Question

Part I 3-year bonds with a stated interest rate of 10% and a face value totaling $650,000 were issued on January 1, 2011. Assume that

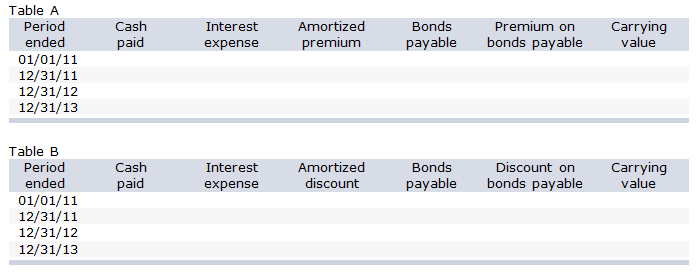

Part I 3-year bonds with a stated interest rate of 10% and a face value totaling $650,000 were issued on January 1, 2011. Assume that interest is computed annually and the market rate of interest is 9%. 1. Compute the issue price of the bonds and prepare the interest amortization table for the life of the bonds. (show work) 2. Prepare the journal entries for all of 2011. Part II On January 1, 2011, a company sells a 3-year bond with a face value of $45,000 and a stated interest rate of 8%. The market interest rate is 6%, The company uses the effective interest method of amortization. Fill in Table A. Fill in Table B assuming the market interest rate is 10%, and the company received only $42,762 for the bond and the company uses the effective-interest method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started