Answered step by step

Verified Expert Solution

Question

1 Approved Answer

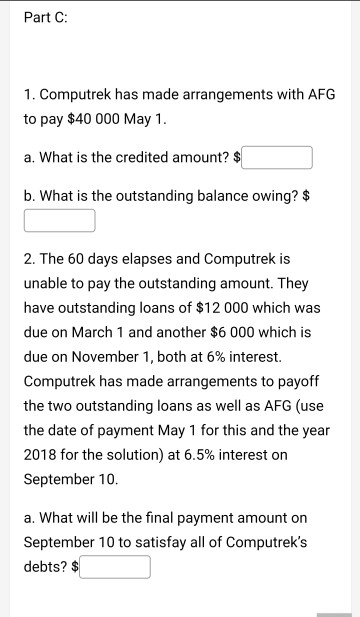

Part C: 1. Computrek has made arrangements with AFG to pay $40 000 May 1. a. What is the credited amount? $ b. What is

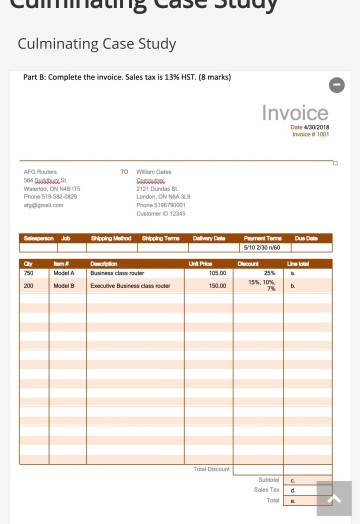

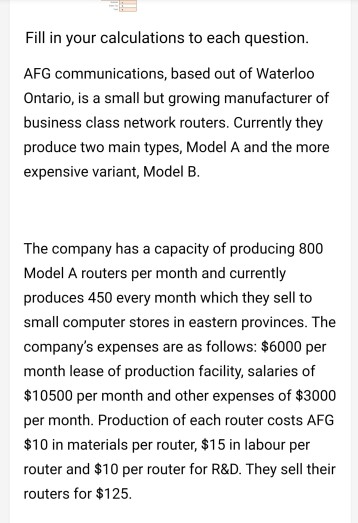

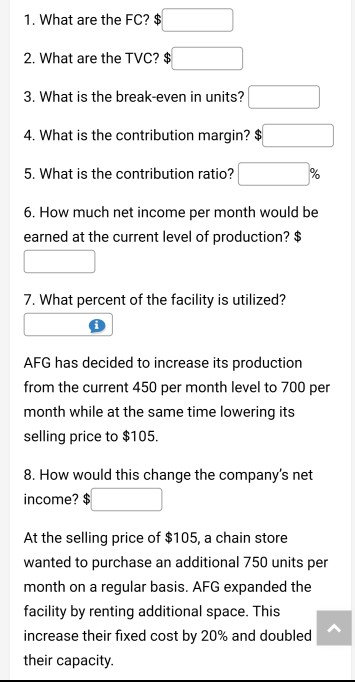

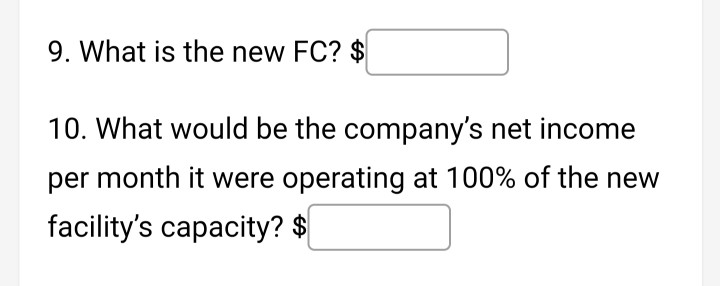

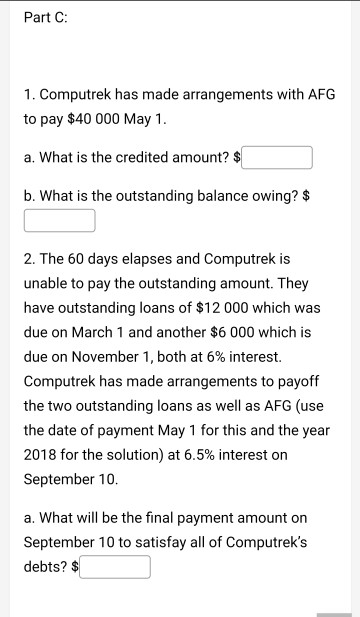

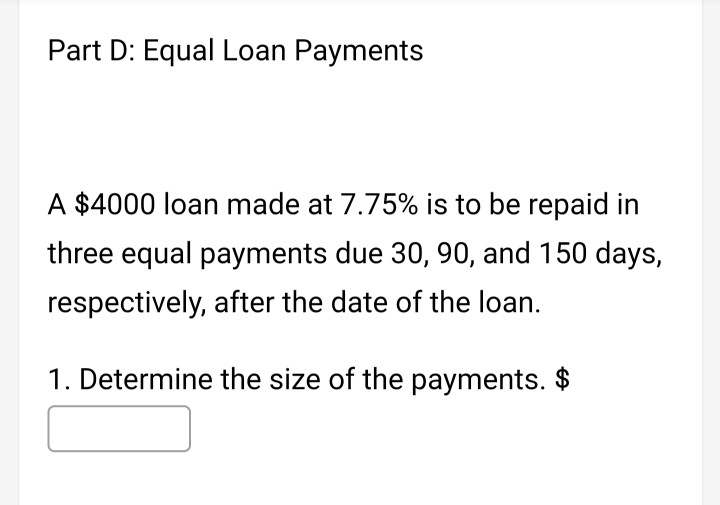

Part C: 1. Computrek has made arrangements with AFG to pay $40 000 May 1. a. What is the credited amount? $ b. What is the outstanding balance owing? $ 2. The 60 days elapses and Computrek is unable to pay the outstanding amount. They have outstanding loans of $12 000 which was due on March 1 and another $6 000 which is due on November 1, both at 6% interest. Computrek has made arrangements to payoff the two outstanding loans as well as AFG (use the date of payment May 1 for this and the year 2018 for the solution) at 6.5% interest on September 10. a. What will be the final payment amount on September 10 to satisfay all of Computrek's debts? $ Culminating Case Study Part B: Complete the invoice. Sales tax is 13% HST. (8 marks) Invoice Date 4/30/2018 Invice 1001 AFGR Water, ON BITS Phone 519 52.0829 @gmail.com TO Wines 2121 Dudes SL London, ON NGA SL Phone 5 16720001 Customer 12345 Son Sharehod Sheera Tom Daley Dube Parent Terme 5/10 230 60 10 Model Dear urmaa thaa the| Eacutive Business and Un Pee 10.00 Decourt 255 15%, 10% 150.00 Total Dent Sub Sales Tax Tot d Fill in your calculations to each question. AFG communications, based out of Waterloo Ontario, is a small but growing manufacturer of business class network routers. Currently they produce two main types, Model A and the more expensive variant, Model B. The company has a capacity of producing 800 Model A routers per month and currently produces 450 every month which they sell to small computer stores in eastern provinces. The company's expenses are as follows: $6000 per month lease of production facility, salaries of $10500 per month and other expenses of $3000 per month. Production of each router costs AFG $10 in materials per router, $15 in labour per router and $10 per router for R&D. They sell their routers for $125. 1. What are the FC? $ 2. What are the TVC? $ 3. What is the break-even in units? 4. What is the contribution margin? $ 5. What is the contribution ratio? 6. How much net income per month would be earned at the current level of production? $ 7. What percent of the facility is utilized? AFG has decided to increase its production from the current 450 per month level to 700 per month while at the same time lowering its selling price to $105. 8. How would this change the company's net income? $ At the selling price of $105, a chain store wanted to purchase an additional 750 units per month on a regular basis. AFG expanded the facility by renting additional space. This increase their fixed cost by 20% and doubled their capacity. 9. What is the new FC? $ 10. What would be the company's net income per month it were operating at 100% of the new facility's capacity? $ Part C: 1. Computrek has made arrangements with AFG to pay $40 000 May 1. a. What is the credited amount? $ b. What is the outstanding balance owing? $ 2. The 60 days elapses and Computrek is unable to pay the outstanding amount. They have outstanding loans of $12 000 which was due on March 1 and another $6 000 which is due on November 1, both at 6% interest. Computrek has made arrangements to payoff the two outstanding loans as well as AFG (use the date of payment May 1 for this and the year 2018 for the solution) at 6.5% interest on September 10. a. What will be the final payment amount on September 10 to satisfay all of Computrek's debts? $ Part D: Equal Loan Payments A $4000 loan made at 7.75% is to be repaid in three equal payments due 30, 90, and 150 days, respectively, after the date of the loan. 1. Determine the size of the payments. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started