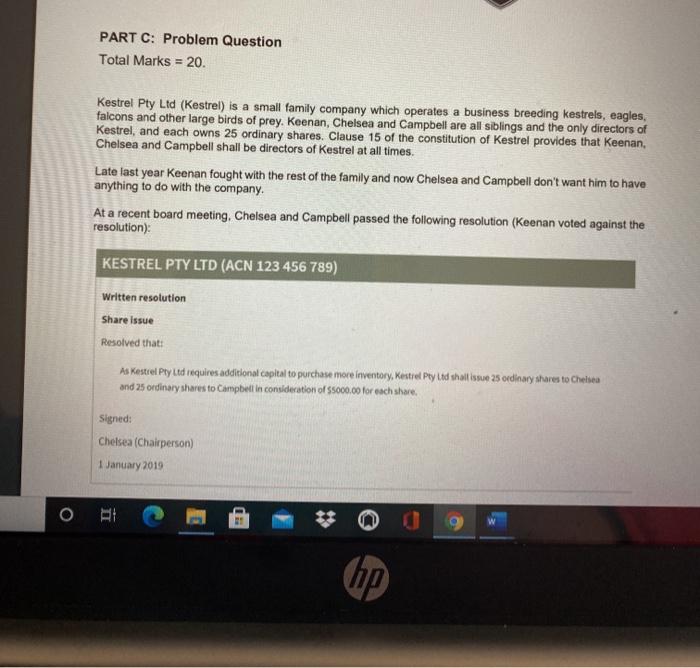

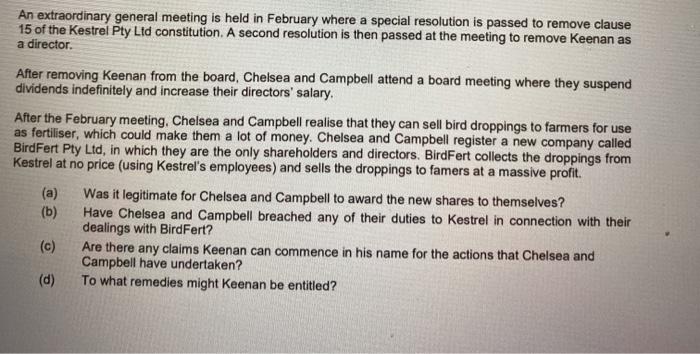

PART C: Problem Question Total Marks = 20 Kestrel Pty Ltd (Kestrel) is a small family company which operates a business breeding Kestrels, eagles, falcons and other large birds of prey. Keenan, Chelsea and Campbell are all siblings and the only directors of Kestrel, and each owns 25 ordinary shares. Clause 15 of the constitution of Kestrel provides that Keenan, Chelsea and Campbell shall be directors of Kestrel at all times. Late last year Keenan fought with the rest of the family and now Chelsea and Campbell don't want him to have anything to do with the company. At a recent board meeting, Chelsea and Campbell passed the following resolution (Keenan voted against the resolution): KESTREL PTY LTD (ACN 123 456 789) written resolution Share issue Resolved that As Kestrel Pty Ltd requires additional capital to purchase more inventory, Kestrel Pty Ltd shall issue 25 ordinary shares to Chelsea and 25 ordinary shares to Campbell in consideration of 5000.00 for each share Signed: Chelsea (Chairperson 1 January 2019 hp An extraordinary general meeting is held in February where a special resolution is passed to remove clause 15 of the Kestrel Pty Ltd constitution. A second resolution is then passed at the meeting to remove Keenan as a director After removing Keenan from the board, Chelsea and Campbell attend a board meeting where they suspend dividends indefinitely and increase their directors' salary, After the February meeting, Chelsea and Campbell realise that they can sell bird droppings to farmers for use as fertiliser, which could make them a lot of money. Chelsea and Campbell register a new company called BirdFert Pty Ltd, in which they are the only shareholders and directors, BirdFert collects the droppings from Kestrel at no price (using Kestrel's employees) and sells the droppings to famers at a massive profit. (a) Was it legitimate for Chelsea and Campbell to award the new shares to themselves? (b) Have Chelsea and Campbell breached any of their duties to Kestrel in connection with their dealings with BirdFert? (c) Are there any claims Keenan can commence in his name for the actions that Chelsea and Campbell have undertaken? (d) To what remedies might Keenan be entitled