Answered step by step

Verified Expert Solution

Question

1 Approved Answer

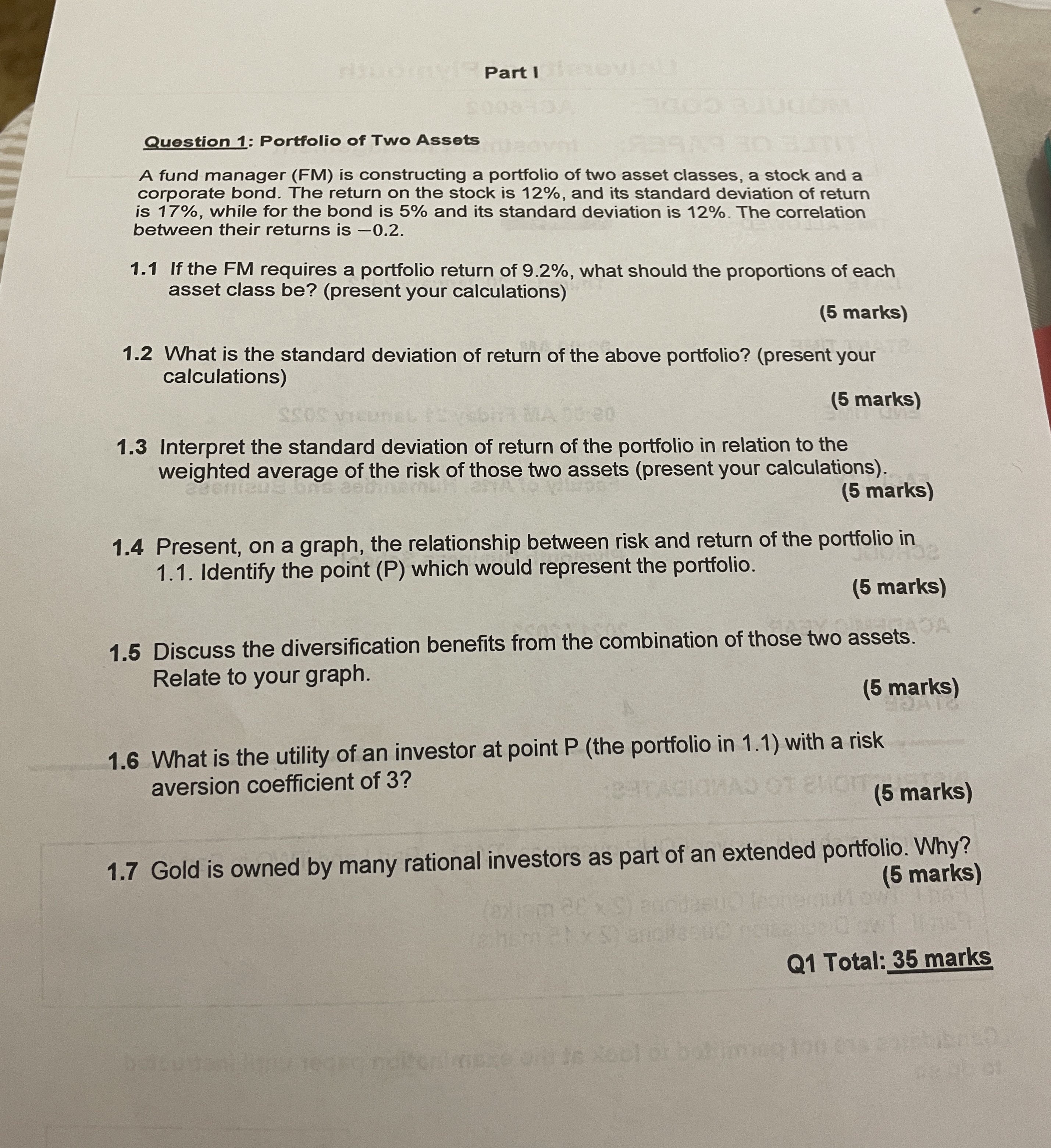

Part I Question 1 : Portfolio of Two Assets A fund manager ( FM ) is constructing a portfolio of two asset classes, a stock

Part I

Question : Portfolio of Two Assets

A fund manager FM is constructing a portfolio of two asset classes, a stock and a

corporate bond. The return on the stock is and its standard deviation of return

is while for the bond is and its standard deviation is The correlation

between their returns is

If the FM requires a portfolio return of what should the proportions of each

asset class bepresent your calculations

marks

What is the standard deviation of return of the above portfolio? present your

calculations

marks

Interpret the standard deviation of return of the portfolio in relation to the

weighted average of the risk of those two assets present your calculations

marks

Present, on a graph, the relationship between risk and return of the portfolio in

Identify the point which would represent the portfolio.

marks

Discuss the diversification benefits from the combination of those two assets.

Relate to your graph.

marks

What is the utility of an investor at point the portfolio in with a risk

aversion coefficient of

marks

Gold is owned by many rational investors as part of an extended portfolio. Why?

marks

Q Total: marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started