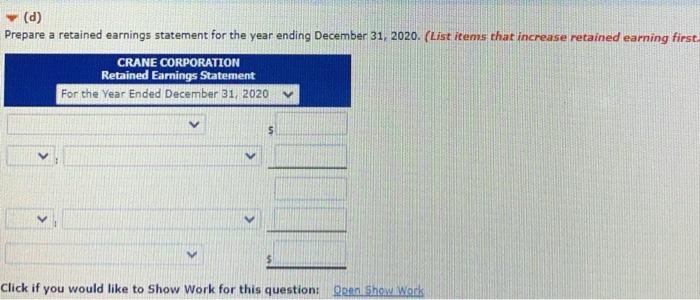

part d

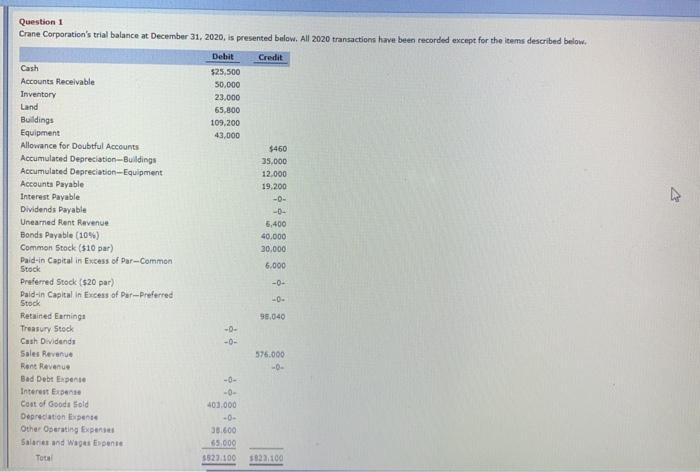

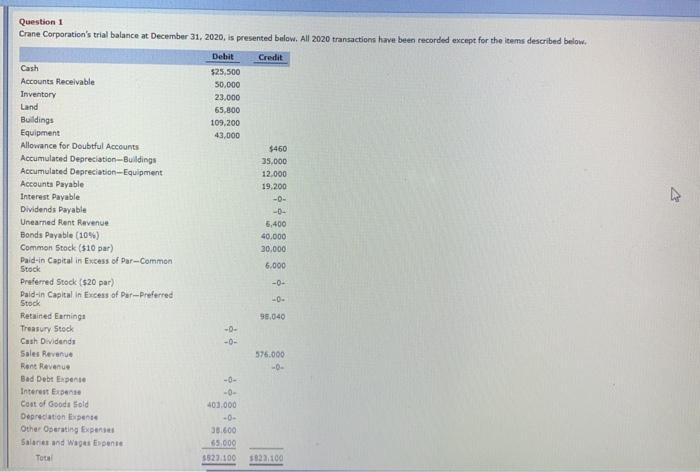

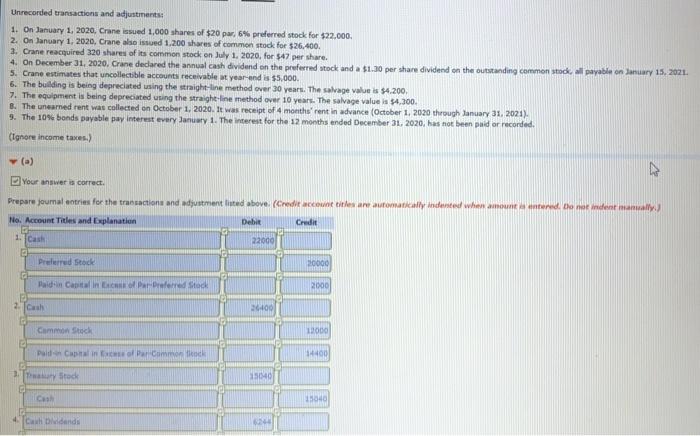

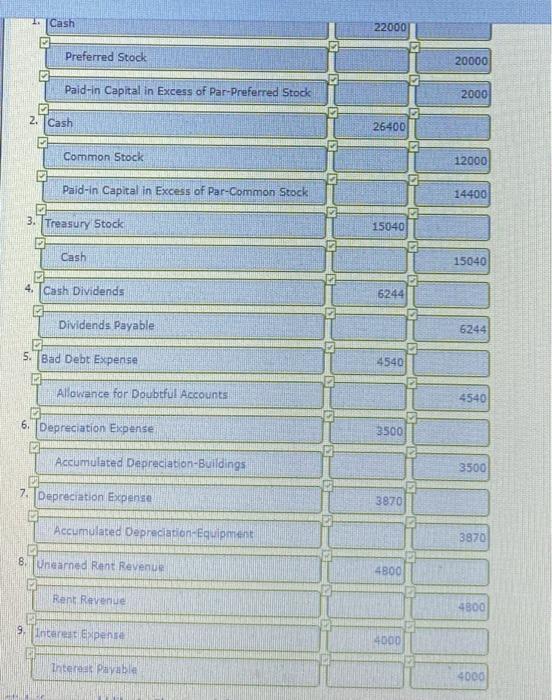

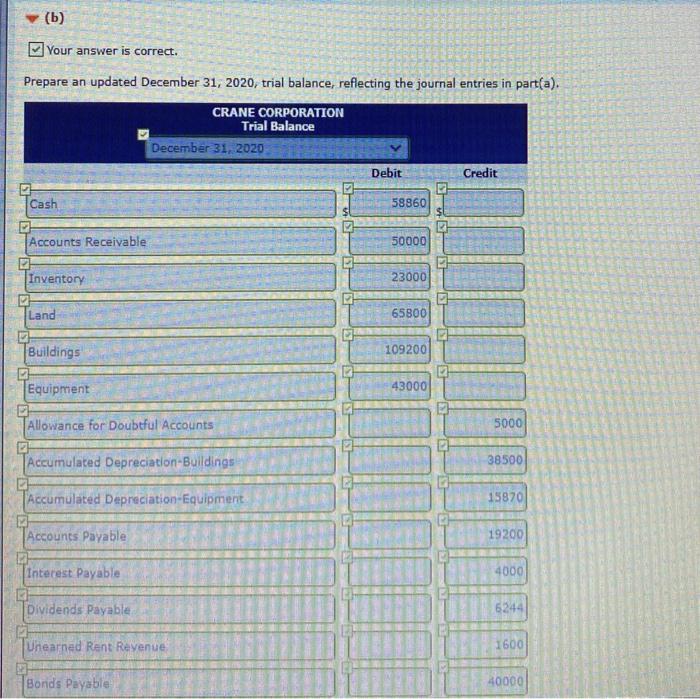

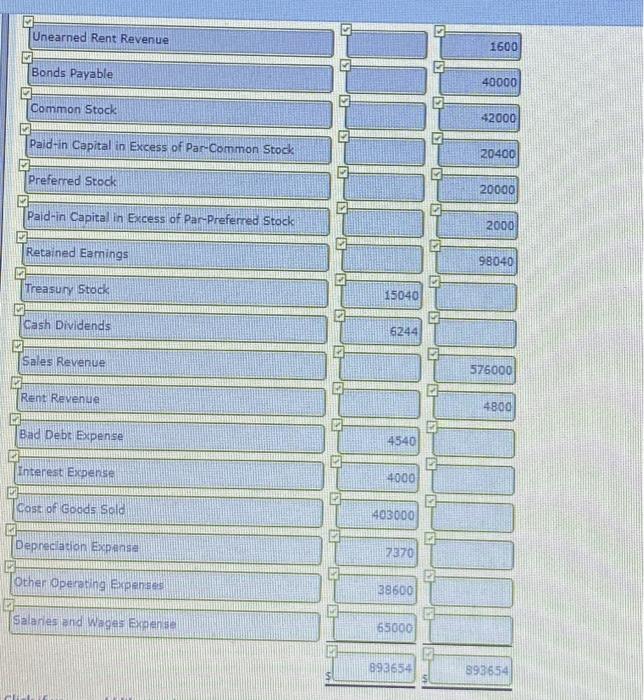

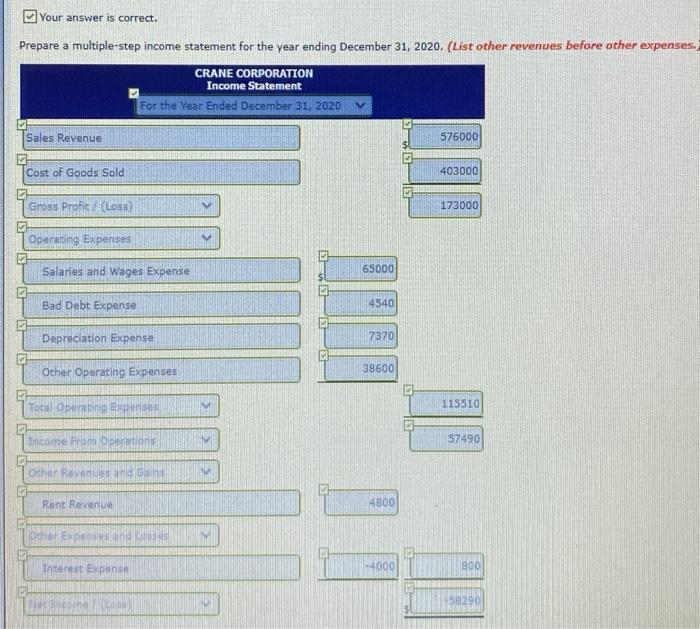

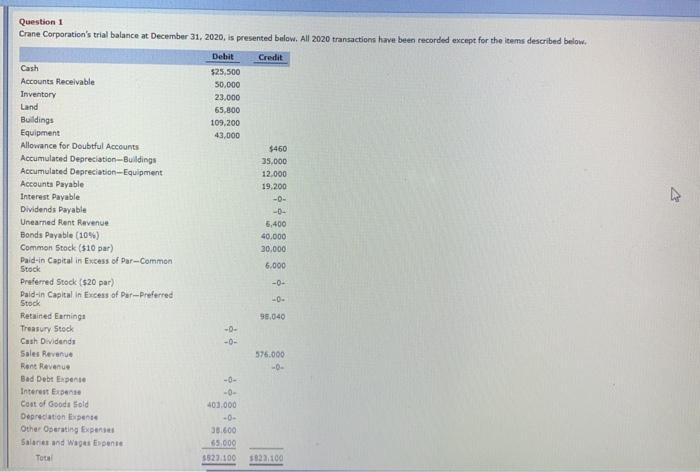

Cash Question 1 Crane Corporation's trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described below. Debit Credit $25,500 Accounts Receivable 50.000 Inventory 23.000 Land 65.800 Buildings 109.200 Equipment 43,000 Allowance for Doubtful Accounts $460 Accumulaced Depreciation-Buildings 35.000 Accumulated Depreciation Equipment 12.000 Accounts Payable 19.200 Interest Payable -- Dividends Payable -0- Unearned Rent Revenue 5,400 Bonds Payable (10%) 40.000 Common Stock (510 par) 30.000 Paid-in Capital in Excess of Par-Common Stock 6,000 Preferred Stock ($20 par) -O- Paid-in Capital in Excess of Par-Preferred LO Stock Retained Earnings 98.040 Treasury Stock Cash Dividende Sales Revenue 576.000 Rent Revenue Bad Debt Expense -0- Interest Expen -0- Cost of Goods Sold 400.000 Deprecationen Other Operating Experts 38.600 Salants and Wagas Espente 65,009 Total $527100 $82,100 - 23.10 Unrecorded transactions and adjustments 1. On January 1, 2020, Crane issued 1,000 shares of $20 par, 6% preferred stock for $22.000 2. On January 1, 2020, Crane also issued 1,200 shares of common stock for $26.400. 2. Crane reacquired 320 shares of its common stock on July 1, 2020, for $47 per share. 4. On December 31, 2020. Crane declared the annual cash dividend on the preferred stock and a $1.30 per share dividend on the outstanding common stock payable on January 15, 2021 5. Crane estimates that uncollectible accounts receivable at year and is $5.000. 6. The building is being depreciated using the straight-line method over 30 years. The salvage value is $4.200 7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is 54.300. 6. The neared rent was collected on October 1, 2020. It was receipt of 4 months' rent in advance (October 1, 2020 through January 31, 2021) 9. The 10% bonds payable pay interest every January 1. The interest for the 12 months ended December 31, 2020, has not been paid or recorded (Ignore income taxes.) (0) Your answer is correct. Prepare jumalates for the transactions and adjustment listed above (Credit countles are automally Indented when and Donor indentally No. Account Titles and Explanation Debit Credit 1. Cal 22000 Prelerred Stock 30000 Paldin Capital in Parere Stock 2000 2. Cal 200 Camo Stock 13000 Pald Captain of Par Common fleck 14400 way Stock 500 Cash 15040 Calidad 1. Cash 22000 . Preferred Stock 20000 Paid-in Capital in Excess of Par-Preferred Stod 2000 2. Cash 26400 Common Stock 12000 Paid-in Capital in Excess of Par-Common Stock 14400 3. Treasury Stock 15040 Cash 15040 4. Cash Dividends 6244 Dividends Payable 5244 5. Bad Debt Expense 4540 Allowance for Doubtful Accounts 4540 6. Depreciation Expense 3500 Accumulated Depreciation-Buildings 3500 72 Depreciation Expense 3870 Accumulated Depreciation Equipment 3870 CO Unearned Rent Revenue 4800 Rent Revenue 4800 9. Interest Expense 4000 Thtera Payable 4000 (b) Your answer is correct. Prepare an updated December 31, 2020, trial balance, reflecting the journal entries in part(a). CRANE CORPORATION Trial Balance December 31, 2020 Debit Credit Cash 58860 . Accounts Receivable 50000 23000 Inventory M Land 65800 Buildings 109200 Equipment 43000 Allowance for Doubtful Accounts 5000 Accumulated Depreciation-Buildings 38500 Accumulated Depreciation Equipment 15870 Accounts Payable 19200 interest Payable 4000 Dividends Payable 6244 Unearnad Rent Revenue 1600 Bords Payable 40000 Unearned Rent Revenue 1600 SI Bonds Payable 40000 Common Stock IS 42000 Paid-in Capital in Excess of Par-Common Stock 20400 Preferred Stock 20000 Paid-in Capital in Excess of Par-Preferred Stock 2000 2 Retained Eamings 98040 Treasury Stock 15040 Cash Dividends 6244 Sales Revenue 576000 Rent Revenue 4800 Bad Debt Expense 4540 Interest Expense 4000 Cost of Goods Sold 403000 Depreciation Expanse 7370 Other Operating Expenses 38500 Salanes and Wages Expense 65000 893654 893654 Your answer is correct. Prepare a multiple-step income statement for the year ending December 31, 2020. (List other revenues before other expenses. CRANE CORPORATION Income Statement For the Year Ended December 31, 2020 Sales Revenue 576000 57 Cost of Goods Sold 403000 Gross Profit! (Loss) 173000 > Operating Expenses Salaries and Wages Expense 65000 . Bad Debt Expense 4540 Depreciation Expense 7370 38600 Other Operating Expenses Total Operating po 115510 Thcome from perions 57490 Other Ravne Rent Revenue 4800 che 901 Interest Expense -4000 300 58290 (d) Prepare a retained earnings statement for the year ending December 31, 2020. (List items that increase retained earning first. CRANE CORPORATION Retained Earnings Statement For the Year Ended December 31, 2020 5 Click if you would like to Show Work for this question Open Show Work