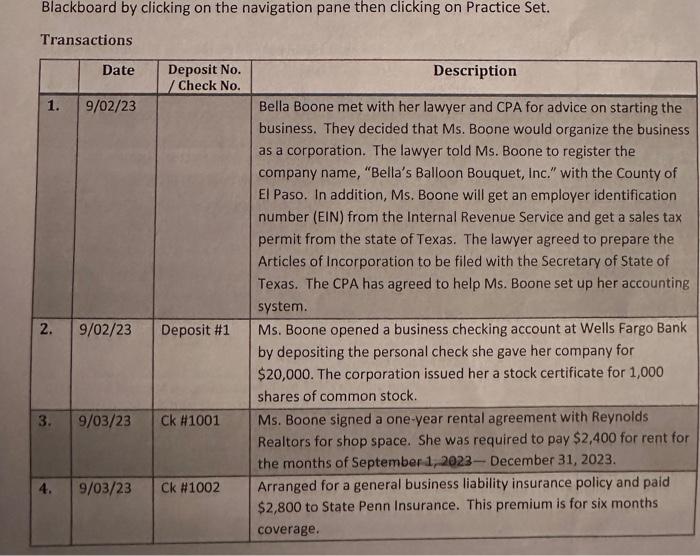

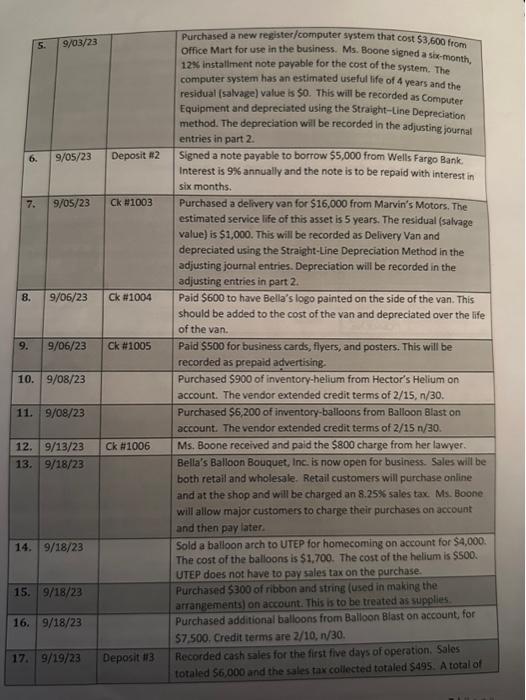

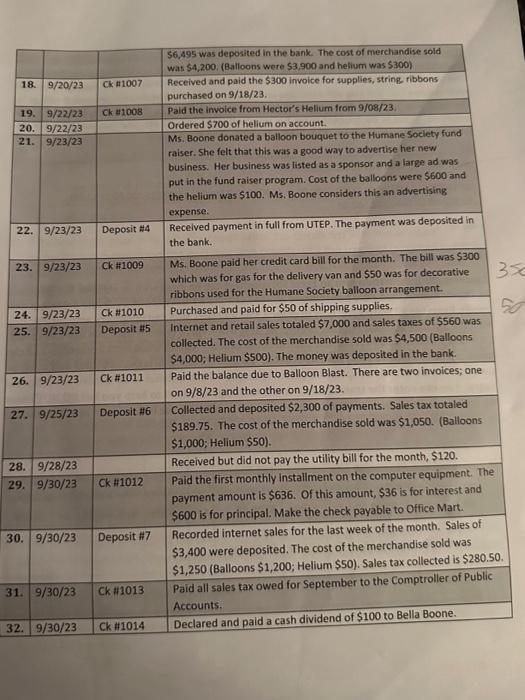

Part Five Instructions Before preparing the Financial Statements make sure all the assignments have been corrected in your spreadsheets. Prepare the Financial Statements listed below using Excel. a. Adjusted Trial Balance b. Income Statement c. Statement of Retained Earnings d. Bolance Sheet Once you finish the Financial Statements follow the instructions below: Step 1: Enter the journal entries into the Excel Template spreadsheet and when completed print it out: Step 2: Use the Excel spreadsheet to answer the questions in Blackboard for the corresponding week in the content folder. Step 3: Once you complete entering information into Blackboard, upload the spreadsheet into Blackboard by clicking on the navigation pane then clicking on Practice Set. Blackboard by clicking on the navigation pane then clicking on Practice Set. \begin{tabular}{|c|c|c|c|} \hline 5 . & 9/03/23 & & \begin{tabular}{l} Purchased a new register/computer system that cost $3,600 from \\ Office Mart for use in the business. Ms. Boone signed a sox-month, \\ 12.5 installiment note payable for the cost of the system. The \\ computer system has an estimated useful life of 4 years and the \\ residual (salvage) value is 50 . This will be recorded as Computer \\ Equipment and depreciated using the Straight-tine Depreciation \\ method. The depreciation will be recorded in the adjusting journal \\ entries in part 2 . \end{tabular} \\ \hline 6. & 9/05/23 & Deposit \#2 & \begin{tabular}{l} Signed a note payable to borrow $5,000 from Wells Fargo Bank. \\ Interest is 9% annually and the note is to be repaid with interest in \\ six months. \end{tabular} \\ \hline 7. & 9/05/23 & Ck#1003 & \begin{tabular}{l} Purchased a delivery van for $16,000 from Marvin's Motors, The \\ estimated service life of this asset is 5 years. The residual (salvage \\ value) is $1,000. This will be recorded as Delivery Van and \\ depreciated using the Straight-Line Depreciation Method in the \\ adjusting journal entries. Depreciation will be recorded in the \\ adjusting entries in part 2 . \end{tabular} \\ \hline 8. & 9/06/23 & Ck #1004 & \begin{tabular}{l} Paid $600 to have Bella's logo painted on the side of the van. This \\ should be added to the cost of the van and depreciated over the life \\ of the van. \end{tabular} \\ \hline 9. & 9/06/23 & Ck #1005 & \begin{tabular}{l} Paid $500 for business cards, flyers, and posters. This will be \\ recorded as prepaid advertising. \end{tabular} \\ \hline 10. & 9/08/23 & & \begin{tabular}{l} Purchased $900 of inventory-helium from Hector's Helium on \\ account. The vendor extended credit terms of 2/15,n/30. \end{tabular} \\ \hline 11. & 9/08/23 & & \begin{tabular}{l} Purchased $6,200 of irventory-balloons from Balloon 8 last on \\ account. The vendor extended credit terms of 2/15n/30. \end{tabular} \\ \hline 12. & 9/13/23 & Ck H1006 & Ms. Boone received and paid the $800 charge from her lawyer. \\ \hline 13. & 9/18/23 & & \begin{tabular}{l} Bella's Balloon Bouquet, Inc. is now open for business. Sales will be \\ both retall and wholesale. Retail customers will purchase online \\ and at the shop and will be charged an 8.25% sales tax Ms. Boone \\ will allow major customers to charge their purchases on account \\ and then pay later. \end{tabular} \\ \hline 14. & 9/18/23 & & \begin{tabular}{l} Sold a balloon arch to UTEP for homecoming on account for $4,000. \\ The cost of the balloons is $1,700. The cost of the helium is $500. \\ UTEP does not have to pay sales tax on the purchase. \end{tabular} \\ \hline 15. & 9/18/23 & & \begin{tabular}{l} Purchased $300 of ribbon and string (used in making the \\ arrangements) on account. This is to be treated as supplies. \end{tabular} \\ \hline 16. & 9/18/23 & & \begin{tabular}{l} arrangements) on account. This is to be treated as suppues. \\ Purchased additional balloons from Balloon Blast on account, for \\ 57,500 . Credit terms are 2/10,n/30. \end{tabular} \\ \hline 17. & 9/29/23 & Deposit 133 & \begin{tabular}{l} Recorded cash sales for the first five days of operation. Sales: \\ totaled $6,000 and the sales tax collected totaled $495. A total of \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline & & & \begin{tabular}{l} $6,495 was deposited in the bank. The cost of merchandise sol \\ was $4,200. (Balloons were $3,900 and helium was $300 ) \end{tabular} \\ \hline 18 & 9/20/2 & CK: $100 & \begin{tabular}{l} Received and paid the $300 invoice for supplies, string ribbons \\ purchased on 9/18/23. \end{tabular} \\ \hline 19 & 9/22/23 & Ck=100 & Paid the invoice from Hector's Helium from 9/08/2 \\ \hline 20 & - 9/22/23 & & Ordered $700 of helium on account. \\ \hline 21 & 9/23/23 & & \begin{tabular}{l} Ordered $700 of helium on account. \\ Ms. Boone donated a balloon bouquet to the Humane Soclety fund \\ raiser. She felt that this was a good way to advertise her new \\ business. Her business was listed as a sponsor and a large ad was \\ put in the fund raiser program. Cost of the balloons were $600 and \\ the helium was $100. Ms, Boone considers this an advertising \\ expense. \end{tabular} \\ \hline 22 & 9/23/23 & Deposit H & \begin{tabular}{l} expense. \\ Recelved payment in full from UTEP. The payment was deposited in \\ the bank. \end{tabular} \\ \hline 23 & 9/23/23 & Ck#1009 & \begin{tabular}{l} Ms. Boone paid her credit card bill for the month. The bill was $30 \\ which was for gas for the delivery van and $50 was for decorative \\ ribbons used for the Humane Society balloon arrangement. \end{tabular} \\ \hline 24 & 9/23/23 & Ck $1010 & Purchased and paid for $50 of shipping supplies. \\ \hline 25 & 5. 9/23/23 & Deposit \#5 & \begin{tabular}{l} Internet and retail sales totaled $7,000 and sales taxes of $560 was \\ collected. The cost of the merchandise sold was $4,500 (Balloons \\ $4,000; Helium $500 ). The money was deposited in the bank. \end{tabular} \\ \hline 26 & i. 9/23/23 & Ck #101 & \begin{tabular}{l} Paid the balance due to Balloon Blast. There are two invoices; one \\ on 9/8/23 and the other on 9/18/23. \end{tabular} \\ \hline 27. & 7. 9/25/23 & Deposit #6 & \begin{tabular}{l} Collected and deposited $2,300 of payments. $ ales tax totaled \\ $189.75. The cost of the merchandise sold was $1,050. (Balloon \\ $1,000; Helium $50 ). \end{tabular} \\ \hline 28. & 1. 9/28/23 & & Received but did not pay the utility bill for the month, $120. \\ \hline 29. & 9/30/23 & Ck #101 & \begin{tabular}{l} Paid the first monthly instaliment on the computer equipment. The \\ payment amount is $636. Of this amount, $36 is for interest and \\ $600 is for principal. Make the check payable to Office Mart. \end{tabular} \\ \hline 30. & 9/30/2 & Deposit \#7 & \begin{tabular}{l} Recorded internet sales for the last week of the month. Sales of \\ $3,400 were deposited. The cost of the merchandise sold was \\ $1,250 (Balloons $1,200; Helium $50 ). Sales tax collected is $280.50 \end{tabular} \\ \hline 31. & 9/30/23 & Ck\#101 & \begin{tabular}{l} Paid all sales tax owed for September to the Comptroller of Public \\ Accounts. \end{tabular} \\ \hline 32. & 9/30/23 & Ck #101 & \begin{tabular}{l} Accounts. \\ Declared and paid a cash dividend of $100 to Bella Boone \end{tabular} \\ \hline \end{tabular}