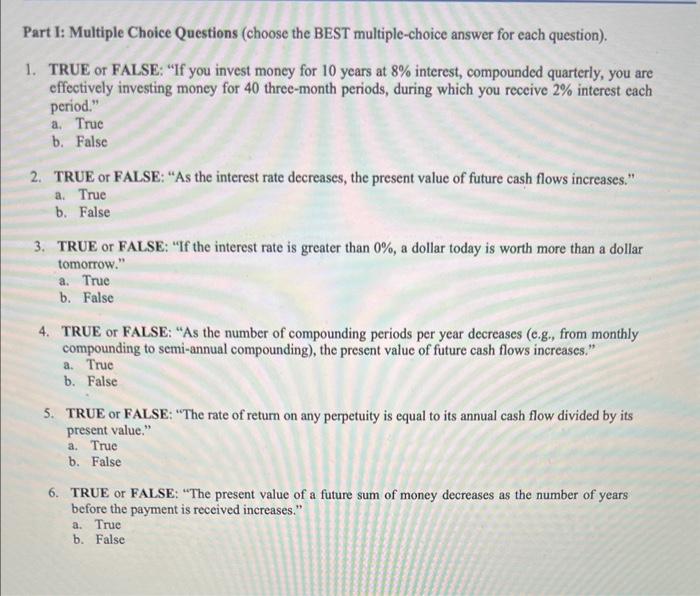

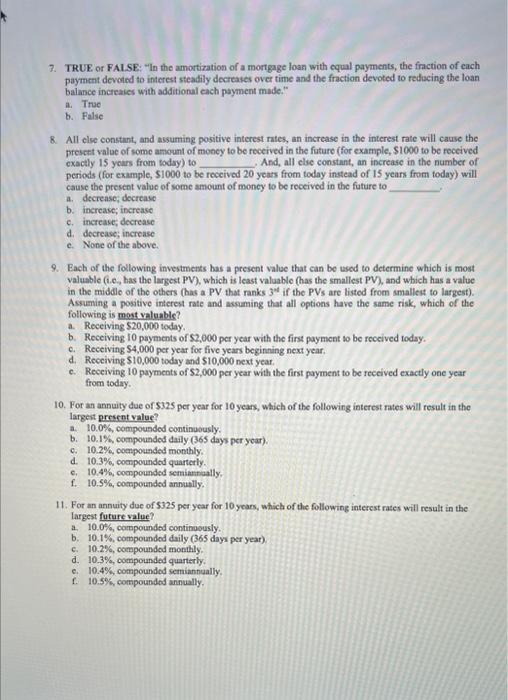

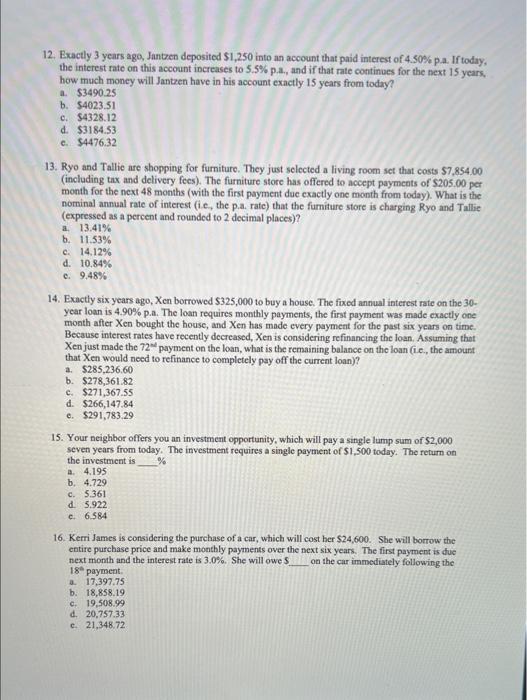

Part I: Multiple Choice Questions (choose the BEST multiple-choice answer for each question). 1. TRUE or FALSE: "If you invest money for 10 years at 8% interest, compounded quarterly, you are effectively investing money for 40 three-month periods, during which you receive 2% interest each period." a. True b. False 2. TRUE or FALSE: "As the interest rate decreases, the present value of future cash flows increases." a. True b. False 3. TRUE or FALSE: "If the interest rate is greater than 0%, a dollar today is worth more than a dollar tomorrow." a. True b. False 4. TRUE or FALSE: "As the number of compounding periods per year decreases (c.g., from monthly compounding to semi-annual compounding), the present value of future cash flows increases." a. True b. False 5. TRUE or FALSE: "The rate of return on any perpetuity is equal to its annual cash flow divided by its present value." a. True b. False 6. TRUE or FALSE: "The present value of a future sum of money decreases as the number of years before the payment is received increases." a. True b. False 7. TRUE or FALSE: "In the amortization of a mortgage loan with equal payments, the fnction of each payment devoted to interest steadily decreases over time and the fraction devoted to redacing the loan balance increaies with additional each payment made." a. True b. False 8. All else constant, and assuming positive interest rates, an increase in the interest rate will cause the present value of some amount of moncy to be received in the future (for example, $1000 to be received exactly 15 yoars from today) to And, all clse constant, an increase in the number of periods (for example, $1000 to be received 20 yeass from today instead of 15 years from foday) will cause the preseot value of some amount of moncy to be received in the future to a. decrease; decrease b. increase; increase c. increase; decrease d. decreasc; increase c. None of the above. 9. Each of the following investments has a present value that can be used to determine which is most valuable (i.e, has the largest PV), which is least valuable (has the smallest PV), and which has a value in the middle of the others (has a PV that ranks 34t if the PVs are listed from smallest to largest). Asruming a positive interest rate and ascuming that all options have the same risk, which of the following is most valuable? a. Receiving $20,000 today. b. Receiving 10 payments of $2,000 per year with the first payment to be received today. c. Receiving $4,000 per year for five years beginning next year. d. Receiving $10,000 todry and $10,000 next year, c. Receiving 10 payments of $2,000 per year with the first payment to be received exactly one year from today. 10. For an annuity due of $325 per year for 10 years, which of the following interest mates will result in the largent present value? a. 10.0%, compounded continuously. b. 10.1%, compounded daily ( 365 days per year). c. 10.2%, compounded monthly. d. 10.3%, cocmpounded quarterly. c. 10.4%, cocopounded semiannatly. f. 10.5%, compounded annutlly. 11. For an annuity due of $325 per year for 10 years, which of the following intercst rates will result in the Largest furure value? a. 10.0%, campounded continovusly. b. 10.1%, compounded daily ( 365 days per year). c. 10.2%, compounded monthly. d. 10.3%, compounded quarterly. e. 10.4%, compoundod semiannually. f. 10.5%, compoundod annually. 12. Exactly 3 years ago, Jantren deposited $1,250 into an account that paid interest of 4.50% p.a. If today, the interest rate on this account increases to 5.5% p.a., and if that rate continues for the next 15 years. how much money will Jantzen have in his account exactly 15 years from today? a. $3490.25 b. 54023.51 c. 54328.12 d. $3184.53 c. $4476.32 13. Ryo and Tallie are shopping for furniture. They just selected a living room set that costs $7,854,00 (including tax and delivery fees). The furniture store has offered to accept payments of 5205.00 per month for the next 48 months (with the first payment due exactly one month from today). What is the nominal annual rate of interest (i.e, the p.a. rate) that the fumiture store is charging Ryo and Tallie (expressed as a percent and rounded to 2 decimal places)? a. 13.41% b. 11.53% c. 14,12% d. 10.84% c. 9.48%6 14. Exactly six years ago, Xen borrowed $325,000 to buy a house. The fixed annual interest rate on the 30year loan is 4.90% p.a. The loan requires monthly payments, the first payment was made exactly one month after Xen bought the house, and Xen has made every paymeat for the past six years on time. Because interest rates have recently decreased, Xen is considering refinancing the loan. Assuming that Xen just made the 72al payment on the loan, what is the remaining balance on the loan (ie., the amourt. that Xen would need to refinance to completely pay off the current loan)? a. $285,236.60 b. $278,361.82 c. $271,367.55 d. $266,147.84 e. $291,783.29 15. Your neighbor offers you an investment opportunity, which will pay a single lump sum of $2,000 seven years from today. The investment requires a single payment of 51,500 today. The return on the investment is a. 4.195 b. 4.729 c. 5.361 d. 5.922 c. 6.584 16. Kerri James is considering the purchase of a car, which will cost her $24,600. She will borrow the entire purehase price and make monthly payments over the next six years. The first payment is due next month and the interest rate is 3.0%. She will owe $ on the car immediately following the 18* payment. a. 17,397,75 b. 18,858.19 c. 19,508.99 d. 20,757.33 c. 21,348,72