Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part I: Multiple Choice Questions (2 x 20 marks = 40 marks) Use the following information to answer Q1 - 02. Ronald owns a

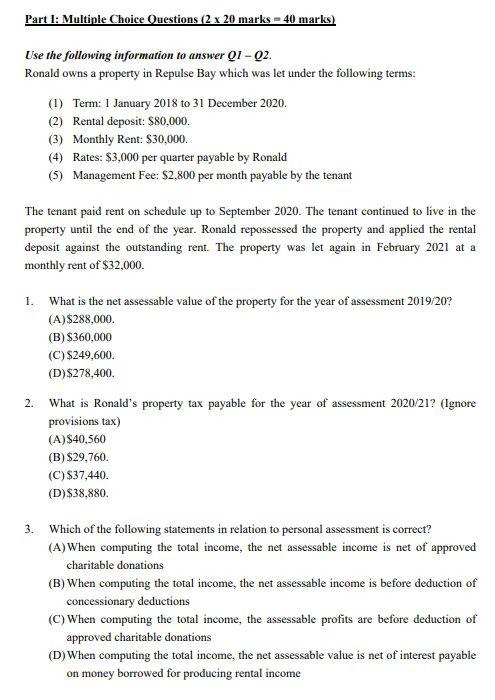

Part I: Multiple Choice Questions (2 x 20 marks = 40 marks) Use the following information to answer Q1 - 02. Ronald owns a property in Repulse Bay which was let under the following terms: (1) Term: 1 January 2018 to 31 December 2020. (2) Rental deposit: $80,000. (3) Monthly Rent: $30,000. (4) Rates: $3,000 per quarter payable by Ronald (5) Management Fee: $2,800 per month payable by the tenant The tenant paid rent on schedule up to September 2020. The tenant continued to live in the property until the end of the year. Ronald repossessed the property and applied the rental deposit against the outstanding rent. The property was let again in February 2021 at a monthly rent of $32,000. 1. What is the net assessable value of the property for the year of assessment 2019/20? (A)$288,000. (B) $360,000 (C) $249,600. (D) $278,400. 2. What is Ronald's property tax payable for the year of assessment 2020/21? (Ignore provisions tax) (A)$40,560 (B) $29,760. (C) $37,440. (D)$38,880. 3. Which of the following statements in relation to personal assessment is correct? (A)When computing the total income, the net assessable income is net of approved charitable donations (B) When computing the total income, the net assessable income is before deduction of concessionary deductions (C) When computing the total income, the assessable profits are before deduction of approved charitable donations (D) When computing the total income, the net assessable value is net of interest payable on money borrowed for producing rental income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started