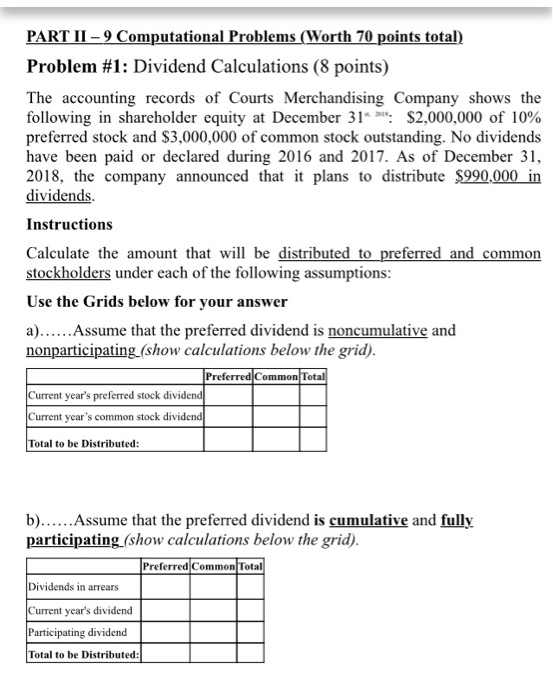

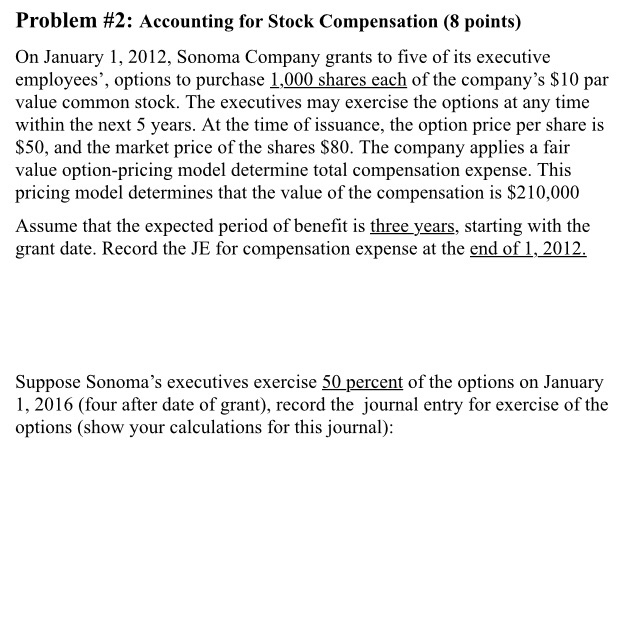

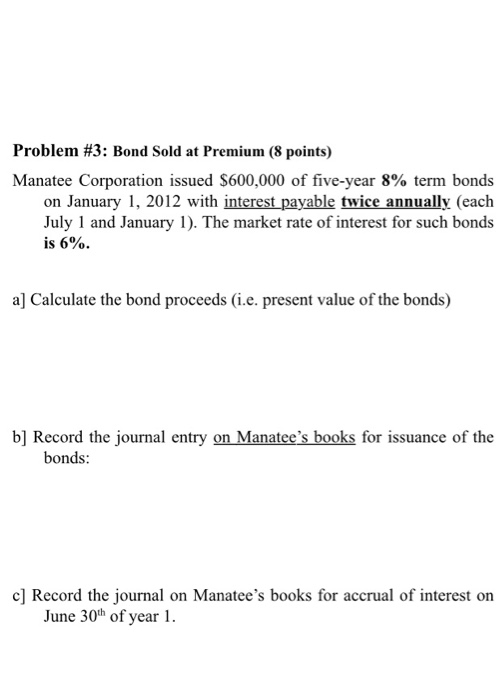

PART II 9 Computational Problems (Worth 70 points total) Problem #1: Dividend Calculations (8 points) The accounting records of Courts Merchandising Company shows the following in shareholder equity at December 31 : $2,000,000 of 10% preferred stock and $3,000,000 of common stock outstanding. No dividends have been paid or declared during 2016 and 2017. As of December 31, 2018, the company announced that it plans to distribute $990,000 in dividends. Instructions Calculate the amount that will be distributed to preferred and common stockholders under each of the following assumptions: Use the Grids below for your answer a)...... Assume that the preferred dividend is noncumulative and nonparticipating (show calculations below the grid). Preferred Common Total Current year's preferred stock dividend Current year's common stock dividend Total to be Distributed: b)...... Assume that the preferred dividend is cumulative and fully participating (show calculations below the grid). Preferred Common Total Dividends in arrears Current year's dividend Participating dividend Total to be Distributed: Problem #2: Accounting for Stock Compensation (8 points) On January 1, 2012, Sonoma Company grants to five of its executive employees', options to purchase 1,000 shares each of the company's $10 par value common stock. The executives may exercise the options at any time within the next 5 years. At the time of issuance, the option price per share is $50, and the market price of the shares $80. The company applies a fair value option-pricing model determine total compensation expense. This pricing model determines that the value of the compensation is $210,000 Assume that the expected period of benefit is three years, starting with the grant date. Record the JE for compensation expense at the end of 1, 2012. Suppose Sonoma's executives exercise 50 percent of the options on January 1, 2016 (four after date of grant), record the journal entry for exercise of the options (show your calculations for this journal): Problem #3: Bond Sold at Premium (8 points) Manatee Corporation issued $600,000 of five-year 8% term bonds on January 1, 2012 with interest payable twice annually (each July 1 and January 1). The market rate of interest for such bonds is 6%. a) Calculate the bond proceeds (.e. present value of the bonds) b) Record the journal entry on Manatee's books for issuance of the bonds: c) Record the journal on Manatee's books for accrual of interest on June 30th of year 1