Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part C The board of directors of Lili Technologies Berhad had approved the expansion plan of the company, which includes purchase of a new

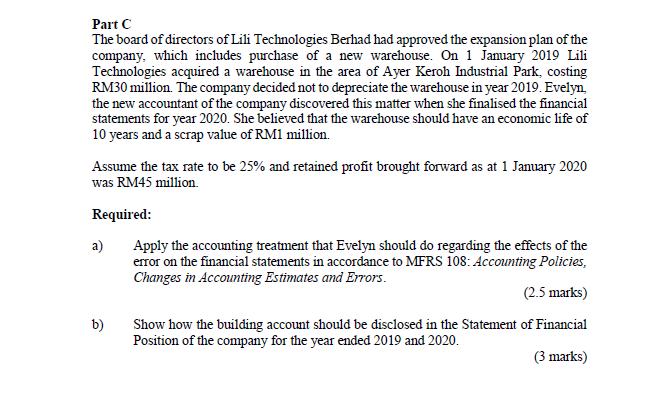

Part C The board of directors of Lili Technologies Berhad had approved the expansion plan of the company, which includes purchase of a new warehouse. On 1 January 2019 Lili Technologies acquired a warehouse in the area of Ayer Keroh Industrial Park, costing RM30 million. The company decided not to depreciate the warehouse in year 2019. Evelyn the new accountant of the company discovered this matter when she finalised the financial statements for year 2020. She believed that the warehouse should have an economic life of 10 years and a scrap value of RM1 million. Assume the tax rate to be 25% and retained profit brought forward as at 1 January 2020 was RM45 million. Required: a) Apply the accounting treatment that Evelyn should do regarding the effects of the error on the financial statements in accordance to MFRS 108: Accounting Policies, Changes in Accounting Estimates and Errors. (2.5 marks) b) Show how the building account should be disclosed in the Statement of Financial Position of the company for the year ended 2019 and 2020. (3 marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation is a mandatory deduction in the profit and loss statements of an entity and the Act all...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started