part e only

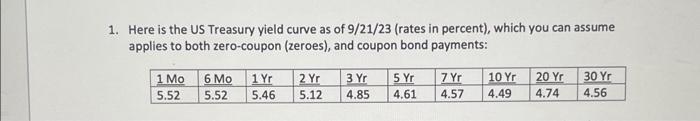

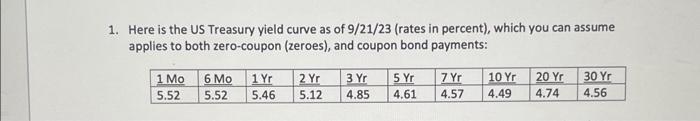

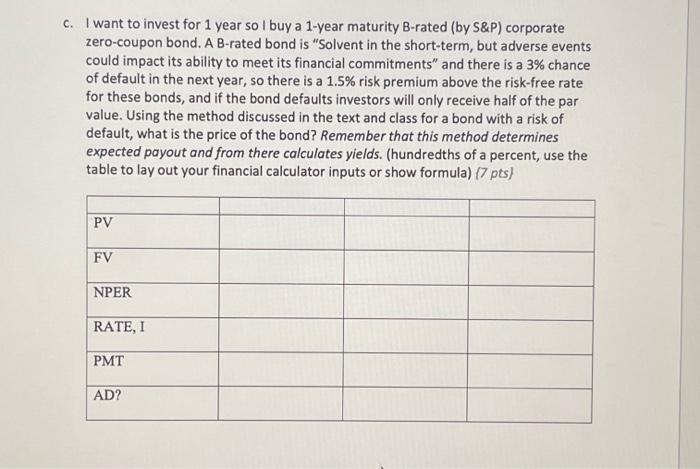

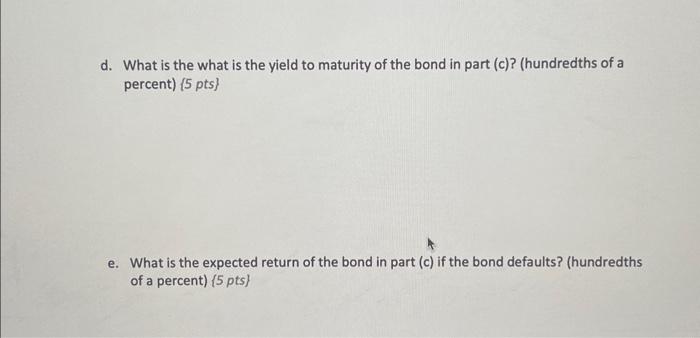

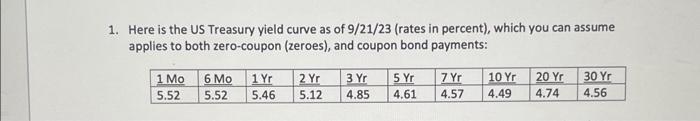

Here is the US Treasury yield curve as of 9/21/23 (rates in percent), which you can assume applies to both zero-coupon (zeroes), and coupon bond payments: c. I want to invest for 1 year so I buy a 1-year maturity B-rated (by S\&P) corporate zero-coupon bond. A B-rated bond is "Solvent in the short-term, but adverse events could impact its ability to meet its financial commitments" and there is a 3% chance of default in the next year, so there is a 1.5% risk premium above the risk-free rate for these bonds, and if the bond defaults investors will only receive half of the par value. Using the method discussed in the text and class for a bond with a risk of default, what is the price of the bond? Remember that this method determines expected payout and from there calculates yields. (hundredths of a percent, use the table to lay out your financial calculator inputs or show formula) (7pts) d. What is the what is the yield to maturity of the bond in part (c)? (hundredths of a percent) (5 pts\} e. What is the expected return of the bond in part (c) if the bond defaults? (hundredths of a percent) (5pts} Here is the US Treasury yield curve as of 9/21/23 (rates in percent), which you can assume applies to both zero-coupon (zeroes), and coupon bond payments: c. I want to invest for 1 year so I buy a 1-year maturity B-rated (by S\&P) corporate zero-coupon bond. A B-rated bond is "Solvent in the short-term, but adverse events could impact its ability to meet its financial commitments" and there is a 3% chance of default in the next year, so there is a 1.5% risk premium above the risk-free rate for these bonds, and if the bond defaults investors will only receive half of the par value. Using the method discussed in the text and class for a bond with a risk of default, what is the price of the bond? Remember that this method determines expected payout and from there calculates yields. (hundredths of a percent, use the table to lay out your financial calculator inputs or show formula) (7pts) d. What is the what is the yield to maturity of the bond in part (c)? (hundredths of a percent) (5 pts\} e. What is the expected return of the bond in part (c) if the bond defaults? (hundredths of a percent) (5pts}