Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part C On October 1 , 2 0 2 4 , Nicklaus Corporation receives permission to replace its $ 1 par value common stock shares

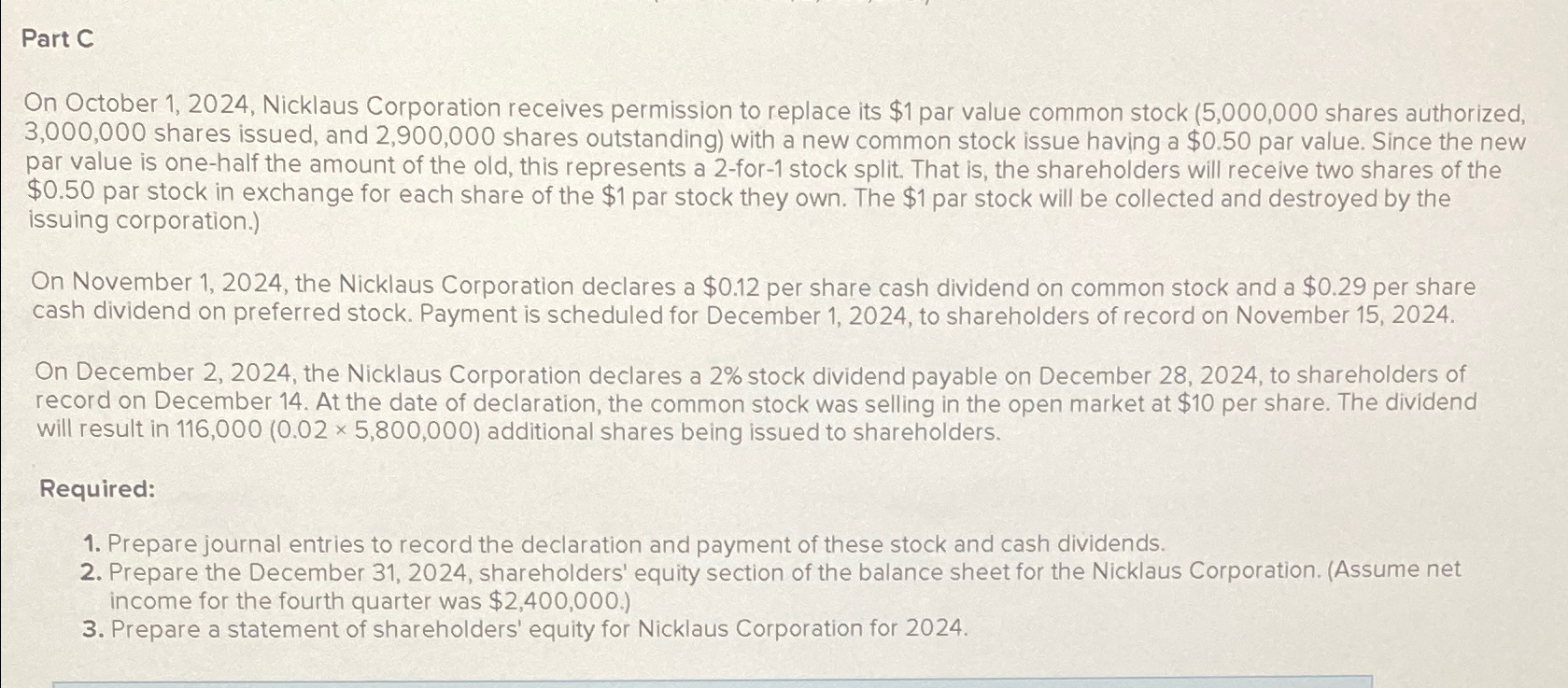

Part C

On October Nicklaus Corporation receives permission to replace its $ par value common stock shares authorized, shares issued, and shares outstanding with a new common stock issue having a $ par value. Since the new par value is onehalf the amount of the old, this represents a for stock split. That is the shareholders will receive two shares of the $ par stock in exchange for each share of the $ par stock they own. The $ par stock will be collected and destroyed by the issuing corporation.

On November the Nicklaus Corporation declares a $ per share cash dividend on common stock and a $ per share cash dividend on preferred stock. Payment is scheduled for December to shareholders of record on November

On December the Nicklaus Corporation declares a stock dividend payable on December to shareholders of record on December At the date of declaration, the common stock was selling in the open market at $ per share. The dividend will result in additional shares being issued to shareholders.

Required:

Prepare journal entries to record the declaration and payment of these stock and cash dividends.

Prepare the December shareholders' equity section of the balance sheet for the Nicklaus Corporation. Assume net income for the fourth quarter was $

Prepare a statement of shareholders' equity for Nicklaus Corporation for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started