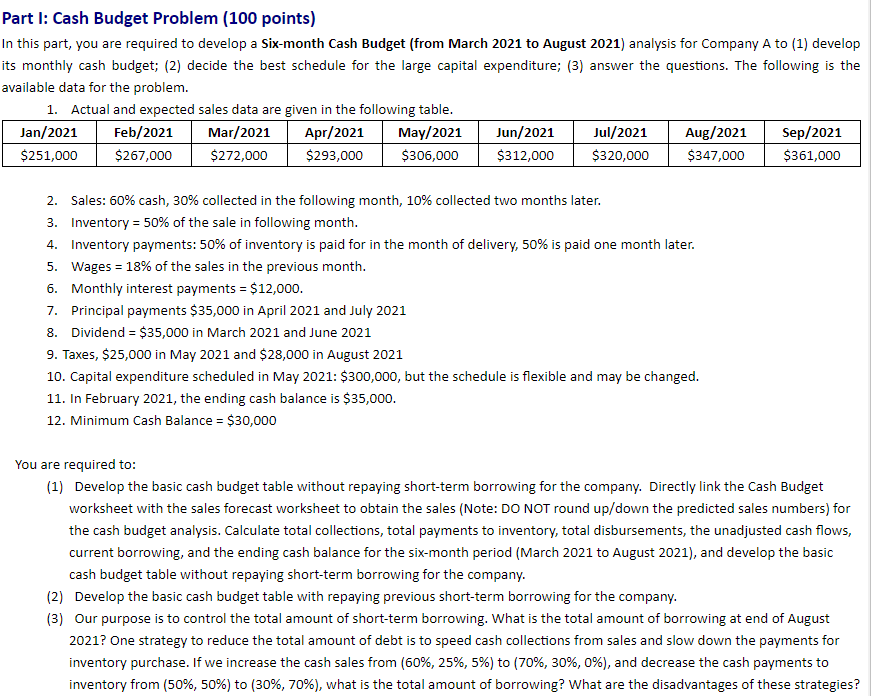

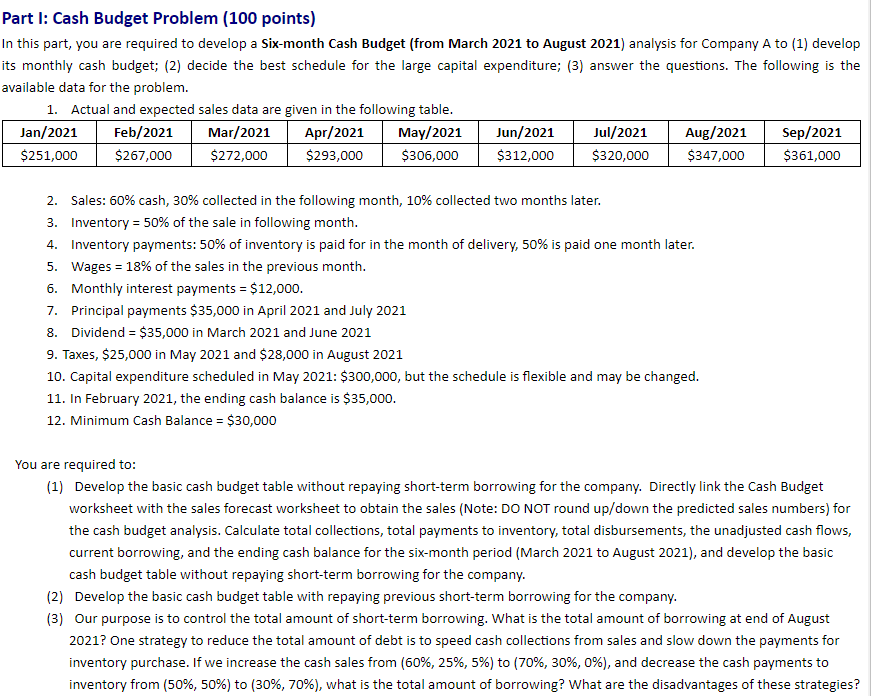

Part I: Cash Budget Problem (100 points) In this part, you are required to develop a six-month Cash Budget (from March 2021 to August 2021) analysis for Company A to (1) develop its monthly cash budget; (2) decide the best schedule for the large capital expenditure; (3) answer the questions. The following is the available data for the problem. 1. Actual and expected sales data are given in the following table. Jan/2021 Feb/2021 Mar/2021 Apr/2021 May/2021 Jun/2021 Jul/2021 Aug/2021 Sep/2021 $251,000 $267,000 $272,000 $293,000 $306,000 $312,000 $320,000 $347,000 $361,000 2. Sales: 60% cash, 30% collected in the following month, 10% collected two months later. 3. Inventory = 50% of the sale in following month. 4. Inventory payments: 50% of inventory is paid for in the month of delivery, 50% is paid one month later. 5. Wages = 18% of the sales in the previous month. 6. Monthly interest payments = $12,000. 7. Principal payments $35,000 in April 2021 and July 2021 8. Dividend = $35,000 in March 2021 and June 2021 9. Taxes, $25,000 in May 2021 and $28,000 in August 2021 10. Capital expenditure scheduled in May 2021: $300,000, but the schedule is flexible and may be changed. 11. In February 2021, the ending cash balance is $35,000. 12. Minimum Cash Balance = $30,000 You are required to: (1) Develop the basic cash budget table without repaying short-term borrowing for the company. Directly link the Cash Budget worksheet with the sales forecast worksheet to obtain the sales (Note: DO NOT round up/down the predicted sales numbers) for the cash budget analysis. Calculate total collections, total payments to inventory, total disbursements, the unadjusted cash flows, current borrowing, and the ending cash balance for the six-month period (March 2021 to August 2021), and develop the basic cash budget table without repaying short-term borrowing for the company. (2) Develop the basic cash budget table with repaying previous short-term borrowing for the company. (3) Our purpose is to control the total amount of short-term borrowing. What is the total amount of borrowing at end of August 2021? One strategy to reduce the total amount of debt is to speed cash collections from sales and slow down the payments for inventory purchase. If we increase the cash sales from (60%, 25%, 5%) to (70%, 30%, 0%), and decrease the cash payments to inventory from (50%, 50%) to (30%, 70%), what is the total amount of borrowing? What are the disadvantages of these strategies? Part I: Cash Budget Problem (100 points) In this part, you are required to develop a six-month Cash Budget (from March 2021 to August 2021) analysis for Company A to (1) develop its monthly cash budget; (2) decide the best schedule for the large capital expenditure; (3) answer the questions. The following is the available data for the problem. 1. Actual and expected sales data are given in the following table. Jan/2021 Feb/2021 Mar/2021 Apr/2021 May/2021 Jun/2021 Jul/2021 Aug/2021 Sep/2021 $251,000 $267,000 $272,000 $293,000 $306,000 $312,000 $320,000 $347,000 $361,000 2. Sales: 60% cash, 30% collected in the following month, 10% collected two months later. 3. Inventory = 50% of the sale in following month. 4. Inventory payments: 50% of inventory is paid for in the month of delivery, 50% is paid one month later. 5. Wages = 18% of the sales in the previous month. 6. Monthly interest payments = $12,000. 7. Principal payments $35,000 in April 2021 and July 2021 8. Dividend = $35,000 in March 2021 and June 2021 9. Taxes, $25,000 in May 2021 and $28,000 in August 2021 10. Capital expenditure scheduled in May 2021: $300,000, but the schedule is flexible and may be changed. 11. In February 2021, the ending cash balance is $35,000. 12. Minimum Cash Balance = $30,000 You are required to: (1) Develop the basic cash budget table without repaying short-term borrowing for the company. Directly link the Cash Budget worksheet with the sales forecast worksheet to obtain the sales (Note: DO NOT round up/down the predicted sales numbers) for the cash budget analysis. Calculate total collections, total payments to inventory, total disbursements, the unadjusted cash flows, current borrowing, and the ending cash balance for the six-month period (March 2021 to August 2021), and develop the basic cash budget table without repaying short-term borrowing for the company. (2) Develop the basic cash budget table with repaying previous short-term borrowing for the company. (3) Our purpose is to control the total amount of short-term borrowing. What is the total amount of borrowing at end of August 2021? One strategy to reduce the total amount of debt is to speed cash collections from sales and slow down the payments for inventory purchase. If we increase the cash sales from (60%, 25%, 5%) to (70%, 30%, 0%), and decrease the cash payments to inventory from (50%, 50%) to (30%, 70%), what is the total amount of borrowing? What are the disadvantages of these strategies