Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part- B Transaction Analysis Scenario It is May 1, 2024 Olivia Parker holds a Bachelor of Education in Early Childhood Education degree and boasts

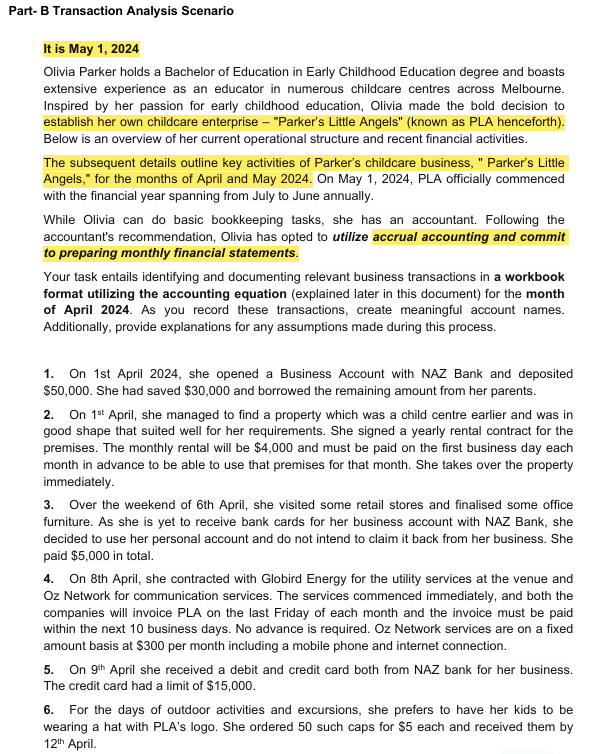

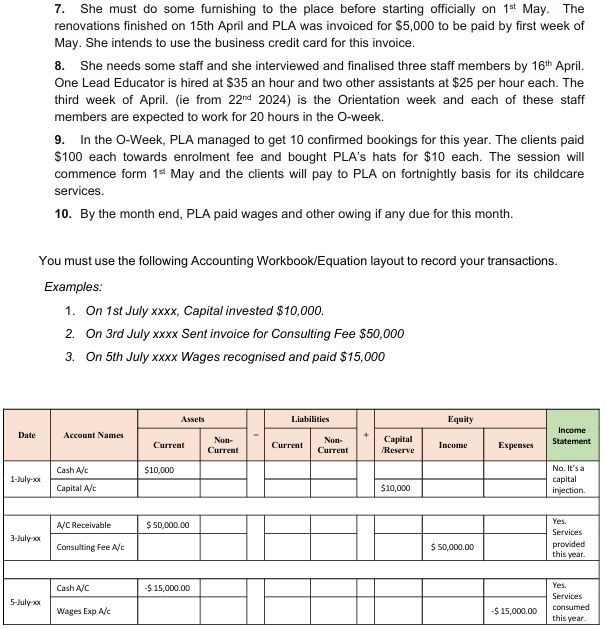

Part- B Transaction Analysis Scenario It is May 1, 2024 Olivia Parker holds a Bachelor of Education in Early Childhood Education degree and boasts extensive experience as an educator in numerous childcare centres across Melbourne. Inspired by her passion for early childhood education, Olivia made the bold decision to establish her own childcare enterprise - "Parker's Little Angels" (known as PLA henceforth). Below is an overview of her current operational structure and recent financial activities. The subsequent details outline key activities of Parker's childcare business, " Parker's Little Angels," for the months of April and May 2024. On May 1, 2024, PLA officially commenced with the financial year spanning from July to June annually. While Olivia can do basic bookkeeping tasks, she has an accountant. Following the accountant's recommendation, Olivia has opted to utilize accrual accounting and commit to preparing monthly financial statements. Your task entails identifying and documenting relevant business transactions in a workbook format utilizing the accounting equation (explained later in this document) for the month of April 2024. As you record these transactions, create meaningful account names. Additionally, provide explanations for any assumptions made during this process. 1. On 1st April 2024, she opened a Business Account with NAZ Bank and deposited $50,000. She had saved $30,000 and borrowed the remaining amount from her parents. 2. On 1st April, she managed to find a property which was a child centre earlier and was in good shape that suited well for her requirements. She signed a yearly rental contract for the premises. The monthly rental will be $4,000 and must be paid on the first business day each month in advance to be able to use that premises for that month. She takes over the property immediately. 3. Over the weekend of 6th April, she visited some retail stores and finalised some office furniture. As she is yet to receive bank cards for her business account with NAZ Bank, she decided to use her personal account and do not intend to claim it back from her business. She paid $5,000 in total. 4. On 8th April, she contracted with Globird Energy for the utility services at the venue and Oz Network for communication services. The services commenced immediately, and both the companies will invoice PLA on the last Friday of each month and the invoice must be paid within the next 10 business days. No advance is required. Oz Network services are on a fixed amount basis at $300 per month including a mobile phone and internet connection. 5. On 9th April she received a debit and credit card both from NAZ bank for her business. The credit card had a limit of $15,000. 6. For the days of outdoor activities and excursions, she prefers to have her kids to be wearing a hat with PLA's logo. She ordered 50 such caps for $5 each and received them by 12th April. 7. She must do some furnishing to the place before starting officially on 1st May. The renovations finished on 15th April and PLA was invoiced for $5,000 to be paid by first week of May. She intends to use the business credit card for this invoice. 8. She needs some staff and she interviewed and finalised three staff members by 16th April. One Lead Educator is hired at $35 an hour and two other assistants at $25 per hour each. The third week of April. (ie from 22nd 2024) is the Orientation week and each of these staff members are expected to work for 20 hours in the O-week. 9. In the O-Week, PLA managed to get 10 confirmed bookings for this year. The clients paid $100 each towards enrolment fee and bought PLA's hats for $10 each. The session will commence form 1st May and the clients will pay to PLA on fortnightly basis for its childcare services. 10. By the month end, PLA paid wages and other owing if any due for this month. You must use the following Accounting Workbook/Equation layout to record your transactions. Examples: 1. On 1st July xxxx, Capital invested $10,000. 2. On 3rd July xxxx Sent invoice for Consulting Fee $50,000 3. On 5th July xxxx Wages recognised and paid $15,000 Assets Liabilities Equity Date Account Names + Current Non- Current Current Non- Current Capital /Reserve Income Statement Income Expenses Cash A/c $10,000 No. It's a 1-July-xxx Capital A/c $10,000 capital injection. A/C Receivable $50,000.00 3-July-xx Consulting Fee A/c Cash A/C -$15,000.00 5-July-xxx Wages Exp A/c $50,000.00 Yes. Services provided this year. Yes. Services consumed -$15,000.00 this year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the accounting entries for the transactions outlined for Parkers Little Angels for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started