000 22,000 130,000 15,000 137,000 17,000 22,000 3,000 56,000 43,000 4,000 310,000 455,000 38,000 3,000 2,000 100,000 50,000 125,000 137,000 455,000 Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named "FSA Groups Work" due by Wednesday, April 21". Each group will be working through the three years of Milavec Financial Statements provided in this group project assignment sheet from one of 3 perspectives or point of view (POV) 1) Investors considering investing $100,000, who will purchase Preferred Stock, 6%, $100 par 2) Lenders considering loaning $100,000 for a 10-year term at 8% interest 39 Internal Management tasked with increasing profits over 3 years by 5% (Please note: your book and Power Points do not included year 5 Milavec results. Please be sure to take Year 5 results into consideration for your group work, group analysis, and final submissions.) There will be a group selection process and a POV selection process facilitated by the Groups feature in D2L. Use the Group feature in D2L to select your group. Once your group is determined, then select your POV. Once your group is formed and your POV is selected, work together to share your initial individual observations. Then considering your group's POV, develop 3 or 4 additional observations to share about Milavec Company that will help others understand Milavec and will help your group formulate an opinion about Milavec that will help you draw a conclusion. Submit your group name, group members, selected POV, and your group's initial observations about Milavec. Sales Cost of Goods Sold Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of Goods Sold Gross Margin Operating Expenses Income before taxes Income taxes Milavec Company Income Statement and Statement of Retained Earnings For the Years Ending Year 5 Net Income Plus: Beg bal Retained Earnings Less: Dividends Ending Balance Retained Earnings Assets Cash Marketable Securities Notes Receivable Accounts Receivable Merchandise Inventory Prepaid Expenses Property Plant and Equipment (net) Total Assets $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,600,000 $ Liabilities and Stockholder's Equity Accounts Payable Salaries Payable Taxes Payable Bonds Payable, 8% $ Preferred Stock, 6%, $100 par, cumulative S Common Stock, $10 par Retained Earnings Total Liabilities and Stockholders' Equity 70,000 $ 1,078,000 $ 1,148,000 $ 60,000 $ 1,088,000 $ 512,000 $ 480,000 $ Milavec Company Balance Sheet $ $ 32,000 $ 12,800 $ As of December 31 Year 5 19,200 $ 162,000 $ 6,000 $ 175,200 $ Year 4 36,200 $ 20,000 $ $ 65,000 $ 60,000 $ $ 340,000 $ 521,200 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 175,200 $ 521,200 $ Year 4 900,000 $ 43,000 $ 637,000 $ 680,000 $ 70,000 $ 610,000 $ 290,000 $ 248,000 $ 42,000 $ 17,000 $ 25,000 $ 137,000 $ $ 162,000 $ Year 3 20,000 $ 20,000 $ 4,000 $ 50,000 $ 70,000 $ 4,000 $ 340,000 $ 508,000 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 162,000 $ 508,000 $ Year 3 800,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18,000 22,000 130,000 15,000 137,000 17,000 22,000 3,000 56,000 43,000 4,000 310,000 455,000 38,000 3,000 2,000 100,000 50,000 125,000 137,000 455,000

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The Group Submission Report is as explained below Stepbystep explanation Group Submission Report From Leaders Name Group Name Group Members Leaders Na...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started