Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part C please this is all the information provided by the question Floating Rate Note Practice Problem Let's denote today by t = 0. The

Part C please

this is all the information provided by the question

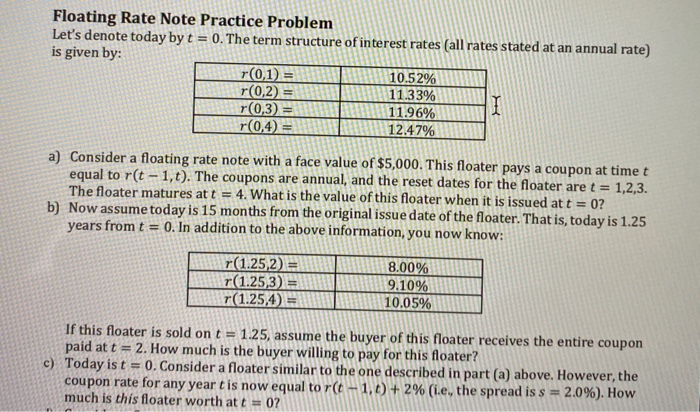

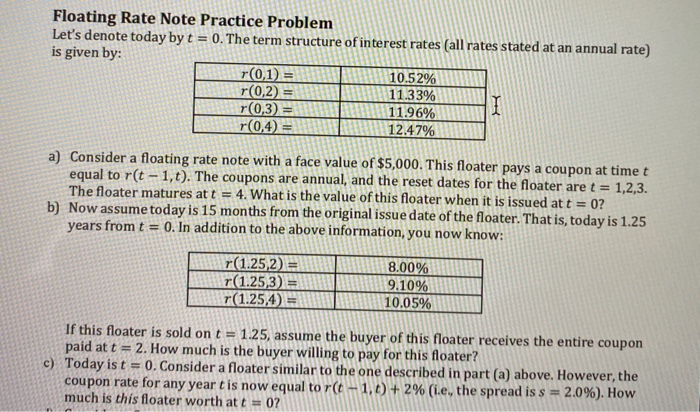

Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at an annual rate) is given by: r(0,1) = 10.52% 11 r(0,2) = 11.33% r(0,3)= 11.96% r(0,4) = 12.47% a) Consider a floating rate note with a face value of $5,000. This floater pays a coupon at timet equal to r(t -1,t). The coupons are annual, and the reset dates for the floater are t = 1,2,3. The floater matures at t = 4. What is the value of this floater when it is issued at t = 0? b) Now assume today is 15 months from the original issue date of the floater. That is, today is 1.25 years from t = 0. In addition to the above information, you now know: r(1.25,2 = r(1.25,3) = r(1.25,4) = 8.00% 9.10% 111|10.05% 11 If this floater is sold on t = 1.25, assume the buyer of this floater receives the entire coupon paid at t = 2. How much is the buyer willing to pay for this floater? c) Today is t = 0. Consider a floater similar to the one described in part (a) above. However, the coupon rate for any year t is now equal to r(t+1,) + 2% (ie, the spread is s 2.0%). How much is this floater worth at t = 0? Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at an annual rate) is given by: r(0,1) = 10.52% 11 r(0,2) = 11.33% r(0,3)= 11.96% r(0,4) = 12.47% a) Consider a floating rate note with a face value of $5,000. This floater pays a coupon at timet equal to r(t -1,t). The coupons are annual, and the reset dates for the floater are t = 1,2,3. The floater matures at t = 4. What is the value of this floater when it is issued at t = 0? b) Now assume today is 15 months from the original issue date of the floater. That is, today is 1.25 years from t = 0. In addition to the above information, you now know: r(1.25,2 = r(1.25,3) = r(1.25,4) = 8.00% 9.10% 111|10.05% 11 If this floater is sold on t = 1.25, assume the buyer of this floater receives the entire coupon paid at t = 2. How much is the buyer willing to pay for this floater? c) Today is t = 0. Consider a floater similar to the one described in part (a) above. However, the coupon rate for any year t is now equal to r(t+1,) + 2% (ie, the spread is s 2.0%). How much is this floater worth at t = 0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started