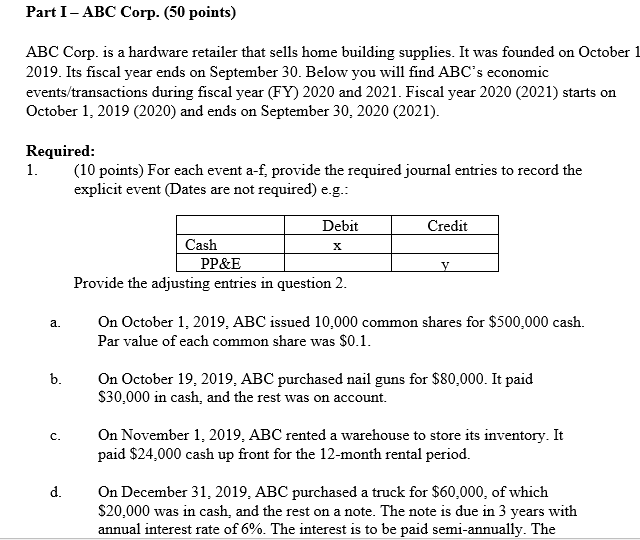

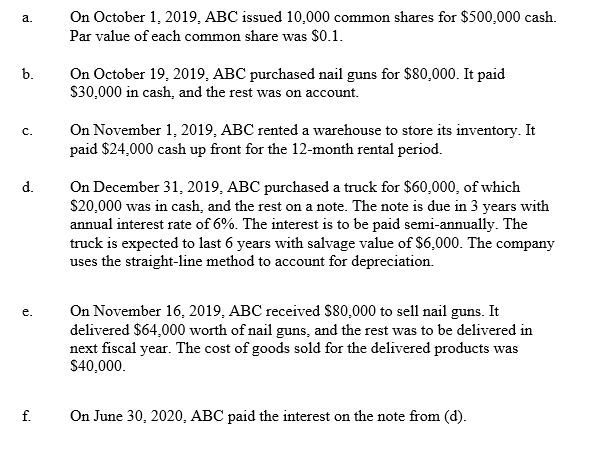

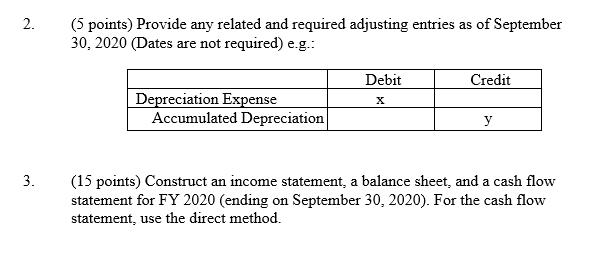

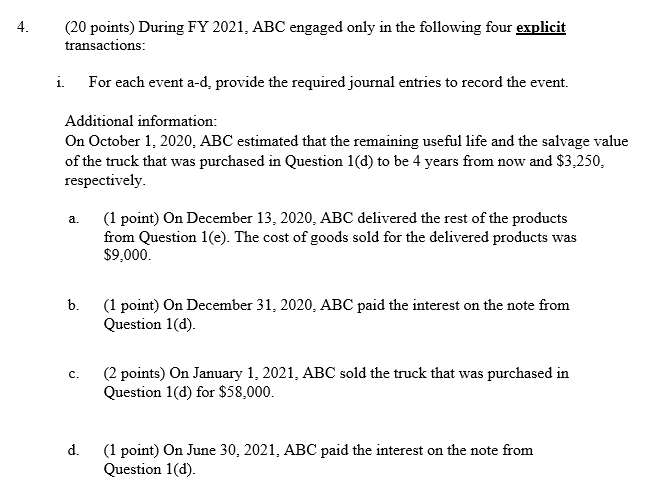

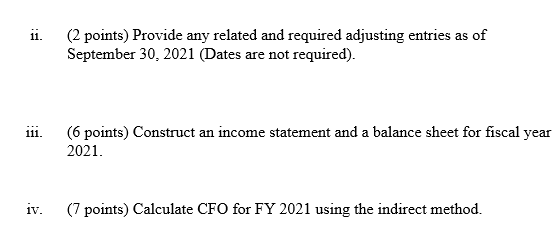

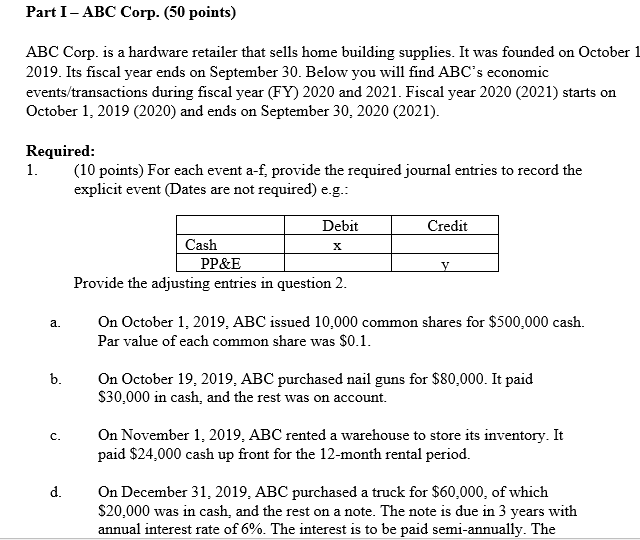

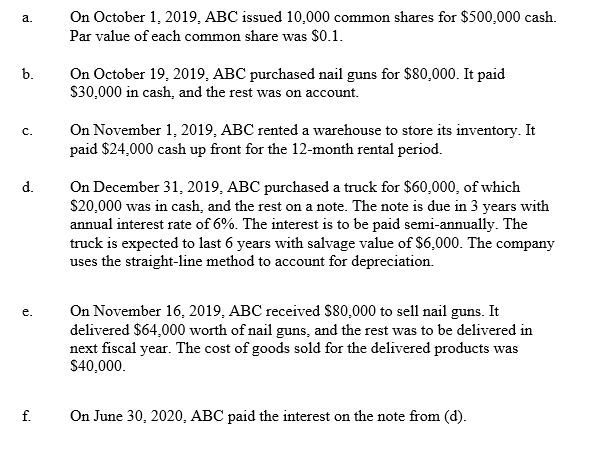

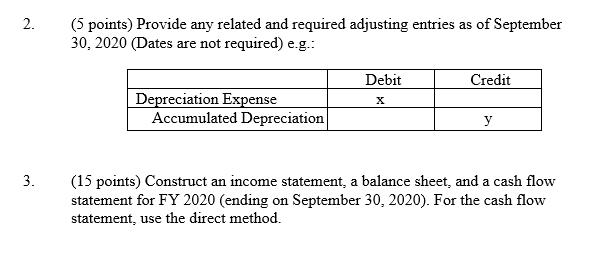

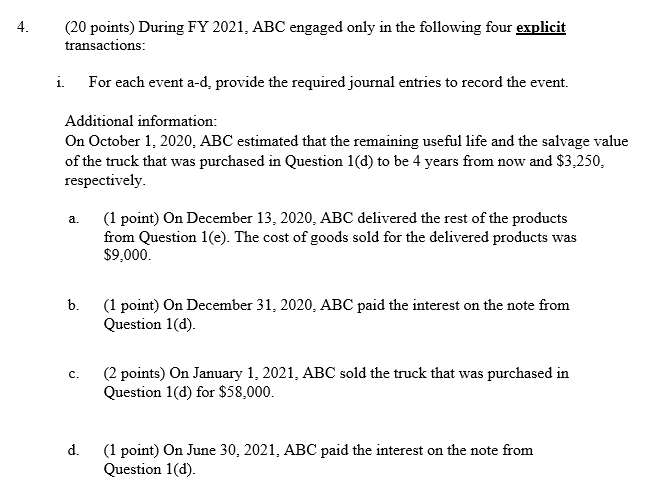

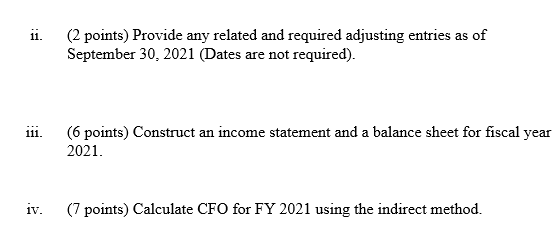

Part I - ABC Corp. (50 points) ABC Corp. is a hardware retailer that sells home building supplies. It was founded on October 1 2019. Its fiscal year ends on September 30. Below you will find ABC's economic events/transactions during fiscal year (FY) 2020 and 2021. Fiscal year 2020 (2021) starts on October 1, 2019 (2020) and ends on September 30, 2020 (2021). Required: 1. (10 points) For each event a-f, provide the required journal entries to record the explicit event (Dates are not required) e.g.: a. b. C. d. Debit X Cash PP&E Provide the adjusting entries in question 2. Credit y On October 1, 2019, ABC issued 10,000 common shares for $500,000 cash. Par value of each common share was $0.1. On October 19, 2019, ABC purchased nail guns for $80,000. It paid $30,000 in cash, and the rest was on account. On November 1, 2019, ABC rented a warehouse to store its inventory. It paid $24,000 cash up front for the 12-month rental period. On December 31, 2019, ABC purchased a truck for $60,000, of which $20,000 was in cash, and the rest on a note. The note is due in 3 years with annual interest rate of 6%. The interest is to be paid semi-annually. The a. b. C. d. e. f. On October 1, 2019, ABC issued 10,000 common shares for $500,000 cash. Par value of each common share was $0.1. On October 19, 2019, ABC purchased nail guns for $80,000. It paid $30,000 in cash, and the rest was on account. On November 1, 2019, ABC rented a warehouse to store its inventory. It paid $24,000 cash up front for the 12-month rental period. On December 31, 2019, ABC purchased a truck for $60,000, of which $20,000 was in cash, and the rest on a note. The note is due in 3 years with annual interest rate of 6%. The interest is to be paid semi-annually. The truck is expected to last 6 years with salvage value of $6,000. The company uses the straight-line method to account for depreciation. On November 16, 2019, ABC received $80,000 to sell nail guns. It delivered $64,000 worth of nail guns, and the rest was to be delivered in next fiscal year. The cost of goods sold for the delivered products was $40,000. On June 30, 2020, ABC paid the interest on the note from (d). 2. 3. (5 points) Provide any related and required adjusting entries as of September 30, 2020 (Dates are not required) e.g.: Depreciation Expense Accumulated Depreciation Debit X Credit y (15 points) Construct an income statement, a balance sheet, and a cash flow statement for FY 2020 (ending on September 30, 2020). For the cash flow statement, use the direct method. 4. (20 points) During FY 2021, ABC engaged only in the following four explicit transactions: For each event a-d, provide the required journal entries to record the event. i. Additional information: On October 1, 2020, ABC estimated that the remaining useful life and the salvage value of the truck that was purchased in Question 1(d) to be 4 years from now and $3,250, respectively. a. b. (1 point) On December 31, 2020, ABC paid the interest on the note from Question 1(d). C. (1 point) On December 13, 2020, ABC delivered the rest of the products from Question 1(e). The cost of goods sold for the delivered products was $9,000. d. (2 points) On January 1, 2021, ABC sold the truck that was purchased in Question 1(d) for $58,000. (1 point) On June 30, 2021, ABC paid the interest on the note from Question 1(d). 11. iii. iv. (2 points) Provide any related and required adjusting entries as of September 30, 2021 (Dates are not required). (6 points) Construct an income statement and a balance sheet for fiscal year 2021. (7 points) Calculate CFO for FY 2021 using the indirect method