Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part c please Q3. An investor intend to purchase one of the three types of real estates, i.e, office building, commercial complex or warehouse. The

part c please

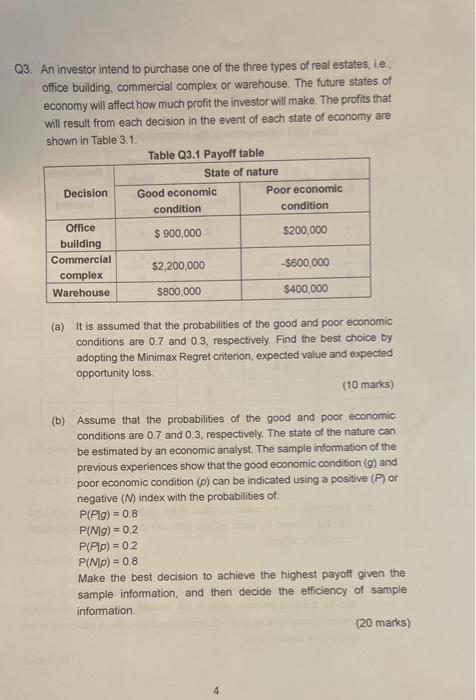

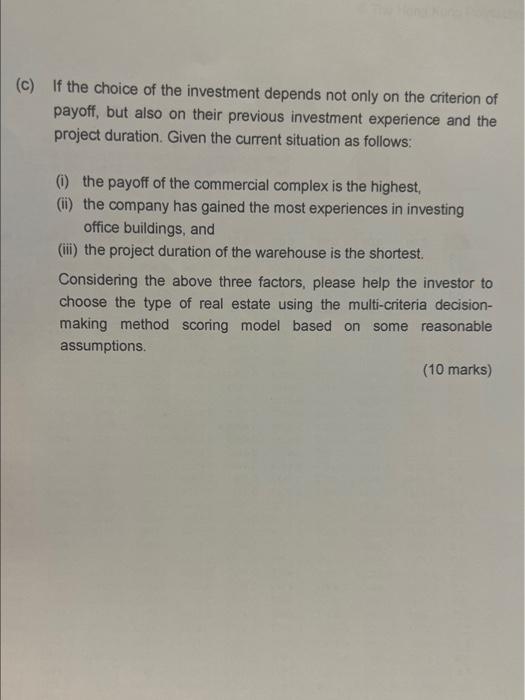

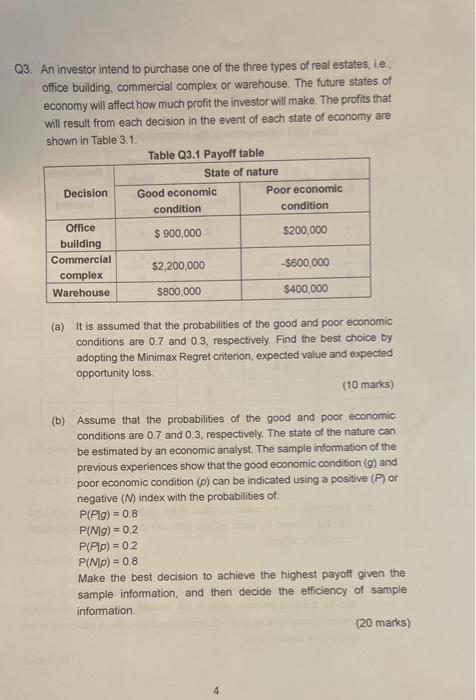

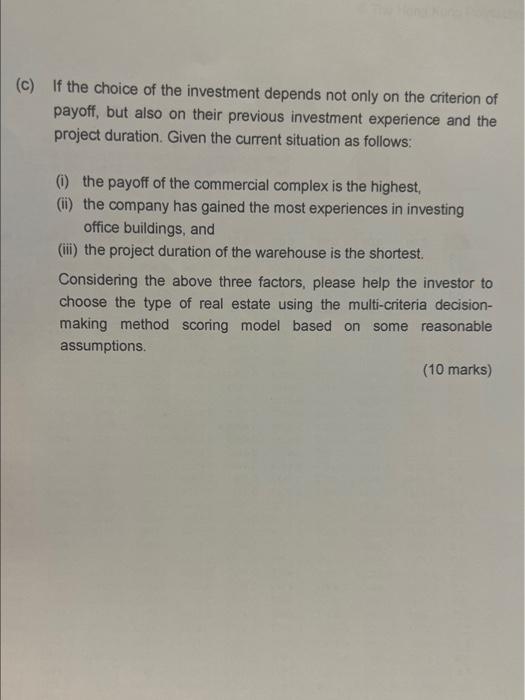

Q3. An investor intend to purchase one of the three types of real estates, i.e, office building, commercial complex or warehouse. The future states of economy will affect how much profit the investor will make. The profits that will result from each decision in the event of each state of economy are shown in Table 3.1. (a) It is assumed that the probabilities of the good and poor economic conditions are 0.7 and 0.3, respectively. Find the best choice by adopting the Minimax Regret criterion, expected value and expected opportunity loss. (10 marks) (b) Assume that the probabilities of the good and poor economic conditions are 0.7 and 0.3, respectively. The state of the nature can be estimated by an economic analyst. The sample information of the previous experiences show that the good economic condition (g) and poor economic condition (p) can be indicated using a positive (P) or negative (N) index with the probabilities of: P(Plg)=0.8 P(Ng)=0.2 P(Pp)=0.2 P(Np)=0.8 Make the best decision to achieve the highest payoff given the sample information, and then decide the efficiency of sample information. (20 marks) 4 c) If the choice of the investment depends not only on the criterion of payoff, but also on their previous investment experience and the project duration. Given the current situation as follows: (i) the payoff of the commercial complex is the highest, (ii) the company has gained the most experiences in investing office buildings, and (iii) the project duration of the warehouse is the shortest. Considering the above three factors, please help the investor to choose the type of real estate using the multi-criteria decisionmaking method scoring model based on some reasonable assumptions. (10 marks) Q3. An investor intend to purchase one of the three types of real estates, i.e, office building, commercial complex or warehouse. The future states of economy will affect how much profit the investor will make. The profits that will result from each decision in the event of each state of economy are shown in Table 3.1. (a) It is assumed that the probabilities of the good and poor economic conditions are 0.7 and 0.3, respectively. Find the best choice by adopting the Minimax Regret criterion, expected value and expected opportunity loss. (10 marks) (b) Assume that the probabilities of the good and poor economic conditions are 0.7 and 0.3, respectively. The state of the nature can be estimated by an economic analyst. The sample information of the previous experiences show that the good economic condition (g) and poor economic condition (p) can be indicated using a positive (P) or negative (N) index with the probabilities of: P(Plg)=0.8 P(Ng)=0.2 P(Pp)=0.2 P(Np)=0.8 Make the best decision to achieve the highest payoff given the sample information, and then decide the efficiency of sample information. (20 marks) 4 c) If the choice of the investment depends not only on the criterion of payoff, but also on their previous investment experience and the project duration. Given the current situation as follows: (i) the payoff of the commercial complex is the highest, (ii) the company has gained the most experiences in investing office buildings, and (iii) the project duration of the warehouse is the shortest. Considering the above three factors, please help the investor to choose the type of real estate using the multi-criteria decisionmaking method scoring model based on some reasonable assumptions. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started