Answered step by step

Verified Expert Solution

Question

1 Approved Answer

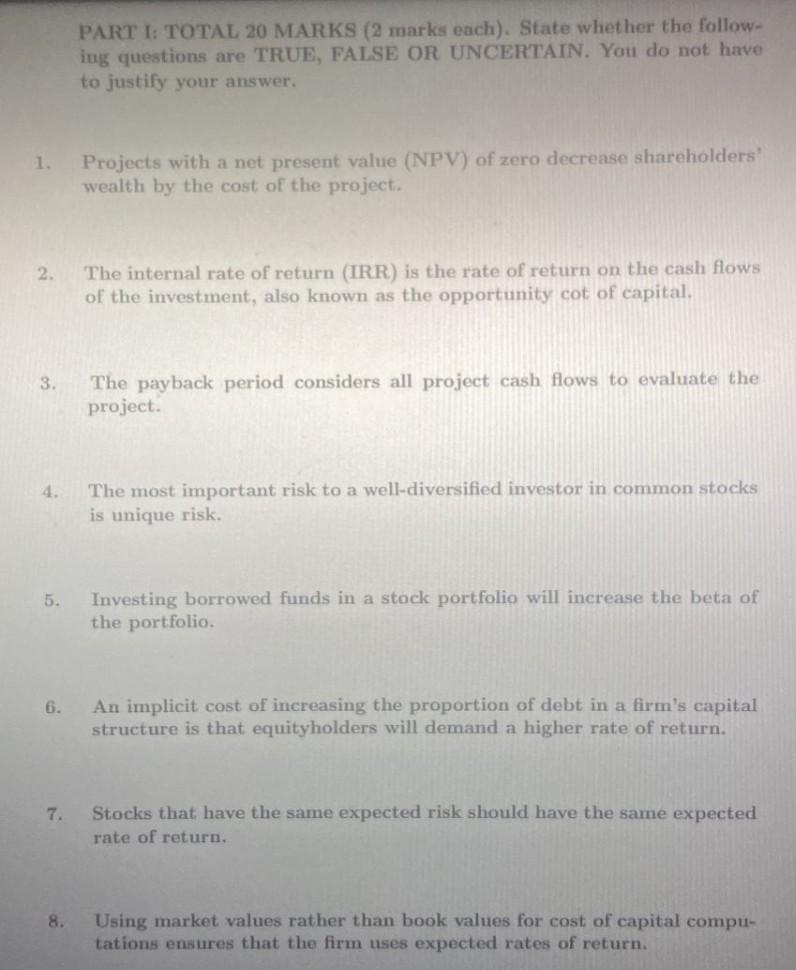

PART I: TOTAL 20 MARKS (2 marks each). State whether the follow- ing questions are TRUE, FALSE OR UNCERTAIN. You do not have to justify

PART I: TOTAL 20 MARKS (2 marks each). State whether the follow- ing questions are TRUE, FALSE OR UNCERTAIN. You do not have to justify your answer. 1. Projects with a net present value (NPV) of zero decrease shareholders' wealth by the cost of the project. 2. The internal rate of return (IRR) is the rate of return on the cash flows of the investment, also known as the opportunity cot of capital. 3. The payback period considers all project cash flows to evaluate the project. 4. The most important risk to a well-diversified investor in common stocks is unique risk 5. Investing borrowed funds in a stock portfolio will increase the beta of the portfolio 6. An implicit cost of increasing the proportion of debt in a firm's capital structure is that equityholders will demand a higher rate of return. 7. Stocks that have the same expected risk should have the same expected rate of return. 8. Using market values rather than book values for cost of capital compu- tations ensures that the firm uses expected rates of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started