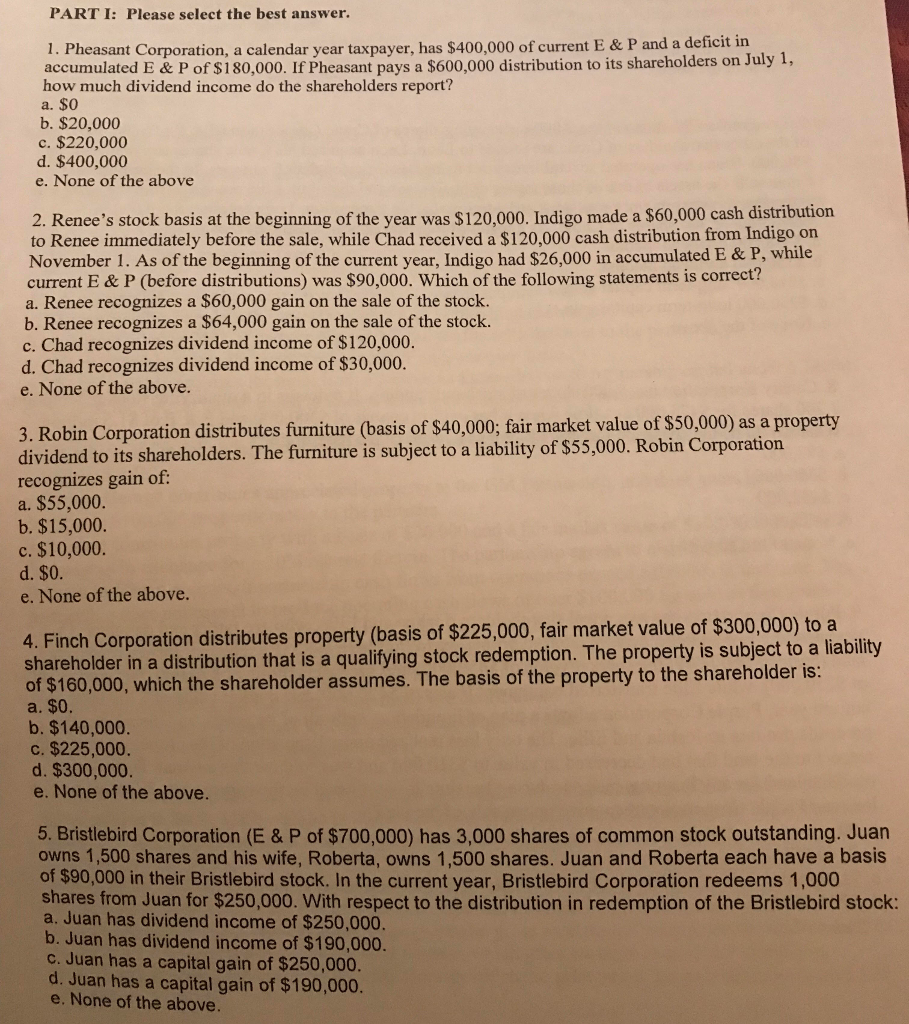

PART I: Please select the best answer. 1. Pheasant Corporation, a calendar year taxpayer, has $400,000 of current E & P and a deficit in accumulated E & P of S180,000. If Pheasant pays a $600,000 distribution to its shareholders on July 1, how much dividend income do the shareholders report? a. $0 b. $20,000 c. $220,000 d. $400,000 e. None of the above 2. Renee's stock basis at the beginning of the year was $120,000. Indigo made a $60,000 cash distribution to Renee immediately before the sale, while Chad received a $120,000 cash distribution from Indigo orn November 1. As of the beginning of the current year, Indigo had $26,000 in accumulated E & P, while current E & P (before distributions) was $90,000. Which of the following statements is correct? a. Renee recognizes a $60,000 gain on the sale of the stock. b. Renee recognizes a $64,000 gain on the sale of the stock. c. Chad recognizes dividend income of $120,000. d. Chad recognizes dividend income of $30,000. e. None of the above 3. Robin Corporation distributes furniture (basis of S40,000; fair market value of $50,000) as a property dividend to its shareholders. The furniture is subject to a liability of $55,000. Robin Corporation recognizes gain of a. $55,000 b. $15,000 c. $10,000 d. $0 e. None of the above 4. Finch Corporation distributes property (basis of $225,000, fair market value of $300,000) to a shareholder in a distribution that is a qualifying stock redemption. The property is subject to of $160,000, which the shareholder assumes. The basis of the property to the shareholder i a. $0. b. $140,000 c. $225,000. d. $300,000 a liability e. None of the above 5. Bristlebird Corporation (E & P of $700,000) has 3,000 shares of common stock outstanding. Juan owns 1,500 shares and his wife, Roberta, owns 1,500 shares. Juan and Roberta each have a basis of $90,000 in their Bristlebird stock. In the current year, Bristlebird Corporation redeems 1,000 shares from Juan for $250,000. With respect to the distribution in redemption of the Bristlebird stock: a. Juan has dividend income of $250,000. b. Juan has dividend income of $190,000 c. Juan has a capital gain of $250,000 d. Juan has a capital gain of $190,000 None of the above