Answered step by step

Verified Expert Solution

Question

1 Approved Answer

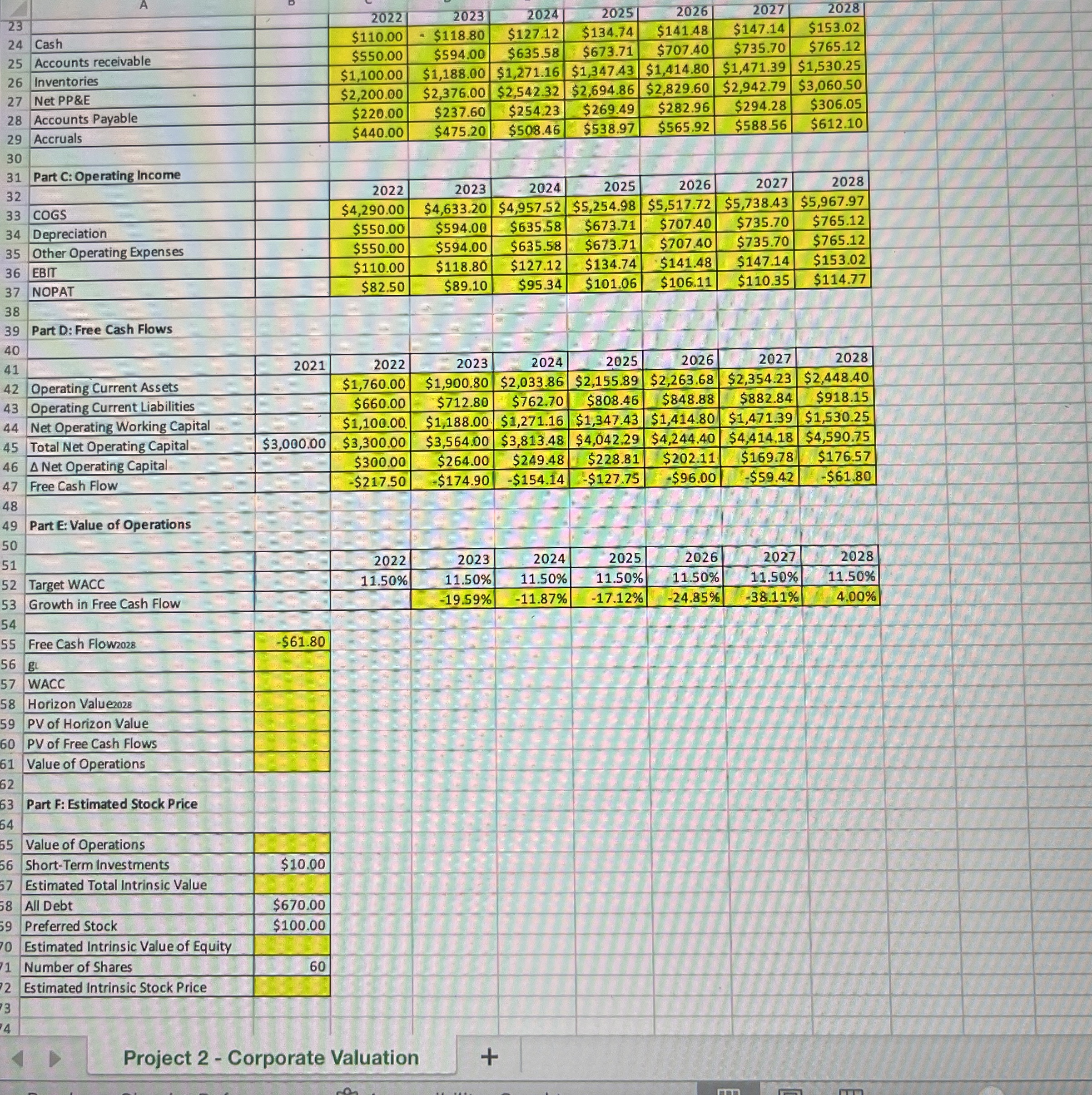

Part C: Operating Income Fill in the table for COGS, Depreciation, and other operating expenses by referencing the required ratios. Calculate the following by referencing

Part C: Operating Income

Fill in the table for COGS, Depreciation, and other operating expenses by referencing the required ratios.

Calculate the following by referencing cells:

EBIT Net Sales COGS Depreciation Other Operating Expenses

NOPAT EBIT Tax Rate

Part D: Free Cash Flows

Calculate the following by referencing cells:

Operating Current Assets Cash Accounts Receivables Inventories

Operating Current Liabilities Accounts Payable Accruals

Net Operating Working Capital Operating Current Assets Operating Current Liabilities

Total Net Operating Capital Net PP&E Net Operating Working Capital

Net Operating Capital Total Net Operating Capital this year Total Net Operating Capital last year

Free Cash Flow NOPAT Net Operating Capital

Part E: Value of Operations

Calculate the following by referencing cells:

gi represents the Growth in the Free Cash Flow when growth becomes constant in the last year.

Use the Excel PV function to calculate the PV of the horizon value. For example, type PVWACC cell reference,

Part E: Value of Operations

Calculate the following by referencing cells:

g represents the Growth in the Free Cash Flow when growth becomes constant in the last year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started