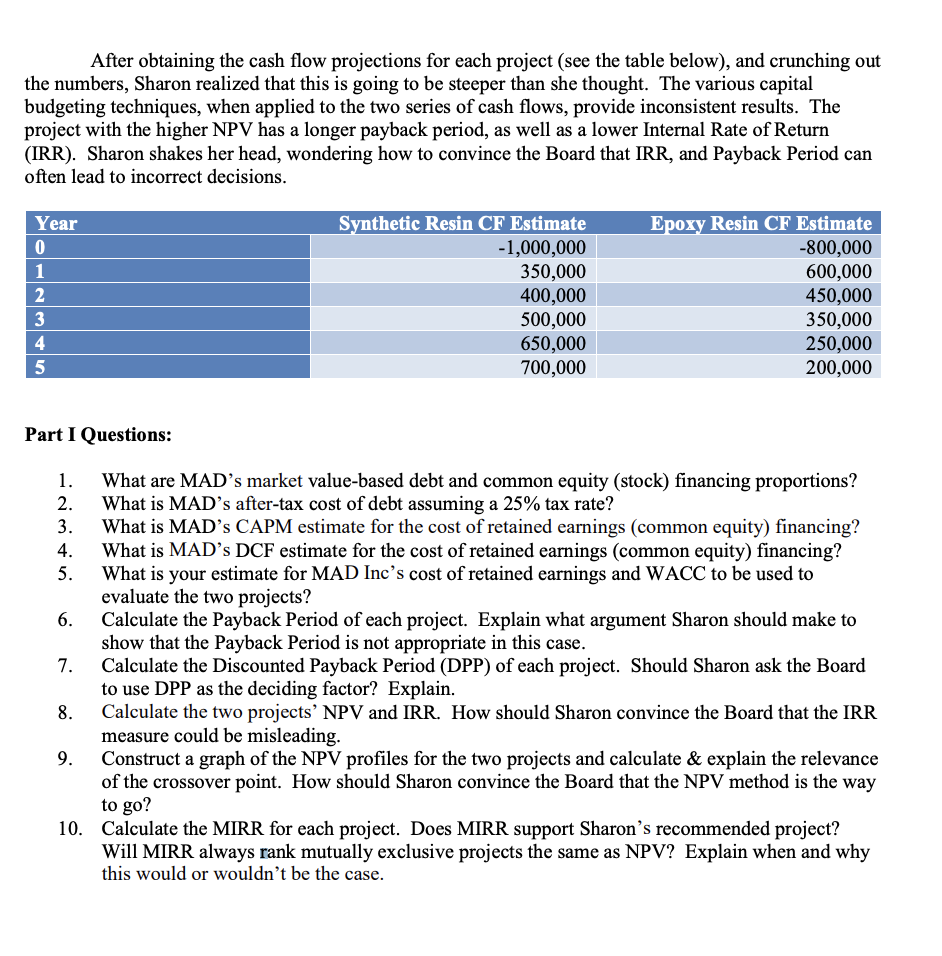

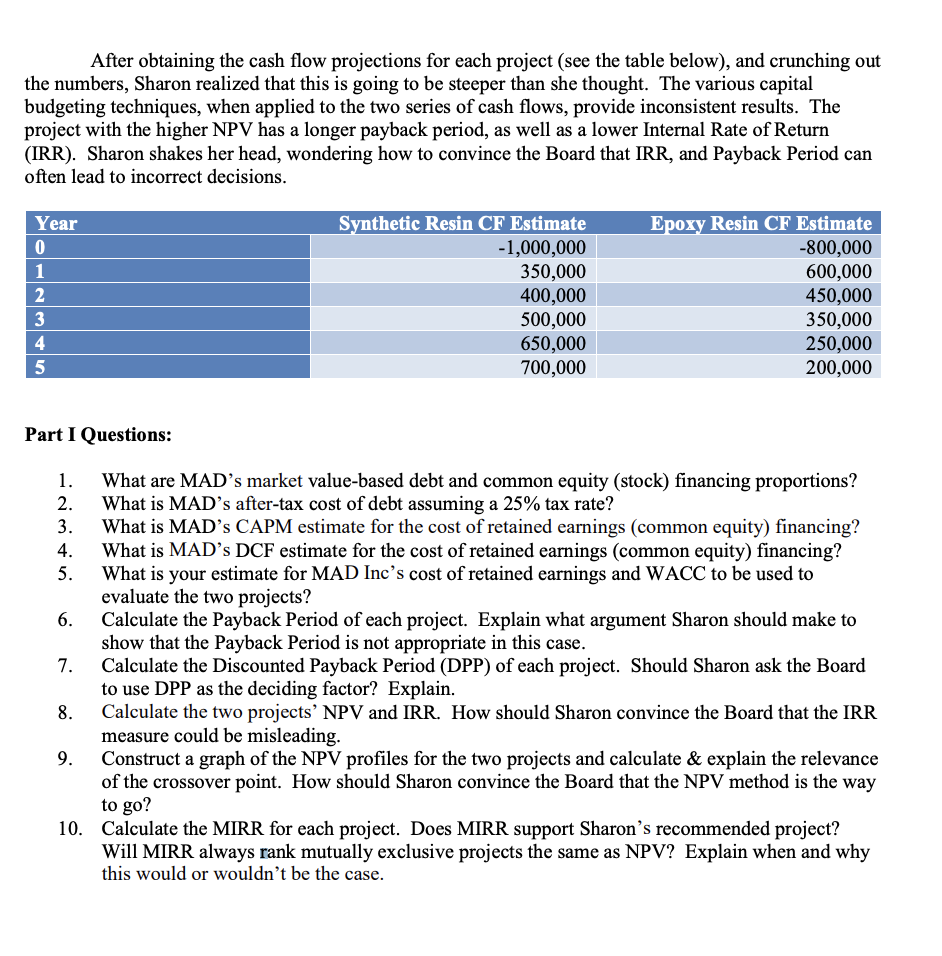

Part I: Cost of Capital & Capital Budgeting Decision Techniques Manic at MAD Inc. MAD Incorporated, established in 1999, has managed to earn a consistently high rate of return on its investments. The secret of its success has been the strategic and timely development, manufacturing, and marketing of innovative products that have been used in various industries. Currently, the management of the company is considering the manufacture of a thermosetting resin as packaging material for electronic products. The Company's Research and Development teams have come up with two alternatives: an epoxy resin, which would have a lower startup cost, and a synthetic resin, which would cost more to produce initially but would have greater economies of scale. At the initial presentation, the project leaders of both teams presented their cash flow projections and provided sufficient documentation in support of their proposals. However, since the products are mutually exclusive, the firm can only fund one proposal. In order to resolve this dilemma, Sharon Meadows, the Assistant Treasurer, and a recent MBA from a prestigious mid-western university, has been assigned the task of analyzing the costs and benefits of the two proposals and presenting findings to the board of directors. Sharon knows that this will be an uphill task, since the board members are not all on the same page when it comes to financial concepts. The Board has historically had a strong preference for using rates of return as its decision criteria. On occasions it has also used the payback period approach to decide between competing projects. However, Sharon is convinced that the net present value (NPV) method is least flawed and when used correctly will always add the most value to a company's wealth. However, before Sharon presents her findings, she needs to determine the appropriate cost of capital for these projects. The two projects are both considered to be equally risky and have the same risk as the company as a whole making them average risk projects. The estimated market value of the company's long-term debt is $20,000,000 and the company has 1,000,000 shares of common stock outstanding with a current market price of $45 per share. MAD Inc. currently pays a dividend of $1.50 on its common stock and security analysts project a constant growth rate in dividends and earnings of 8%. Sharon estimates the current risk-free rate at 1.6% and the market risk premium at 8%, and MAD Inc.'s common stock has an estimated beta of 1.2. MAD has a 30-year bond outstanding with a $1,000 par value with an annual coupon rate of 5%. This bond makes semi-annual coupon payments and sells at 115% of its par value. Sharon thinks this bond's yield to maturity would make a good estimate of the company's before-tax cost of debt. After obtaining the cash flow projections for each project (see the table below), and crunching out the numbers, Sharon realized that this is going to be steeper than she thought. The various capital budgeting techniques, when applied to the two series of cash flows, provide inconsistent results. The project with the higher NPV has a longer payback period, as well as a lower Internal Rate of Return (IRR). Sharon shakes her head, wondering how to convince the Board that IRR, and Payback Period can often lead to incorrect decisions. Year 0 1 2 3 4 5 Synthetic Resin CF Estimate -1,000,000 350,000 400,000 500,000 650,000 700,000 Epoxy Resin CF Estimate -800,000 600,000 450,000 350,000 250,000 200,000 Part I Questions: 1. What are MAD's market value-based debt and common equity (stock) financing proportions? 2. What is MAD's after-tax cost of debt assuming a 25% tax rate? 3. What is MAD's CAPM estimate for the cost of retained earnings (common equity) financing? 4. What is MAD's DCF estimate for the cost of retained earnings (common equity) financing? 5. What is your estimate for MAD Inc's cost of retained earnings and WACC to be used to evaluate the two projects? 6. Calculate the Payback Period of each project. Explain what argument Sharon should make to show that the Payback Period is not appropriate in this case. 7. Calculate the Discounted Payback Period (DPP) of each project. Should Sharon ask the Board to use DPP as the deciding factor? Explain. 8. Calculate the two projects NPV and IRR. How should Sharon convince the Board that the IRR measure could be misleading. 9. Construct a graph of the NPV profiles for the two projects and calculate & explain the relevance of the crossover point. How should Sharon convince the Board that the NPV method is the way to go? 10. Calculate the MIRR for each project. Does MIRR support Sharons recommended project? Will MIRR always rank mutually exclusive projects the same as NPV? Explain when and why this would or wouldn't be the case