Question

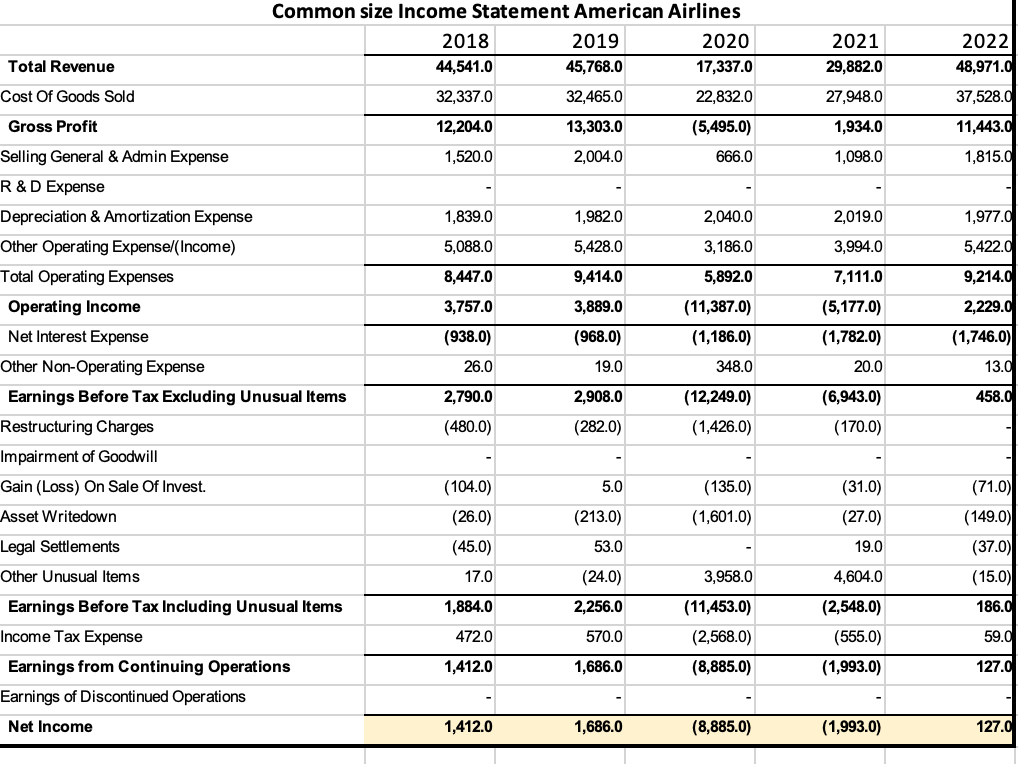

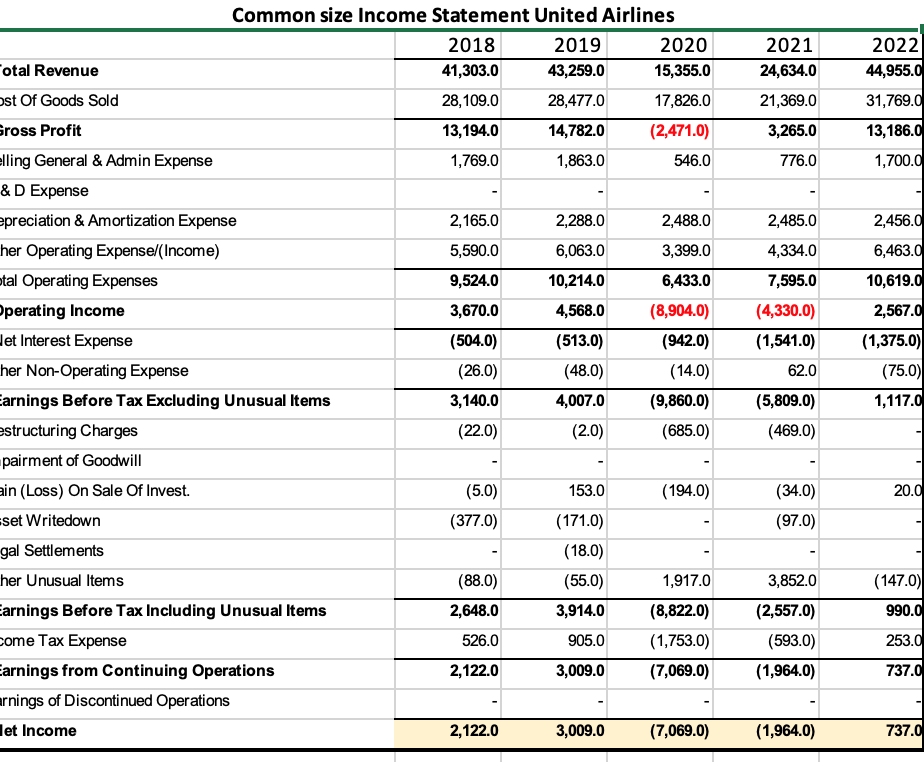

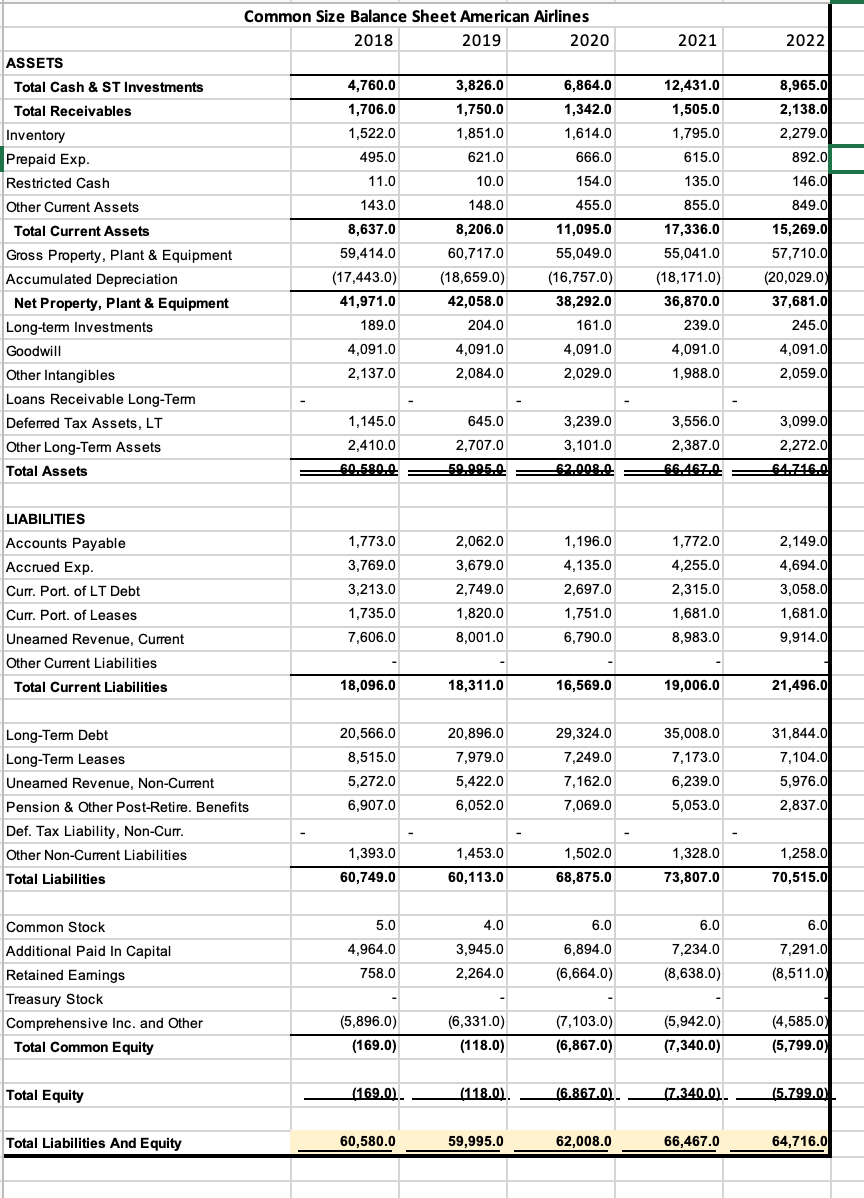

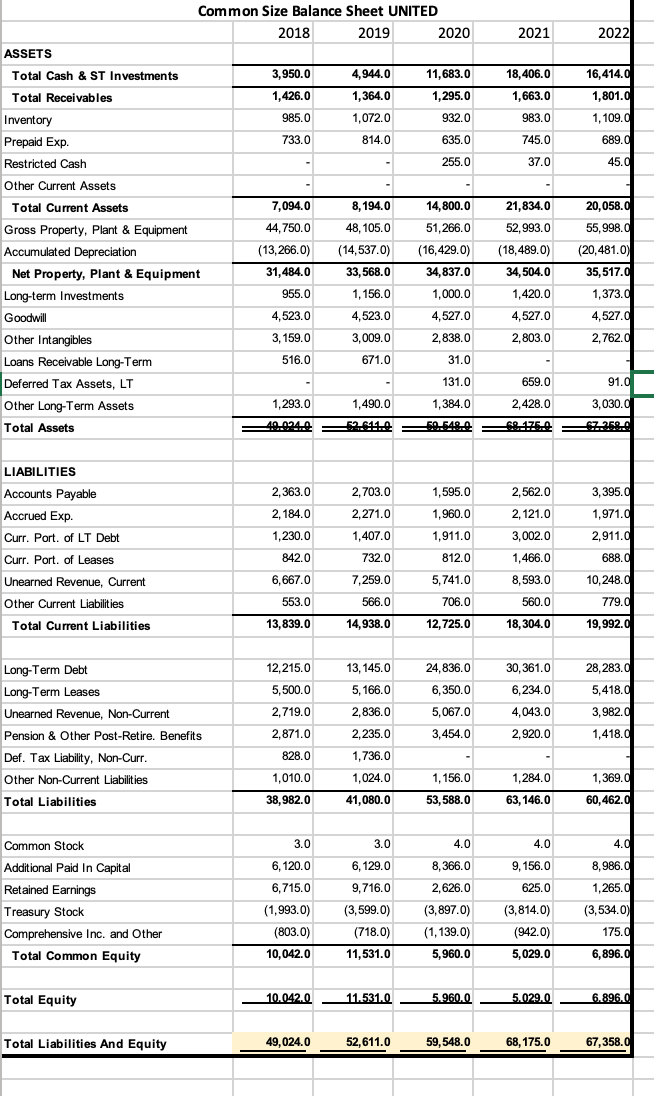

Part c. What useful information do you receive from these common size statements? Use the useful information to compare the financial performance and the financial

Part c. What useful information do you receive from these common size statements? Use the useful information to compare the financial performance and the financial position of these two companies in 2020. How did Covid affect these firms?

Question 2. (3 points). Analyze the financial performance and position of each company over the period of 2017-2022? Comment on the change in the financial performance/position of each company during this period.

Question 3. (6 points). Compare and contrast the financial performance and position of these two firms. Your answer should state which firm has better performance over the period 2018-2022? Which firm seems to manage its assets and costs more efficiently? Provide evidence to support your conclusion?

use the following ratios in the analysis:Should use the follow ratios in your analysis

2.1- Liquidity: current ratio, quick rati

2.3- Profitability: ROE (return on equity), ROA (return on assets), profit margin (gross profit margin, net income margin)

2.4- Asset management: asset turnover (revenue/total assets), Accounts Receivable turnover, Inventory turnover, Accounts Payable turnover

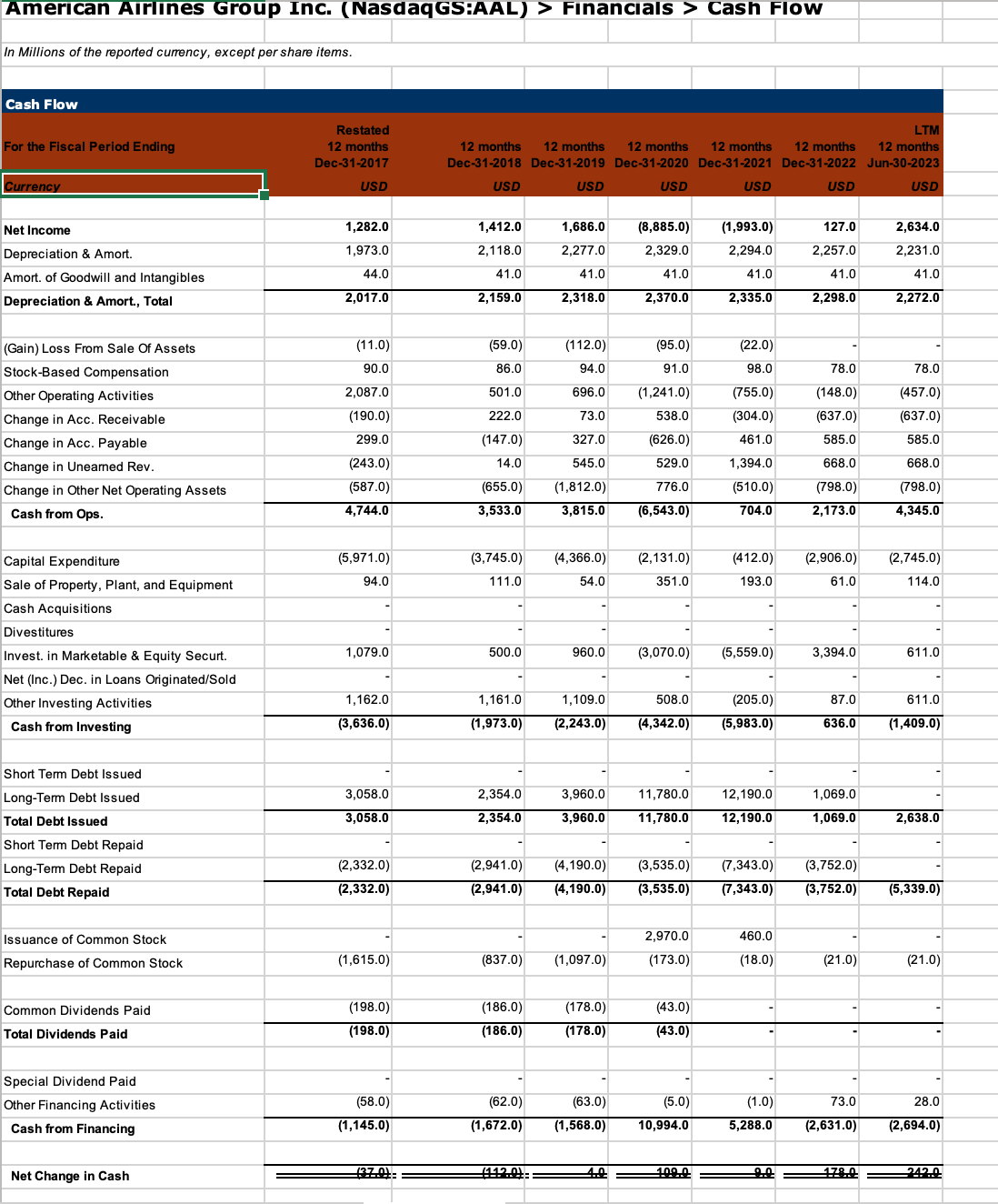

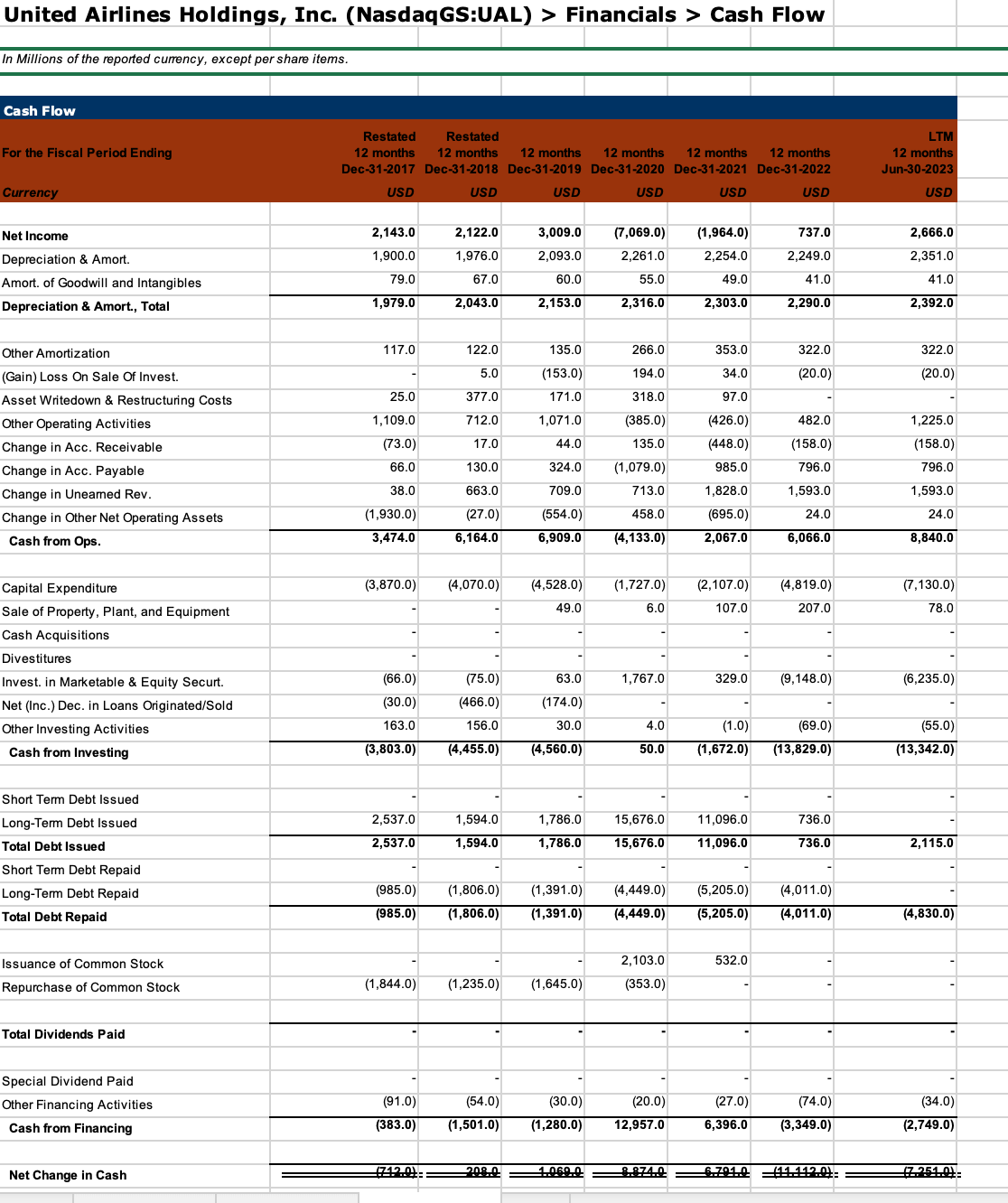

Common size Income Statement United Airlines Common size Income Statement American Airlines American Alrlines Group Inc. (NasdaqGS:AAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total (Gain) Loss From Sale Of Assets Stock-Based Compensation Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock Common Dividends Paid Total Dividends Paid Special Dividend Paid Other Financing Activities Cash from Financing Net Change in Cash Restated 12 months Dec-31-2017 12 months 12 months 12 months 12 months 12 months Dec-31-2018 Dec-31-2019 Dec-31-2020 Dec-31-2021 Dec-31-2022 Jun-30-2023 USD USD USD USD 1,412.0 1,282.0 1,973.0 2,118.0 44.0 2,017.0 2,159.0 (11.0) 90.0 2,087.0 (190.0) 299.0 (243.0) (587.0) 4,744.0 (5,971.0) 94.0 (3,745.0) 111.0 (4,366.0) 54.0 (2,131.0) 351.0 (412.0) 193.0 (2,906.0) 61.0 (2,745.0) 114.0 United Airlines Holdings, Inc. (NasdaqGS:UAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Restated Restated 12 months 12 months USDUSDUSDUSDUSDUSD LTM 12 months Jun-30-2023 USD Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total Other Amortization (Gain) Loss On Sale Of Invest. Asset Writedown \& Restructuring Costs Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock 2,143.0 2,122.0 1,900.0 1,976.0 3,009.0 79.0 2,093.0 (7,069.0) 1,979.0 67.0 2,261.0 (1,964.0) 2,254.02,249.0 \begin{tabular}{r|r|} 737.0 & 2,666.0 \\ \hline, 249.0 & 2,351.0 \end{tabular} \begin{tabular}{|r|r|r|r|r|r|r|} \hline & 60.0 & 55.0 & 49.0 & 41.0 & 41.0 \\ \hline 1,979.0 & 2,043.0 & 2,153.0 & 2,316.0 & 2,303.0 & 2,290.0 & 2,392.0 \\ \hline \end{tabular} 117.0 122.0 135.0 (153.0) 266.0 353.0 3220 322.0 (20.0) 25.0 377.0 171.0 194.0 34.0 (20.0) 1,071.0 (385.0) (426.0) 482.0 1,225.0 (73.0) 17.0 (158.0) (158.0) 66.0 130.0 324.0 (1,079.0) 985.0 796.0 796.0 1.593 .0 38.0 (1,930.0) 709.0 1,593.0 1,593.024.0 \begin{tabular}{rrr|r|r|rr|r|} 24.0 \\ \hline(1,930.0) & (27.0) & (554.0) & 458.0 & (695.0) & 24.0 & 8,840.0 \end{tabular} Total Dividends Paid (66.0) (75.0) 63.0 1,767.0 329.0(9,148.0) (6,235.0) (30.0) (466.0) (174.0) (1.0) (69.0) (55.0) (3,803.0) (4,455.0) (4,560.0) (1,672.0)(13,829.0) (13,342.0) Special Dividend Paid Other Financing Activities Cash from Financing (91.0) (54.0) (30.0) (20.0) (27.0) (74.0) (7,130.0) 78.0 (383.0) (1,501.0) (1,280.0) 12,957.0 6,396.0 (3,349.0) (34.0) (4,830.0) Net Change in Cash 2080 (2,749.0) Common size Income Statement United Airlines Common size Income Statement American Airlines American Alrlines Group Inc. (NasdaqGS:AAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total (Gain) Loss From Sale Of Assets Stock-Based Compensation Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock Common Dividends Paid Total Dividends Paid Special Dividend Paid Other Financing Activities Cash from Financing Net Change in Cash Restated 12 months Dec-31-2017 12 months 12 months 12 months 12 months 12 months Dec-31-2018 Dec-31-2019 Dec-31-2020 Dec-31-2021 Dec-31-2022 Jun-30-2023 USD USD USD USD 1,412.0 1,282.0 1,973.0 2,118.0 44.0 2,017.0 2,159.0 (11.0) 90.0 2,087.0 (190.0) 299.0 (243.0) (587.0) 4,744.0 (5,971.0) 94.0 (3,745.0) 111.0 (4,366.0) 54.0 (2,131.0) 351.0 (412.0) 193.0 (2,906.0) 61.0 (2,745.0) 114.0 United Airlines Holdings, Inc. (NasdaqGS:UAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Restated Restated 12 months 12 months USDUSDUSDUSDUSDUSD LTM 12 months Jun-30-2023 USD Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total Other Amortization (Gain) Loss On Sale Of Invest. Asset Writedown \& Restructuring Costs Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock 2,143.0 2,122.0 1,900.0 1,976.0 3,009.0 79.0 2,093.0 (7,069.0) 1,979.0 67.0 2,261.0 (1,964.0) 2,254.02,249.0 \begin{tabular}{r|r|} 737.0 & 2,666.0 \\ \hline, 249.0 & 2,351.0 \end{tabular} \begin{tabular}{|r|r|r|r|r|r|r|} \hline & 60.0 & 55.0 & 49.0 & 41.0 & 41.0 \\ \hline 1,979.0 & 2,043.0 & 2,153.0 & 2,316.0 & 2,303.0 & 2,290.0 & 2,392.0 \\ \hline \end{tabular} 117.0 122.0 135.0 (153.0) 266.0 353.0 3220 322.0 (20.0) 25.0 377.0 171.0 194.0 34.0 (20.0) 1,071.0 (385.0) (426.0) 482.0 1,225.0 (73.0) 17.0 (158.0) (158.0) 66.0 130.0 324.0 (1,079.0) 985.0 796.0 796.0 1.593 .0 38.0 (1,930.0) 709.0 1,593.0 1,593.024.0 \begin{tabular}{rrr|r|r|rr|r|} 24.0 \\ \hline(1,930.0) & (27.0) & (554.0) & 458.0 & (695.0) & 24.0 & 8,840.0 \end{tabular} Total Dividends Paid (66.0) (75.0) 63.0 1,767.0 329.0(9,148.0) (6,235.0) (30.0) (466.0) (174.0) (1.0) (69.0) (55.0) (3,803.0) (4,455.0) (4,560.0) (1,672.0)(13,829.0) (13,342.0) Special Dividend Paid Other Financing Activities Cash from Financing (91.0) (54.0) (30.0) (20.0) (27.0) (74.0) (7,130.0) 78.0 (383.0) (1,501.0) (1,280.0) 12,957.0 6,396.0 (3,349.0) (34.0) (4,830.0) Net Change in Cash 2080 (2,749.0)

Common size Income Statement United Airlines Common size Income Statement American Airlines American Alrlines Group Inc. (NasdaqGS:AAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total (Gain) Loss From Sale Of Assets Stock-Based Compensation Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock Common Dividends Paid Total Dividends Paid Special Dividend Paid Other Financing Activities Cash from Financing Net Change in Cash Restated 12 months Dec-31-2017 12 months 12 months 12 months 12 months 12 months Dec-31-2018 Dec-31-2019 Dec-31-2020 Dec-31-2021 Dec-31-2022 Jun-30-2023 USD USD USD USD 1,412.0 1,282.0 1,973.0 2,118.0 44.0 2,017.0 2,159.0 (11.0) 90.0 2,087.0 (190.0) 299.0 (243.0) (587.0) 4,744.0 (5,971.0) 94.0 (3,745.0) 111.0 (4,366.0) 54.0 (2,131.0) 351.0 (412.0) 193.0 (2,906.0) 61.0 (2,745.0) 114.0 United Airlines Holdings, Inc. (NasdaqGS:UAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Restated Restated 12 months 12 months USDUSDUSDUSDUSDUSD LTM 12 months Jun-30-2023 USD Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total Other Amortization (Gain) Loss On Sale Of Invest. Asset Writedown \& Restructuring Costs Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock 2,143.0 2,122.0 1,900.0 1,976.0 3,009.0 79.0 2,093.0 (7,069.0) 1,979.0 67.0 2,261.0 (1,964.0) 2,254.02,249.0 \begin{tabular}{r|r|} 737.0 & 2,666.0 \\ \hline, 249.0 & 2,351.0 \end{tabular} \begin{tabular}{|r|r|r|r|r|r|r|} \hline & 60.0 & 55.0 & 49.0 & 41.0 & 41.0 \\ \hline 1,979.0 & 2,043.0 & 2,153.0 & 2,316.0 & 2,303.0 & 2,290.0 & 2,392.0 \\ \hline \end{tabular} 117.0 122.0 135.0 (153.0) 266.0 353.0 3220 322.0 (20.0) 25.0 377.0 171.0 194.0 34.0 (20.0) 1,071.0 (385.0) (426.0) 482.0 1,225.0 (73.0) 17.0 (158.0) (158.0) 66.0 130.0 324.0 (1,079.0) 985.0 796.0 796.0 1.593 .0 38.0 (1,930.0) 709.0 1,593.0 1,593.024.0 \begin{tabular}{rrr|r|r|rr|r|} 24.0 \\ \hline(1,930.0) & (27.0) & (554.0) & 458.0 & (695.0) & 24.0 & 8,840.0 \end{tabular} Total Dividends Paid (66.0) (75.0) 63.0 1,767.0 329.0(9,148.0) (6,235.0) (30.0) (466.0) (174.0) (1.0) (69.0) (55.0) (3,803.0) (4,455.0) (4,560.0) (1,672.0)(13,829.0) (13,342.0) Special Dividend Paid Other Financing Activities Cash from Financing (91.0) (54.0) (30.0) (20.0) (27.0) (74.0) (7,130.0) 78.0 (383.0) (1,501.0) (1,280.0) 12,957.0 6,396.0 (3,349.0) (34.0) (4,830.0) Net Change in Cash 2080 (2,749.0) Common size Income Statement United Airlines Common size Income Statement American Airlines American Alrlines Group Inc. (NasdaqGS:AAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total (Gain) Loss From Sale Of Assets Stock-Based Compensation Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock Common Dividends Paid Total Dividends Paid Special Dividend Paid Other Financing Activities Cash from Financing Net Change in Cash Restated 12 months Dec-31-2017 12 months 12 months 12 months 12 months 12 months Dec-31-2018 Dec-31-2019 Dec-31-2020 Dec-31-2021 Dec-31-2022 Jun-30-2023 USD USD USD USD 1,412.0 1,282.0 1,973.0 2,118.0 44.0 2,017.0 2,159.0 (11.0) 90.0 2,087.0 (190.0) 299.0 (243.0) (587.0) 4,744.0 (5,971.0) 94.0 (3,745.0) 111.0 (4,366.0) 54.0 (2,131.0) 351.0 (412.0) 193.0 (2,906.0) 61.0 (2,745.0) 114.0 United Airlines Holdings, Inc. (NasdaqGS:UAL) > Financials > Cash Flow In Millions of the reported currency, except per share items. Cash Flow For the Fiscal Period Ending Restated Restated 12 months 12 months USDUSDUSDUSDUSDUSD LTM 12 months Jun-30-2023 USD Currency Net Income Depreciation \& Amort. Amort. of Goodwill and Intangibles Depreciation \& Amort., Total Other Amortization (Gain) Loss On Sale Of Invest. Asset Writedown \& Restructuring Costs Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. Capital Expenditure Sale of Property, Plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable \& Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid Issuance of Common Stock Repurchase of Common Stock 2,143.0 2,122.0 1,900.0 1,976.0 3,009.0 79.0 2,093.0 (7,069.0) 1,979.0 67.0 2,261.0 (1,964.0) 2,254.02,249.0 \begin{tabular}{r|r|} 737.0 & 2,666.0 \\ \hline, 249.0 & 2,351.0 \end{tabular} \begin{tabular}{|r|r|r|r|r|r|r|} \hline & 60.0 & 55.0 & 49.0 & 41.0 & 41.0 \\ \hline 1,979.0 & 2,043.0 & 2,153.0 & 2,316.0 & 2,303.0 & 2,290.0 & 2,392.0 \\ \hline \end{tabular} 117.0 122.0 135.0 (153.0) 266.0 353.0 3220 322.0 (20.0) 25.0 377.0 171.0 194.0 34.0 (20.0) 1,071.0 (385.0) (426.0) 482.0 1,225.0 (73.0) 17.0 (158.0) (158.0) 66.0 130.0 324.0 (1,079.0) 985.0 796.0 796.0 1.593 .0 38.0 (1,930.0) 709.0 1,593.0 1,593.024.0 \begin{tabular}{rrr|r|r|rr|r|} 24.0 \\ \hline(1,930.0) & (27.0) & (554.0) & 458.0 & (695.0) & 24.0 & 8,840.0 \end{tabular} Total Dividends Paid (66.0) (75.0) 63.0 1,767.0 329.0(9,148.0) (6,235.0) (30.0) (466.0) (174.0) (1.0) (69.0) (55.0) (3,803.0) (4,455.0) (4,560.0) (1,672.0)(13,829.0) (13,342.0) Special Dividend Paid Other Financing Activities Cash from Financing (91.0) (54.0) (30.0) (20.0) (27.0) (74.0) (7,130.0) 78.0 (383.0) (1,501.0) (1,280.0) 12,957.0 6,396.0 (3,349.0) (34.0) (4,830.0) Net Change in Cash 2080 (2,749.0) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started